There’s usually two forms of ideological rhetoric that accompany low interest rates. The first is that the Fed has “manipulated” interest rates lower. And the second is that the Fed is “punishing savers”. Let’s take a look at each of these ideas because I find them misleading at best and hypocritical at worst. The first misunderstanding has to do with Fed policy and its setting of interest rates. We should be very clear about the Fed’s role in the overnight market where they set interest rates. The Federal Reserve is the monopoly supplier of reserves in the overnight market. This means that the Fed determines the cost of its liabilities. As a natural monopolist the Fed is a price setter, not a price taker. Therefore, the Fed literally cannot “manipulate” the cost of its liabilities. Manipulation implies that “the market” should determine the cost of reserves, but there is no “market” in reserves. The Fed supplies reserves and determines the cost of those reserves by managing the quantity and price of those reserves. There’s a reasonable response to this – that the Fed itself is a “manipulation”. This is true of course. The Fed was created as a clearinghouse for the interbank market. But this was done to mitigate the risks caused by allowing banks to manage this process on their own.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

There’s usually two forms of ideological rhetoric that accompany low interest rates. The first is that the Fed has “manipulated” interest rates lower. And the second is that the Fed is “punishing savers”. Let’s take a look at each of these ideas because I find them misleading at best and hypocritical at worst.

The first misunderstanding has to do with Fed policy and its setting of interest rates. We should be very clear about the Fed’s role in the overnight market where they set interest rates. The Federal Reserve is the monopoly supplier of reserves in the overnight market. This means that the Fed determines the cost of its liabilities. As a natural monopolist the Fed is a price setter, not a price taker. Therefore, the Fed literally cannot “manipulate” the cost of its liabilities. Manipulation implies that “the market” should determine the cost of reserves, but there is no “market” in reserves. The Fed supplies reserves and determines the cost of those reserves by managing the quantity and price of those reserves.

There’s a reasonable response to this – that the Fed itself is a “manipulation”. This is true of course. The Fed was created as a clearinghouse for the interbank market. But this was done to mitigate the risks caused by allowing banks to manage this process on their own. And we know from the persistent crises of the late 1800’s and early 1900’s that banks just aren’t always good at managing their risks and certainly shouldn’t be managing the payment system entirely on their own because, as private profit seeking entities, they are prone to risk taking, booms, busts and economic contagion due to their centrality in the economic system.

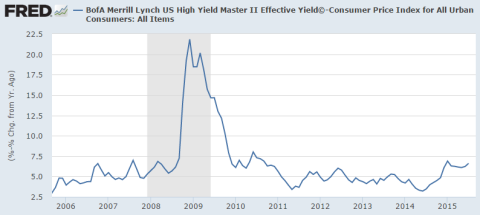

The second form of ideological rhetoric that often accompanies low interest rates is that savers get “punished” by low interest rates. But this assumes that all interest rates are low in real terms. And this just isn’t true. Savers could reach out on the risk curve a bit and obtain high yield income that is almost 7% above the rate of inflation.

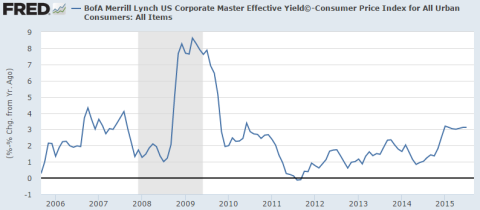

They could also obtain investment grade income that is over 3% above the rate of inflation:

But this isn’t what these people are usually referring to. What they really want is risk free income. And that usually comes from the US government as a function of the Fed’s policies. Ironically, these complaints usually come from “hard money” and anti government types. And in arguing for risk free income they’re essentially asking for a handout from the US government in the form of higher interest payments from Uncle Sam. In doing so they’re arguing for a higher government deficit and debt since interest income is one of the largest expenses in the budget deficit.

Further, I haven’t even touched on the fact that an appropriately diversified saver shouldn’t be relying entirely on risk free returns in the first place. A well diversified saver should have their portfolio invested in many pots of varying risk levels. This could mean some small portion of equities, long duration fixed income instruments, private sector bond instruments, muni bonds, etc. And by any measure a well diversified portfolio with a conservative allocation has done quite well in the low interest rate environment.

Lastly, these “free market” thinkers should love 0% interest rates. Not only does it set overnight rates at the natural rate of 0% (since banks will naturally bid down the cost of reserves in the overnight market), but it reduces the deficit, government debt and allows private entities to increasingly bear the burden of paying interest income to the private sector. What’s not to love? That is, of course, unless you think the government should offer a risk free form of income, which, in my opinion, is a totally reasonable view to maintain.