Not good. Raises the specter of May having weakened after some April numbers were looking a bit better: Empire State Mfg SurveyHighlightsWhat little momentum there was in the New York manufacturing sector is fizzling, based on the Empire State index which came in much weaker-than-expected, at minus 9.02 in the May report to end two lonely looking gains in April and March.New orders are at minus 5.54, also ending two prior months of gains and rejoining a long run of negative readings going back all last year. Inventories, at minus 7.29, are extending their equally long dismal run of contraction as manufacturers, seeing soft demand ahead, work down their stocks. Employment, at plus 2.08, is up for a second month but just barely while shipments turned lower, to minus 1.94. Selling prices are down, the workweek is down, and delivery times are shortening — all signs of weakness.This together with the Philly Fed, which are the two most closely watched regional reports, have been showing bursts of life the last few months, in what perhaps are early indications of strength tied to dollar depreciation and lower oil prices. But this report is definitely not among this group and will raise talk of another flat year for manufacturing. The Philly Fed, to be posted Thursday, looks to be a major highlight of the week.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Not good. Raises the specter of May having weakened after some April numbers were looking a bit better:

Empire State Mfg Survey

Highlights

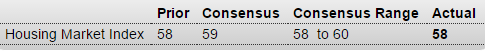

What little momentum there was in the New York manufacturing sector is fizzling, based on the Empire State index which came in much weaker-than-expected, at minus 9.02 in the May report to end two lonely looking gains in April and March.New orders are at minus 5.54, also ending two prior months of gains and rejoining a long run of negative readings going back all last year. Inventories, at minus 7.29, are extending their equally long dismal run of contraction as manufacturers, seeing soft demand ahead, work down their stocks. Employment, at plus 2.08, is up for a second month but just barely while shipments turned lower, to minus 1.94. Selling prices are down, the workweek is down, and delivery times are shortening — all signs of weakness.

This together with the Philly Fed, which are the two most closely watched regional reports, have been showing bursts of life the last few months, in what perhaps are early indications of strength tied to dollar depreciation and lower oil prices. But this report is definitely not among this group and will raise talk of another flat year for manufacturing. The Philly Fed, to be posted Thursday, looks to be a major highlight of the week.

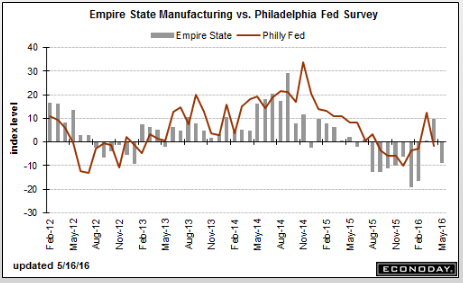

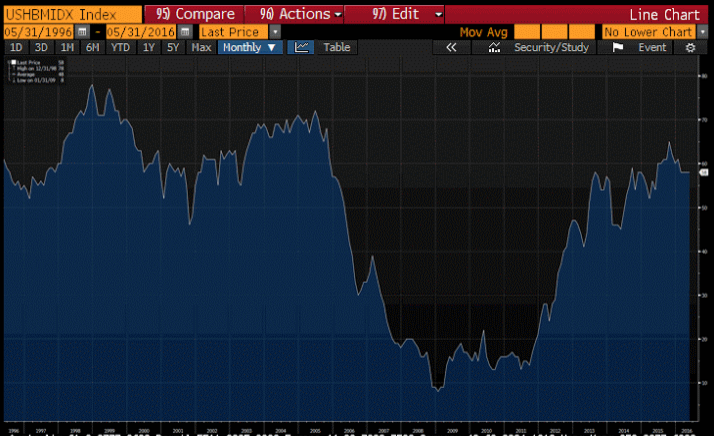

Lower than expected and still seems like the depressed housing industry has most recently been decelerating, as per the chart:

Housing Market Index

Highlights

Optimism among home builders is solid and steady, at 58 for the May housing market index. This is the fourth straight 58 for this index where anything over 50 is positive. And sales are the most positive component in this report, at 65 for 6-month sales and 63 for present sales. The drag on the index comes from traffic, unchanged at 44 and continuing to reflect unusual lack of interest from first-time buyers.The West has the highest composite score at 67, befitting the region’s importance for new construction. The South, which is the largest market, is next at 60 with the Midwest right behind at 59. The Northeast, where dense development limits the new home market, trails in the far distance at 36.

The availability of jobs together with low mortgage rates are solid pluses for the new housing outlook. But strength in the housing sector has been less than overwhelming this year and lack of acceleration in this report is part of the story.

Finally!

Japanese Prime Minister Shinzo Abe said on Monday a majority of Group of Seven leaders agree on the need to deploy fiscal stimulus measures to boost global demand.

Japan will host a G7 finance ministers and central bankers summit on May 20-21, and there are doubts about how much progress policymakers can make in shifting the global economy out of its current spell of slow growth and low inflation.

Earlier this month, Abe traveled to Europe to meet G7 heads in preparation for the meeting in Japan.