One thing that’s stood out during the most recent stock market turmoil is that bonds aren’t performing all that well either. US Treasury Bonds are up just 3.5% since stocks peaked and the aggregate bond index is up less than 1%. The concern here is that ultra low yielding bonds can’t decline sustainably below 0% and are therefore unlikely to provide much downside protection in the future whereas environments like the 2008 financial crisis and before offered investors far more protection because yields were higher. There’s some sad math behind the reality of falling bond yields [insert sad trombone]. As yields approach the 0% mark they produce less and less potential upside. Here’s a general guideline for how much protection you’ll get from 10 year yields falling by 50% from 6% all the way down to 0.19%: As your yield gets cut in half so too does your upside protection. In other words, low yielding bonds become a worse and worse hedge as the yields decline. And herein lies the problem of a diversified portfolio. Investors who are used to a portfolio like the 60/40 of the 80s, 90s and 00s are in for a nasty surprise. Their 60% stock slice is now generating even more permanent loss risk than ever. And their bond slice is acting more and more like a true cash component. This puts the traditional 60/40 investor in a bind.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

One thing that’s stood out during the most recent stock market turmoil is that bonds aren’t performing all that well either. US Treasury Bonds are up just 3.5% since stocks peaked and the aggregate bond index is up less than 1%. The concern here is that ultra low yielding bonds can’t decline sustainably below 0% and are therefore unlikely to provide much downside protection in the future whereas environments like the 2008 financial crisis and before offered investors far more protection because yields were higher.

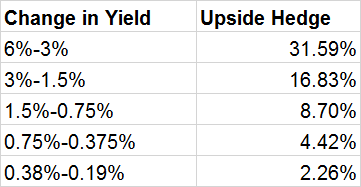

There’s some sad math behind the reality of falling bond yields [insert sad trombone]. As yields approach the 0% mark they produce less and less potential upside. Here’s a general guideline for how much protection you’ll get from 10 year yields falling by 50% from 6% all the way down to 0.19%:

As your yield gets cut in half so too does your upside protection. In other words, low yielding bonds become a worse and worse hedge as the yields decline. And herein lies the problem of a diversified portfolio. Investors who are used to a portfolio like the 60/40 of the 80s, 90s and 00s are in for a nasty surprise. Their 60% stock slice is now generating even more permanent loss risk than ever. And their bond slice is acting more and more like a true cash component. This puts the traditional 60/40 investor in a bind. They’re going to have to start deviating from 60/40 if they want to to generate the same type of nominal and risk adjusted returns because there is simply no way their bond component can protect them to the same degree that it once did. In fact, if rates become more positively skewed in the years ahead the bond piece might contribute more permanent loss risk in the near-term than many of these investors are hoping for.

This doesn’t mean that bonds can’t still be a good hedge for stocks, but it does mean that diversified investors are likely to increasingly deviate from 60/40 as they realize that this allocation doesn’t offer the same types of returns that it did in a high and falling interest rate environment.