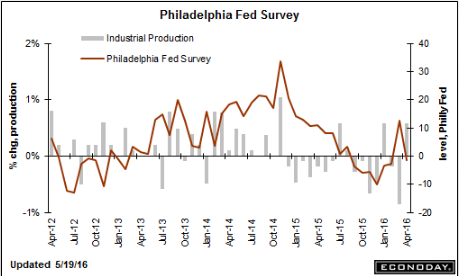

Back into contraction after a blip up in April: Philadelphia Fed Business Outlook SurveyHighlightsAfter popping higher in March the Philly Fed index has been dead flat since, at minus 1.6 in April and now minus 1.8 for May to point to slight contraction in the Mid-Atlantic manufacturing sector.After jumping to 15.7 in March, new orders posted a zero in April followed now by minus 1.9 in May. And contraction in unfilled orders is deepening, at minus 8.8 vs minus 6.3 and minus 1.9 in the prior two months. Employment remains in contraction at minus 3.3 with the workweek also in contraction and at a steep minus 15.1.Shipments are down as are inventories while confidence in the 6-month outlook is eroding, though only moderately. And price data are positive and are showing some welcome pressure, at 15.7 for inputs for a second month of solid improvement and at 14.8 for selling prices which is the best reading since October 2014.But the bulk of this report is a disappointment and follows even greater weakness in Monday’s Empire State report. The factory sector continues to stumble along, not yet showing much benefit from the falling dollar, which boosts exports, nor the rebound in oil prices which should eventually boost energy spending.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Back into contraction after a blip up in April:

Philadelphia Fed Business Outlook Survey

Highlights

After popping higher in March the Philly Fed index has been dead flat since, at minus 1.6 in April and now minus 1.8 for May to point to slight contraction in the Mid-Atlantic manufacturing sector.After jumping to 15.7 in March, new orders posted a zero in April followed now by minus 1.9 in May. And contraction in unfilled orders is deepening, at minus 8.8 vs minus 6.3 and minus 1.9 in the prior two months. Employment remains in contraction at minus 3.3 with the workweek also in contraction and at a steep minus 15.1.

Shipments are down as are inventories while confidence in the 6-month outlook is eroding, though only moderately. And price data are positive and are showing some welcome pressure, at 15.7 for inputs for a second month of solid improvement and at 14.8 for selling prices which is the best reading since October 2014.

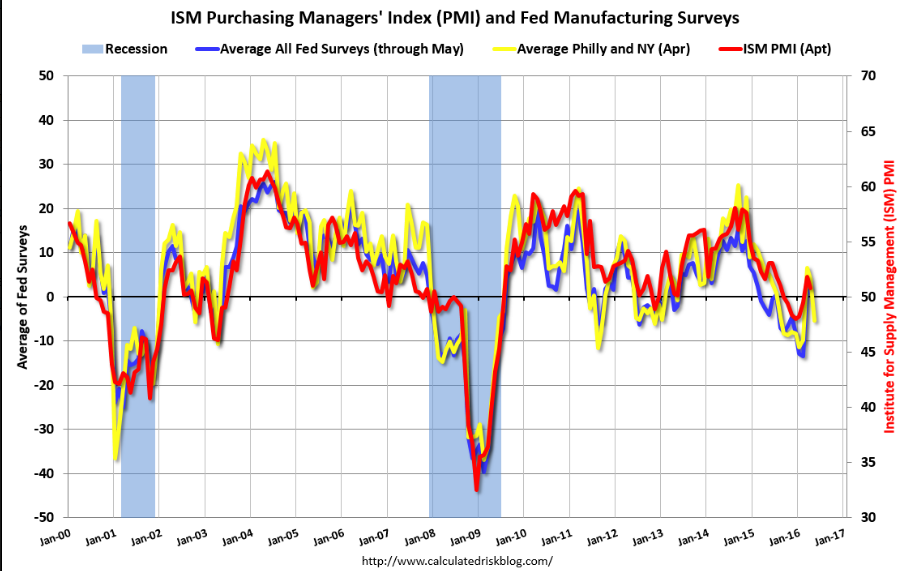

But the bulk of this report is a disappointment and follows even greater weakness in Monday’s Empire State report. The factory sector continues to stumble along, not yet showing much benefit from the falling dollar, which boosts exports, nor the rebound in oil prices which should eventually boost energy spending.

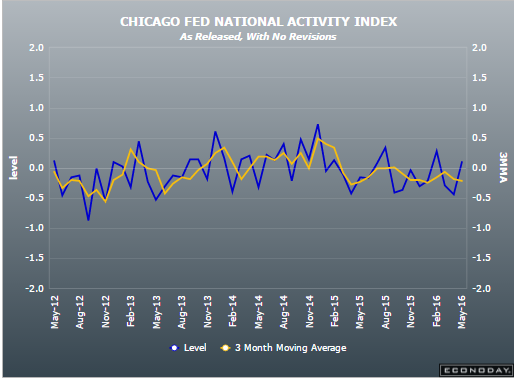

Up this month but it’s volatile month to month so best to look at the 3 month average which went more negative: