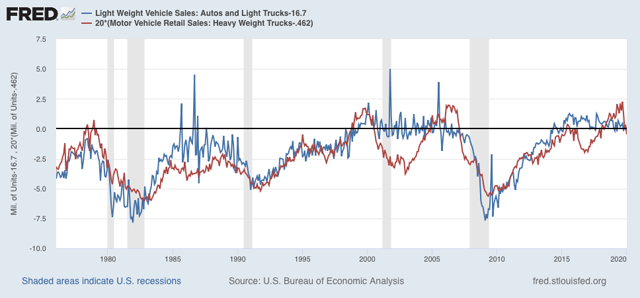

Vehicle sales for February continue to show mixed picture Let’s take a look at February car and heavy truck sales. Putting this in perspective of economic cycles, typically, after housing turns, consumer purchases of vehicles and then other durable goods (like major appliances) turn down. Broader consumer purchases are the last to turn down before a recession. Light vehicle sales in February were estimated by the BEA at 16.7 million annualized (blue in the graph below, subtracting 16.7 so that February = 0). This is slightly below January’s level, but not nearly so much as would presage a recession. For that I would expect to see a number below 16.25 million: Meanwhile heavy truck sales came in at 0.462 million annualized (red, also normed so that

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Let’s take a look at February car and heavy truck sales. Putting this in perspective of economic cycles, typically, after housing turns, consumer purchases of vehicles and then other durable goods (like major appliances) turn down. Broader consumer purchases are the last to turn down before a recession.

Light vehicle sales in February were estimated by the BEA at 16.7 million annualized (blue in the graph below, subtracting 16.7 so that February = 0). This is slightly below January’s level, but not nearly so much as would presage a recession. For that I would expect to see a number below 16.25 million:

Meanwhile heavy truck sales came in at 0.462 million annualized (red, also normed so that February = 0). Although this is slightly higher than January’s level, it is the fourth poor reading in a row, and demonstrates the producer downturn – although it is consistent with previous slowdowns and is not quite as severe as before the last two recessions.

Meanwhile heavy truck sales came in at 0.462 million annualized (red, also normed so that February = 0). Although this is slightly higher than January’s level, it is the fourth poor reading in a row, and demonstrates the producer downturn – although it is consistent with previous slowdowns and is not quite as severe as before the last two recessions.

There is no coronavirus impact in these numbers. They continue to show a producer downturn and a reasonably healthy consumer expansion.