More evidence that housing has roared back This morning we got the final important July housing reports: new home sales and house prices. New single home sales are very volatile and heavily revised, so it is always wise to take the initial report with a grain of salt. On the other hand, it is the most leading of all the reports. With that caveat, this morning’s report of 901,000 sales annualized is the highest reading since December 2006! It is also in line with peak home sales in all periods prior to the 2000s housing bubble: The below graph focuses on the last 8 years, and compares with the much less volatile single-family permits (red, right scale): The bottom line is that the huge rebound is legitimate and not based on an outlier report.

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

More evidence that housing has roared back

This morning we got the final important July housing reports: new home sales and house prices.

New single home sales are very volatile and heavily revised, so it is always wise to take the initial report with a grain of salt. On the other hand, it is the most leading of all the reports.

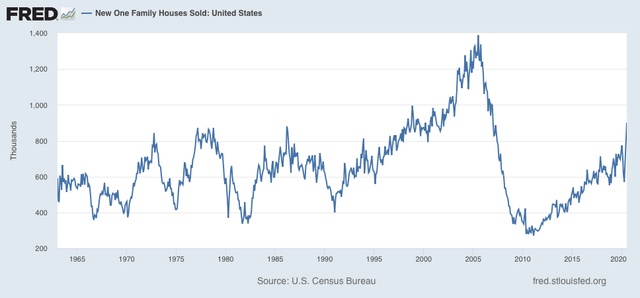

With that caveat, this morning’s report of 901,000 sales annualized is the highest reading since December 2006! It is also in line with peak home sales in all periods prior to the 2000s housing bubble:

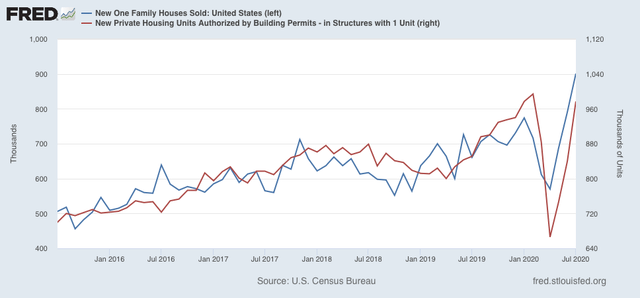

The below graph focuses on the last 8 years, and compares with the much less volatile single-family permits (red, right scale):

The bottom line is that the huge rebound is legitimate and not based on an outlier report.

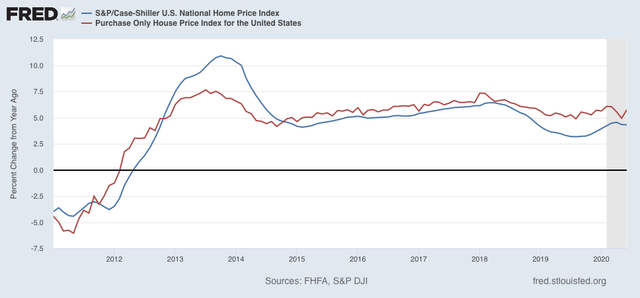

House prices lag sales, turning higher or lower with a delay. that was certainly borne out by both the July Case-Shiller and FHFA house price indexes, shown YoY below:

House price appreciation is down from earlier this year but can be expected to accelerate shortly.

That’s what record all-time low mortgage rates will do.