By Eric Tymoigne Throughout this series, posts have used balance sheets extensively to get an understanding of the monetary operations of developed economies, but nothing has been said about what a monetary instrument is. It is time to spend some time on the nature of monetary instruments and the inner workings of monetary systems. A monetary system is composed of two core elements: A unit of account that provides a common method of measurement: the euro (€), the pound sterling (₤), the yen (¥), the dollar ($), etc. Monetary instruments: specific financial instruments denominated in the unit of account and issued by the government and the private sector. This post first explains what financial instruments are and how monetary instruments fit within the existing range of instruments. It then delves into what determines the nominal and real value of monetary instruments and into what makes them accepted. Financial Instruments Balance sheets contain many types of financial instruments. Some of them are issued by an economic unit (financial liabilities), others are held by that same economic unit (financial assets). Financial instruments are just formal promises to make monetary payments.

Topics:

Eric Tymoigne considers the following as important: Eric Tymoigne, money and banking

This could be interesting, too:

Mike Norman writes Banks And Money (Sigh) — Brian Romanchuk

Mike Norman writes Lars P. Syll — The weird absence of money and finance in economic theory

Eric Tymoigne writes Can the US Treasury run out of money when the US government can’t?

Eric Tymoigne writes “What You Need To Know About The Trillion National Debt”: The Alternative SHORT Interview

By Eric Tymoigne

Throughout this series, posts have used balance sheets extensively to get an understanding of the monetary operations of developed economies, but nothing has been said about what a monetary instrument is. It is time to spend some time on the nature of monetary instruments and the inner workings of monetary systems. A monetary system is composed of two core elements:

- A unit of account that provides a common method of measurement: the euro (€), the pound sterling (₤), the yen (¥), the dollar ($), etc.

- Monetary instruments: specific financial instruments denominated in the unit of account and issued by the government and the private sector.

This post first explains what financial instruments are and how monetary instruments fit within the existing range of instruments. It then delves into what determines the nominal and real value of monetary instruments and into what makes them accepted.

Financial Instruments

Balance sheets contain many types of financial instruments. Some of them are issued by an economic unit (financial liabilities), others are held by that same economic unit (financial assets). Financial instruments are just formal promises to make monetary payments. The way a promise is structured varies widely depending on the needs of the issuer, but common questions that a promise must answer are:

- Who is the issuer? The mark of the issuer (name, head, etc.) is present so bearers know who is supposed to fulfill the promise embedded in the financial instrument.

- What is the unit of account used? Financial instruments cannot exist before there is a unit of measurement of monetary transactions and accounts.

- At what price will the issuer take back its promissory note? There is a face/par value: number of units of account the financial instrument carries ($100, $10, $1, 25 cents, etc.).

- When will the issuer take back its promissory note? There is a term to maturity: The length of time it will take to fulfill the promise, at which point the issuer takes back the financial instrument it issued (and then destroys it to make sure nobody can reacquire it and then have a claim on the issuer). The term can go from zero (issuer takes back whenever presented by bearers) to infinity (issuer takes back at its discretion, maybe never).

- How will the issuer take back its promissory notes? The expected means that will be used by the issuer to fulfill his promises, also called more technically the “reflux mechanisms/channels.” (The previous post showed that the way this question is answered is crucial for financial stability)

- What is (are) the reward(s)/benefit(s) for those willing to trust the issuer? Financial instruments may reward their bearers: income, voting rights, avoid prison, etc.

- Is there some guarantee in case of the issuer is unable or unwilling to fulfill the promise? Financial instruments may be secured/collateralized: if the issuer defaults on its promises, the bearers get paid by taking ownership of assets of the issuer (house for mortgages, etc.)

- Is it possible to transfer the promissory note to another bearer? Financial instruments may be negotiable, i.e. the person to whom the promise has to be fulfilled can be changed by transferring ownership of the financial instrument. Some financial instruments are not transferable because they name the beneficiary (e.g. savings bonds issued by U.S. Treasury) and cannot be endorsed to someone else (e.g., a check drawn to pay Mr. X can be used by Mr. X to pay Mr. Y).

Depending on how these questions are answered, the name of a financial instrument changes, in the same way dogs and cats have different names depending on their height, color of their fur, etc. For example, a Treasury bill does not provide any reward and is due within a year. A common share provides a reward depending on the profit of the issuing company, gives a voting right, and the company does not promise to take back its shares.

As stated in a previous post, anybody can make any kinds of promise. The hard parts are, first, to convince others of the genuineness of the promise so they are willing to accept a financial instrument and, second, to fulfill the promise once it has been accepted. Finance establishes a legal framework for recording the creation and fulfillment of promises, and it measures, more or less accurately, the credibility of these promises at any point in time.

Finally, within a country, there is a hierarchy of financial instruments in the sense that some are more easily accepted. The most widely accepted financial instruments are those that are negotiable, of the highest creditworthiness, of the highest liquidity, and of the shortest term to maturity. In contemporaneous economies with a monetarily sovereign government, central bank monetary instruments are at the top of the hierarchy. They are followed by bank monetary instruments that were made perfectly liquid following the emergence of interbank par-clearing and settlement and deposit guarantee. Below the previous monetary instruments are financial instruments traded on an organized exchange (issued mostly by governments and corporations: shares, bonds, notes, bills, etc.). At the bottom of the hierarchy, there are all sorts of promises such as local currencies and personal promissory notes. This hierarchy is not fixed and, throughout history, the top monetary instrument was not always a government monetary instrument.

A Specific Financial Instrument: Monetary Instruments

Some issuers make the following promise to bearers:

- I will take back my promissory note whenever you want me to do so: Term to maturity is instantaneous/zero.

- I will take back my promissory note from anybody who presents it to me: Only the issuer’s mark is on the instrument and no beneficiary is named: impersonal receiver/beneficiary (either no name or “the bearer”).

- I will take back my promissory note at par in payment of debts owed me: By handing to me my promissory notes, I will reduce any debt you owe me by the face value of the note. The government accepts reserves to settle taxes at face value (the government does not accept cash from the public in payment of taxes for security and tractability reasons, instead it works through banks), banks accept at face value funds in the bank accounts to settle what is owed to them.

The promise may contain two additional clauses:

- I will exchange my promissory note for something else whenever the bearer wants me to do so: there is a conversion clause. Banks promise to convert bank accounts (and bank notes when they used to issue them) into government monetary instruments on demand. Governments may promise conversion into gold or a foreign currency.

- I will use gold or another precious metal to make the promissory note: the promissory note is secured. In the same way a house is a collateral for a mortgage, gold may be a collateral for a coin.

This type of financial instruments are monetary instruments. Similarly to any other financial instrument, the creation of monetary instruments involves someone becoming liable (the issuer of the monetary instrument) because monetary instruments embed a financial promise.

At What Price Should a Financial Instrument Circulate Amount Bearers?

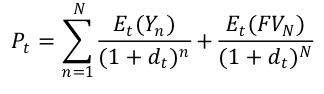

The nominal value, P, at which a financial instrument ought to circulate among bearers is called the fair price, or fair value. The net present value is a common way to judge the fair price of many financial instruments. It represents the sum of all the discounted streams of payments that are expected by bearers until a financial instrument matures:

Where the subscript t indicates the present time, Ptis the current fair value, Yn is the nominal income promised at a future time n, FVN is the face value that will prevail at maturity, Etindicates current expectations about income and face value, dtis the current discount rate imposed by bearers, N is the time lapse until maturity (n = 0 is the issuance time) (The Σ character means “sum of”).

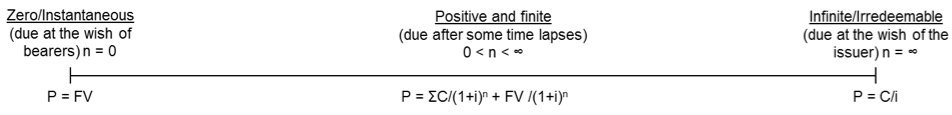

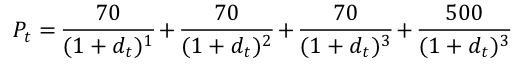

There is a wide variety of financial instruments that uses this formula. One can classify financial instruments according to the term to maturity (Figure 1).

Figure 1. Financial Instruments and Term to Maturity

At one extreme are modern government monetary instruments that provide no income (Y = 0), are redeemed at the discretion of the bearers (N = 0), and are expected to be taken back by the government at their initial face value at any time, Pt = FV0. Monetary instruments circulate at par all the time because they are zero-term zero-coupon financial instruments. At the other extreme are consols that have a given expected income and are redeemed at the discretion of the issuer (N → ∞), Pt = Et(Y)/dt. They are infinite-term positive-coupon financial instruments. Shares have the same term to maturity as consols. If a collateral exists, in case of default, the fair value depends on the expected ability of creditors to recover some of the unpaid dues embedded in a promise. Thus, in case of default, the fair value is equal to the expected value of the collateral and available recourses discounted back to the present.

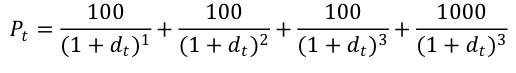

For example, say that company X issues 3-year bonds with a face value of $1000 and a coupon rate of 10%. This means that company X will buy back its bonds for $1000 in three years and will pay $100 of interest income (called the “coupon”). In that case, what market participants are willing to pay for the bond today is (assume an annual coupon payment to simplify):

There is a missing element that prevents the determination of the fair price: what is the value of d today? d represents the interest rate that market participants want (the “market rate”). The market rate may be different from the interest rate offered by company X (the coupon rate):

- If d = 20% then P = $789.35. The bond trades at a discount (i.e. below face value). For the first $100 provided next year market participants are willing to pay today $83.33 ($100/1.2) because $83 placed at 20% today provides $100 next year, etc.

- If d = 10% then P = $1000. Bond trades at par. Market participants agree that the interest rate proposed by company X is enough, so they pay full price for the bond.

- If d = 5% then P = $1136.16. Market participants are getting more reward from the coupon than what they wish so they are willing to buy the bond at a premium (i.e. above face value). The amount of the premium will be just enough to make the rate of return on the bond equal to 5%.

As explained in a previous post, the value of d depends on a number of factors including the risk of default by the issuer. The higher the probability that coupons and/or principal cannot be honored, the steeper the discount rate, and so the further below par the 3-year bond trades.

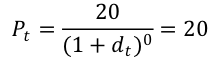

For a $20 unconvertible Federal Reserve note, the government does not promise any coupon and promises to take back the FRNs at anytime at $20, so:

The $20 FRN trades at parity all the time. The discount factor does not matter because the term to maturity is instantaneous.

These two examples assumed that the issuer does not default. Say that right after the issuance of the 3-year bonds, company X announces that it cannot make the $100 coupon payments nor the principal payment. Some negotiation with bondholders leads to an agreement that company X will pay $70 coupons and $500 of principal. Then the new fair value of the bond is:

Again the fair value depends on d that increased tremendously following the announcement of default.

The same applies with Federal Reserve note and other monetary instruments. Say that the government announces it only accepts $20 FRNs for $10 at any time, i.e. a $20 FRNs only redeems $10 of debts owed to the government. Then the new face value is actually $10 and so the fair price is $10. In the economy, the $20 circulates among bearers for $10. Shops take the $20 note only for $10 worth of items, banks that receive a $20 note only credit $10 to the bank accounts of the persons who hand the $20 FRNs, and repaying bank debts with a $20 FRNs only clears $10 of bank debts. Holders of FRNs take a 50% haircut. This may seem strange but only because we are not accustomed to that anymore. In the Middle Ages, kings used to change the face value of their coins all the time as explained in in a later post. Until the late 19th century, private bank notes were applied a discount that varied overtime.

Fair value and Purchasing Power.

There are situations in which the value of all financial instruments changes at the same time relative to the value of goods and services (inflation or deflation) or relative to another unit of account (depreciation or appreciation). These changes in purchasing power are due either to the discretionary decisions of a monetary authority (e.g., the government decides to devaluate its currency) or to mechanisms at work in a monetary system.

The changes in the value of the unit of account should be differentiated from the changes in the fair value of a monetary instrument. While both changes lead to the same result (changes in purchasing power), the mechanisms at play are different. Changes in the value of the unit of account relate to expected and actual changes in macroeconomic conditions. Changes in the fair value relate to expected and actual changes in the characteristics of a financial instrument (e.g. default) or in the financial infrastructure (e.g., disruption in payment system). For bank and government monetary instruments, this second type of changes has not occurred since government guarantees have been put in place, interbank bank settlement at par has been done efficiently, and unconvertible currency has become common and its supply elastic.

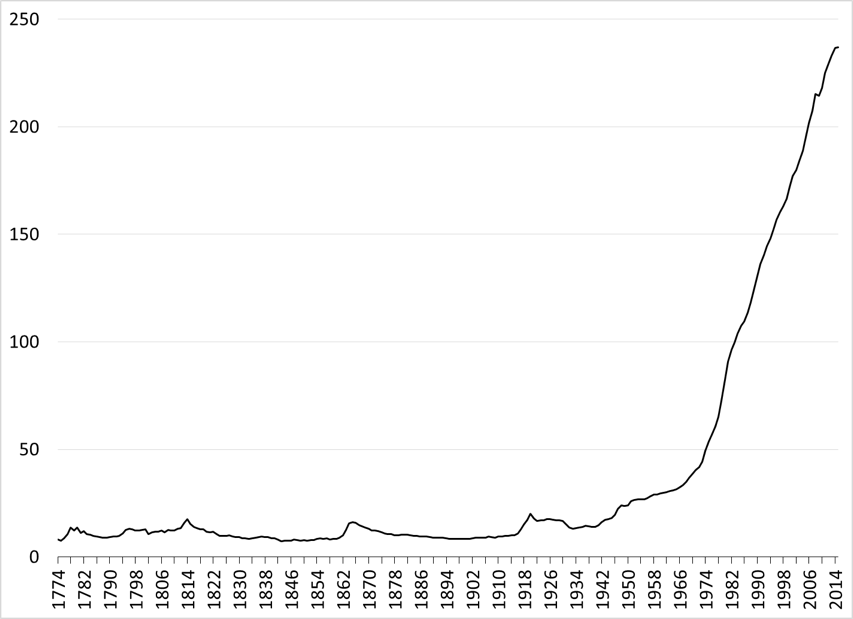

One major debate of monetary history wonders if the issuer of a monetary instrument, and more generally any other financial instrument, is liable for the decline in the purchasing power of what is owed the bearers. Say that you owe $100 to someone, should you be liable if the purchasing power of that $100 change? Should the principal amount you owe rise/fall to compensate for inflation/deflation? Legal scholars discuss this issue in terms of Nominalism (that answers no) versus Valorism (that answers yes). Recently, this question has been of greater concern for creditors given that there has been an inflationary bias since the end of World War Two. Governments around the world have been unwilling to let deflationary forces develop following the horrible experience of the Great Depression (Figure 2).

Figure 2. Consumer Price Index in the United States: 1774-2015 (base: 1982-84).

Sources: Bureau of Labor Statistics and Historical Statistics of the United States.

Nominalism has prevailed throughout history. As such financial instruments cannot be considered to be claims on goods and services. Creditors bear the inflation risk, debtors bear the deflation risk. While debtors may choose to issue inflation-protected financial instruments (e.g. Treasury inflation protected bonds), it is their discretion not their obligation.

An implication of the prevalence of nominalism is that the creditworthiness of an issuer is only related to the ability to make the nominal payment promised (the Ys and FV in the fair price formula) and creditworthiness cannot be judge by looking at purchasing power. As such, inflation/deflation does not represent a decline/increase in the creditworthiness of a government, or banks, or any other issuer of monetary instruments.

A simple way to understand why Nominalism has prevailed is that issuers of financial instruments have very little control over output-price dynamics. Businesses can try to be more efficient to meet the demands of their creditors, and households have some influence over their income and expenditure sources. Governments have some part to play in the inflationary bias, and could do more to promote price stability by having structural policies that deal with employment and price stability, but even governments only have limited control about upward price dynamics. It would be unfair to ask the issuers of financial instruments to protect their creditors for something over which they have little control and ability to influence.

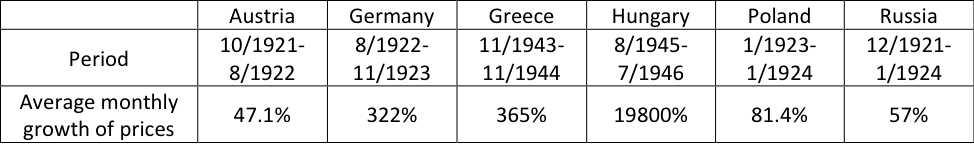

While cases of hyperinflation are often attributed to the government running the printing press, one needs to look at the underlying economic conditions to get to the bottom of the problem. Political, technological and natural causes are usually underpinning problems because inflation is usually NOT a monetary issue. The government printing monetary instruments en masse is just a last desperate response to a deeper underlying problem. For example the German hyperinflation has its root in the costly Versailles agreements. The recent episode of hyperinflation in Zimbawe has its root in colonialism, land reform and decaying infrastructure. Table 1 shows inflation rates for several countries, all around the two world wars.

Table 1. Examples of Hyperinflation.

Source: Friedman et al. Studies in the Quantity Theory of Money.

To conclude, the financial characteristics of monetary instruments lead to a stable nominal value (parity) in the proper financial environment (see next post for improper financial environment). This stable nominal value plays a crucial role in the stability of the financial system because it provides a reliable means to pay debts, which promotes liquidity and solvency. However, these characteristics do not guarantee a stable purchasing power and so a monetary instrument may not be a reliable medium of exchange. A good part of the story of monetary systems has been to try to establish a smoothly working monetary system based on a financial instrument that is both perfectly liquid and of stable purchasing power. This quest has been unsuccessful (only perfect liquidity has been achieved) but it has had a tremendous influence on the view of scholars, politicians and the general population about “money.”

Acceptance of Monetary Instruments

As stated earlier anybody can create monetary instruments. There are many websites that allow to do so, and Figure 3 shows a monetary instrument that I created. Let us call it the E.T. note. My name is present and the note is worth 5 cities. The “City” is the unit of account. I deliberately chose a weird name for the unit of account to make the point that the unit of account is an abstract and arbitrary unit of measurement that has no relation to anything. While some units of account find their origins in weight measures, they rapidly lost that connection (e.g., a pound sterling is not represented by a pound of fine silver, a pound sterling is just a pound sterling). Other names of units of account are just made up, sometimes to reflect political or cultural aspirations (the “Euro”), and have never had anything to objectify them.

The E.T. note is a formal promise. By issuing it to bearers, I promise to take the note whenever presented to me. How can I get others to accept in payments that piece of paper? The answer depends on how credible my promise is to others: When will bearers have the opportunity to hand it back to me and what are the benefits for doing so? If potential bearers never see any opportunity to give the note back to me or if the reward for doing so is negligible, they won’t accept the note in payment. As such, there are three ways to make bearers realize that my promise is credible:

- Forced acceptance: I kill you/cut your hands/put you in prison/(fill the blank for any other miserable things I could to do to you) if you don’t take it. The problem with force is that it is difficult and costly to enforce, and not a very effective way to promote confidence in the promise I made. Persuasion always works better than force so here are two ways to persuade.

- Convertible into something valuable:

- If you are one of my students: you automatically get an A in a course I teach if you hand me some E.T. notes (the higher the amount of notes to provide the higher the demand). This is good as far as it goes, but very few people take my courses.

- If you are not one of my students: When you give the note back to me, I will give you some gold worth 5 cities. That will help to widen acceptance provided that 5 cities worth of gold is significant, and provided that others believe that I have the means to get the gold I promise.

- Impose a debt on bearers that can be paid with the monetary instrument together with penalties if payment is not done:

- If you are one of my students: handing me some notes counts for a certain percentage of your grade. Acceptance will depend on how much doing so counts. For example, if handing back a certain number of notes counts for 100% of the grade, then demand for E.T. notes will be high, if 1% demand will be low. I am imposing a tax on my students. Some economics departments have done such a thing with great success to promote community services by students (DVDs and Buckaroos)

- If you are not one of my students: Any debt you owe to me can be paid by handing to me some E.T. notes. Acceptance by potential bearers will depend on the extent to which others are indebted to me, as well as my ability to enforce the payments of dues owe to me (and to punish if payment is not done). Limited amount of debtors, ability to evade payment, and lack of effective enforcement mechanisms will reduce the acceptance of my notes.

These means of creating an initial and basic demand for monetary instruments can be combined but today, the ability of an issuer to entice, or to force, other economic units to become indebted to the issuer is the main means to create an acceptance for a monetary instrument.

In my classroom my ability to do so is very high and, as such, I can acquire many things from my students (including their labor power) by paying them with the E.T. notes. I can then use that power for my own selfish interest (buy stuff from my students for my own enjoyment) or for more social goals (community services to be performed by students). Beyond my classroom, I have no ability to make others indebted to me and my ability to impose force or to provide something valuable in exchange for my note is limited. As such the demand for E.T. notes is small outside the classroom.

The same applies to a government within its border, provided it is credible, and as such the government can use that power to spend however it likes (hopefully for the benefits of its citizens) to fulfill the demand for its currency. Outside a country, leaving aside international arrangements that may promote a currency, the demand for a national currency will also be limited because the ability of the national governments to impose debts on foreigners is limited. If the currency allows foreigners to obtain something valuable, either from the issuer through conversion or because the economy produces things that foreigners want (see below for other sources of demand for a monetary instrument), foreigners will be willing to net save the currency.

The broader your “captive” population, the greater your ability to impose debts on that population and to punish it if it does not comply, and the more widely your monetary instrument is accepted. Guaranteeing convertibility into something else valuable will help further.

Figure 3. A E.T. note worth five cities.

A central point is that acceptance of a monetary instrument depends crucially on the credibility of the issuer in terms of fulfilling the promise it made. Anybody can try to issue a monetary instrument but the credibility of the issuer may be weak and so acceptance will be limited or nil. Of course, the same applies to any other financial instruments. Bonds with a higher credit rating are more widely accepted, companies who are about to go bankrupt see their share price fall toward zero as demand for them plunges.

The monetary instruments issued by the government and banks are in high demand because they have a large amount of debtors. Government’s ability to impose tax liabilities and other dues (and to throw people in jail if the tax is not paid) has been the preferred method to create an initial willingness to hold its monetary instruments. The higher the ability to enforce the dues and the lower the ability to evade the dues, the higher the demand for the government monetary instruments. When the credibility of state is low, the state may introduce a conversion clause that promises gold or foreign currency on demand. While this occurred quite frequently in the past, the financial basis for this conversion clause decreased dramatically with greater political stability, greater monetary stability, and better enforcement mechanisms. A later post will study examples when convertibility was an important means to create a demand for government monetary instruments.

Banks create monetary instruments by swapping promissory notes with its customers. As such, the issuance of bank monetary instruments simultaneously creates debtors of banks. These debtors have an automatic demand for the bank monetary instruments as long as banks have the ability to enforce the claims they have on non-bank agents (banks can seized assets or have other recourses if payment is not done). For those who are not indebted to banks, the bank also promises conversion at par into government monetary instruments. Today, the credibility of the convertibility clause is reinforced given that governments guarantee the ability to convert (FDIC deposit guarantee, lender of last resort, and maintenance of an efficient payment system).

To conclude, in the broadest terms, the greater the credibility of the issuer, the greater his ability to find people willing to hold his promises. Indeed, more people will have to make payments to that issuer or can get something valuable from that issuer. This provides the core reason why a specific monetary instrument is accepted. Beyond this core reason, bearers may hold a monetary instrument to perform transactions now or in the future with other bearers (see last section). However, if the issuer decides to demonetize its promissory note, these other reasons to hold a monetary instrument do not maintain its fair value.

Trust and Monetary System: Trust in Issuer vs. Societal Trust

Acceptance introduces the central role of trust for a well-functioning monetary system. Whenever there is promise, there is trust. But one needs to be careful to understand how trust matters. The answer to “why do you accept a $20 note?” is usually “because I trust others to do so.” To understand why this does not go far enough (beyond the fact that this answer is circular), let us start with another financial instrument.

Going back to the fair value example presented above. We saw that the nominal value at which a bond trades is critically dependent on the ability of the issuer to fulfill the promises made. Say that company X now declares it cannot make any of the payments owed on the bond. In that case the fair value of the bond is $0—there is no demand for the bond—, unless bondholders have the ability to seize assets of company X. Similarly, if the government states that it won’t accept its $20 FRN whenever presented by bearers, the fair price of the $20 FRN is now $0—the demand for it falls to nothing given that FRNs are uncollateralized non-recourse promissory notes. Regarding monetary instruments issued by banks, bearers must trust that: 1- banks will convert at par into government monetary instruments at any time, 2- that they can clear debts owed to banks with bank monetary instruments.

This brings forward an important point. While societal trust (trust of bearers about other bearers’ willingness to hold a monetary instrument) may help financial instruments to circulate more broadly, the trust at the core of the circulation of a financial instrument is the financial credibility of the issuer (trust of bearers about the issuer’s willingness and ability to fulfill its promise). Without the latter, the fair value of an unsecured non-recourse unconvertible financial instrument falls to zero. As one may expect, a later post will show that this trust was hard to earn.

While all this must follow from the logic of finance, it is not hard to find historical cases that illustrate this. The most recent one is the transition to the Eurozone. Figure 4 shows a 50 French franc note that the French government used to accept at face value in payments. From January 1 2002, the French economy moved to the Euro and its government refused French franc in payments. To make the transition smoother, for the next ten years, the Banque de France allowed conversion of its notes into euro-denominated notes at the rate of 1 euro for 6.55957 French franc (people could go to any branch of the Banque de France to get their francs converted into euros). Since 2012, the French franc notes are no longer convertible into euro notes and their fair value is now zero unit of account. French franc notes may still have a value as collectible object but not as monetary instrument, they have become commodities.

Figure 4. A 50 French franc note.

In the Middle Ages, coins did not have any face value marked on them. Bearers of the coins would have to periodically listen to royal proclamations in public squares, fairs, and markets to know at what value the King would take its coins in payments, i.e. to know the face value. A later post will show that there was some drawbacks to that system.

During the free banking era in the US in the mid 1800s, Banks discouraged or refused conversion in species on demand:

Banks sometimes used remote locations as their redemption points in order to avoid having to redeem their notes in specie. Another method used by the banks to discourage specie demands was to refuse to accept their own notes, except at a large discount. Customers were told that, if they waited, the notes would be later redeemed at par, but such promises were not always kept. The states attempted to require the banks to re-deem at par, but those efforts did not meet with success. (Markham 2002, 169)

This problem was compounded by widespread forgery that reinforced the reluctance of banks to take their notes immediately at par, even in payments from debtors, because the truthfulness of the notes could not be established. As such, given that both the convertibility promise and the payment promise embedded in banknotes were violated, banknotes traded at a discount. This problem was compounded by the absence of an interbank par-clearing and settlement mechanism.

In the end none of us think about the ability to pay the issuer at face value with its monetary instrument when we accept them. However, without the issuer’s promise to take back its monetary instrument at par whenever presented by bearers, there would not be a well-functioning monetary system. The credibility of the issuer, if strong, creates an anchor toward which bearers’ expectations about Ys and FV converge and provides stable nominal value.

What Are Monetary Instruments Used For? Monetary Functions

We now know why economic units accept a monetary instrument. While the necessity to pay the issuer and the availability of conversion create a demand for monetary instruments, economic units also want to use monetary instruments for other purposes, namely daily expenses, private debt settlements, portfolio choices, and precautionary savings. A monetary instrument can be used as:

- Means of payments: paying debts

- Medium of exchange: buying things

- Store of value: keep some purchasing power for the future by saving monetary instruments

The ability to perform these functions is not limited to monetary instruments as defined as above. Also, some authors, who define monetary instruments according to their functions (more next post), broaden the definition of monetary instruments to anything used as means of payment, or/and medium of exchange, or/and store of value.

In any case, the ability of a monetary instrument to perform the previous functions is tied to the creditworthiness of the issuer of the monetary instruments; otherwise, monetary instruments would be a poor means of payment, a poor medium of exchange even the short run, and an even more terrible long-term store of value than they already are. This would be the case not because of inflation (or depreciation), but because their fair value would not be constant.

Note that a monetary instrument cannot perform the function of unit of account because there cannot be monetary instrument without having a unit of account first. As such, the unit of account cannot be a medium of exchange, a store of value, or a means of payment. Stated another way, a monetary system necessitates a unit of account and carriers of this unit of account, but they have separate roles—one measures, the other records the measurement.

A unit of account can take the name of an object but it has an independent existence from the object. This manifests itself in two ways. First, the object may disappear but the unit of account persists, or, second, the relationship between the unit of account and the object can change. A cowry unit of account may exist without any cowry shell being used in transactions. If cowries are used, their value in terms of the cowry unit may change—one cowry shell may be worth one cowry at one time and three cowries at another time.

Finally, going back to a previous post, if a monetary instrument is demanded for other things than paying the issuer, then the issuer must issue more monetary instruments than what it gets back from its debtors. A net financial accumulation of monetary instruments by bearers means that the issuer usually must be in deficit. Treasury issues government monetary instruments by spending, and it destroys government monetary instruments by taxing. The fiscal deficit is a net injection of government monetary instruments in the non-government sectors (financial asset go up) without a net increase in the financial liabilities of the non-government sector (financial liabilities stay the same). This permanent net injection is possible because economic units want to net save the government monetary instruments for the purposes cited above. If economic units only want to hold government monetary instruments for tax purposes, the equilibrium fiscal position is zero; economic units have no desire to net save the government monetary instruments.

This point is very well illustrated by the Massachusetts Bay colonies that issued unconvertible, unsecured bills that they promised to accept in payment of taxes. The provincial government noted the importance of a tax system for the stability of its monetary system (this allowed circulation at par of the bills); but the government also noted that taxes tended to drain too many bills out of the economy compared to what was desired by private economic units (which created deflationary forces). This created a dilemma:

The retirement of a large proportion of the circulating medium through annual taxation, regularly produced a stringency from which the legislature sought relief through postponement of the retirements. If the bills were not called in according to the terms of the acts of issue, public faith in them would lessen, if called in there would be a disturbance of the currency. On these points there was a permanent disagreement between the governor and the representatives. (Davis 1900, 21)

Private sector desired to hold bills for other purposes than the payment of tax liabilities, but, by draining most of the bills via taxes, the government prevented the domestic private sector from accumulating its desired amount of bills. At the same time, taxes were at the foundation of that monetary system so they needed to be implemented as expected. Ultimately, the provincial government was unsure about how to proceed in terms of the amount of bills to recall. Some knowledge of national accounting helps to solve this dilemma: the size of the fiscal position (surplus, balanced, or deficit) should be left to be determined by what non-government sectors want to net save.

That is it for today! Next is some FAQs about monetary systems.