March housing, latest weekly jobless claims slightly less apocalyptic than expected If I were President, the one industry in the economy that I would be actively trying to prop up is housing. As I have repeated constantly over the past 10+ years, housing is a long leading indicator. The permit that is issued today means a house that is built over the next 4 to 12 months, means contractors being employed, mortgages being issued, and furnishings, appliances, and landscaping continuing to be bought for a year or two afterward. In other words, if I could keep the housing industry going through the coronavirus pandemic, it would lay a solid basis for the return of the consumer thereafter. The bad news is, needless to say, that there is no such organized

Topics:

NewDealdemocrat considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

March housing, latest weekly jobless claims slightly less apocalyptic than expected

If I were President, the one industry in the economy that I would be actively trying to prop up is housing. As I have repeated constantly over the past 10+ years, housing is a long leading indicator. The permit that is issued today means a house that is built over the next 4 to 12 months, means contractors being employed, mortgages being issued, and furnishings, appliances, and landscaping continuing to be bought for a year or two afterward.

In other words, if I could keep the housing industry going through the coronavirus pandemic, it would lay a solid basis for the return of the consumer thereafter. The bad news is, needless to say, that there is no such organized effort, whether by government or business itself. The less bad news is that permits and starts did not completely fall apart in March, but of course only the second half of March was really impacted by the coronavirus shutdowns.

Let’s take a look.

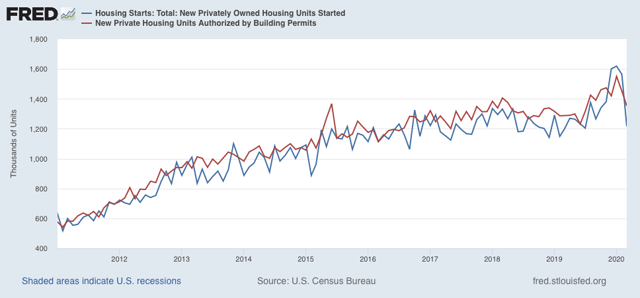

Actual housing starts declined 348,000 on an annualized basis to 1.216 million (blue), while permits (red) declined less: -99,000 to 1.353 million:

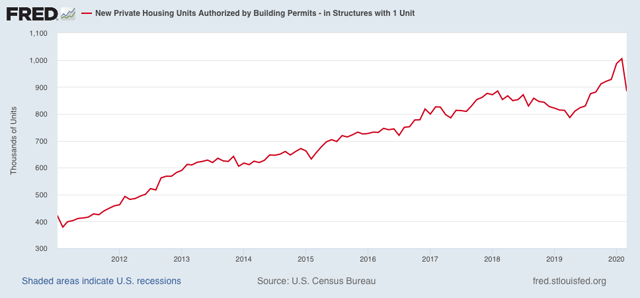

The less volatile single family permits declined -121,000 to 884,000 annualized:

The March declines above only took us back to the levels of last summer, so so far, so not so awful.

If I were a developer, I would be finding a way to keep my model homes open, with hand sanitizer generously available, a rule of one household at a time in the sales office and model, a sanitizing agent to accompany prospective buyers and clean up after each tour, and an advertising campaign touting those things and advocating people get out of the house to tour my open models, noting record low mortgage rates as well. Maybe some enterprising developer will blaze the trail.

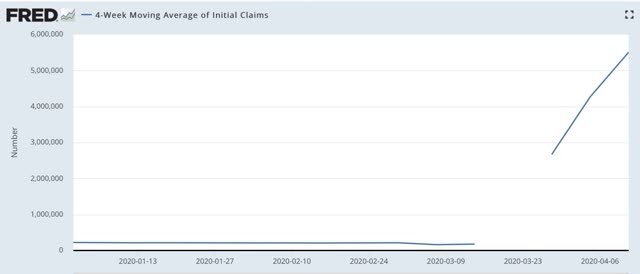

In the meantime, initial jobless claims declined to a less awful 5.245 million last week, bringing the total for the past 4 weeks to over 22 million! And that doesn’t include all the people who apparently have been able to get through to file in some States. Here’s the 4 week moving average:

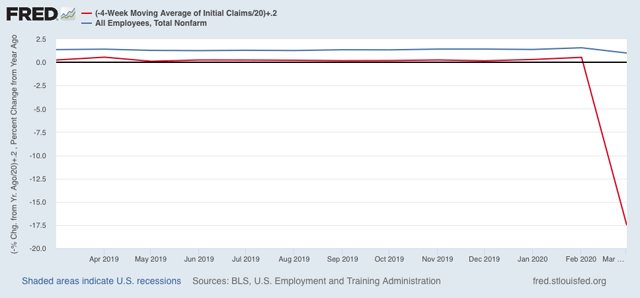

With one more week to plug into my model, it continues to look like 20 to 25 million jobs will be recorded as lost when the April jobs report comes out: