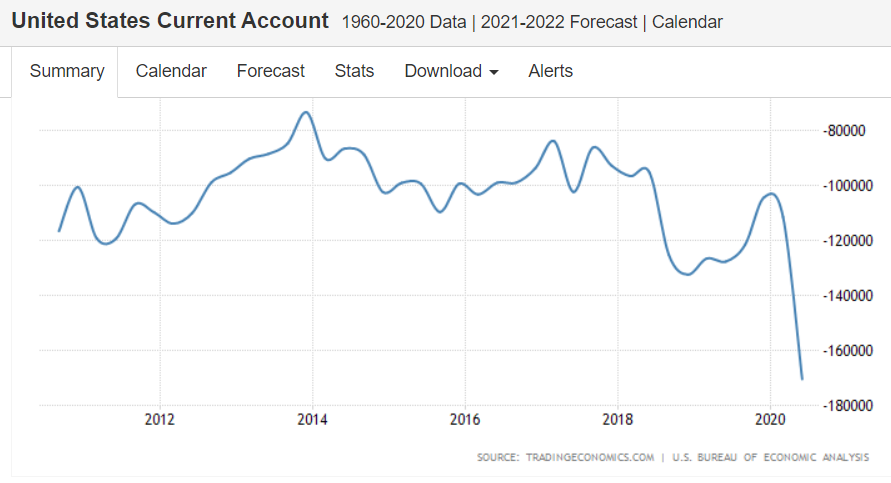

The current account deficit in the US widened by billion, or 52.9%, to 0.5 billion in Q2 2020, the biggest gap since Q3 2008. It is equivalent to 3.5% of the GDP, compared to 2.1% in Q1. It mostly reflects an expanded deficit on goods and reduced surpluses on primary income and on services. All major transactions declined in part due to COVID-19, as many businesses were operating at limited capacity or ceased operations, and the movement of travelers across borders was restricted. Exports went down mainly due to petroleum and products; civilian aircraft; parts and engines and passenger cars; and services of travel and air passenger transport. Receipts of primary income also went down mostly due to equity securities and primarily earnings. Receipts of secondary

Topics:

WARREN MOSLER considers the following as important: Economic Releases

This could be interesting, too:

WARREN MOSLER writes Consumer sentiment, real retail sales, industrial production, wages

WARREN MOSLER writes New manufacturers orders, vehicle sales, unemployment claims, rents, oil prices

WARREN MOSLER writes Saudi price hike, private payrolls, new hires, corporate profits

WARREN MOSLER writes Pending home sales, Durable goods orders, oil rigs and production

The current account deficit in the US widened by $59 billion, or 52.9%, to $170.5 billion in Q2 2020, the biggest gap since Q3 2008. It is equivalent to 3.5% of the GDP, compared to 2.1% in Q1. It mostly reflects an expanded deficit on goods and reduced surpluses on primary income and on services. All major transactions declined in part due to COVID-19, as many businesses were operating at limited capacity or ceased operations, and the movement of travelers across borders was restricted. Exports went down mainly due to petroleum and products; civilian aircraft; parts and engines and passenger cars; and services of travel and air passenger transport. Receipts of primary income also went down mostly due to equity securities and primarily earnings. Receipts of secondary income fell due to primarily private sector fines and penalties and payments dropped on lower primarily private sector fines and penalties, and in general government transfers, primarily international cooperation.