Consumer prices rise a “normal” 0.2% in September In September Consumer prices rose a “normal” 0.2%, the first such typical increase since the pandemic began (blue in the graph below): For the past 40 years, recessions had typically happened when CPI less energy costs (red) had risen to close to or over 3%/year. We are nowhere near that now (last 15 years shown in graph): Because wages are “stickier” than prices, typically as recessions beat down prices (or at least price increases), in real terms wages rise. That has been the case for the coronavirus recession as well: As a result, as I’ve noted for the past several months, real hourly wages for non-supervisory workers have finally exceeded their previous 1973 peak: Of course, this is

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Consumer prices rise a “normal” 0.2% in September

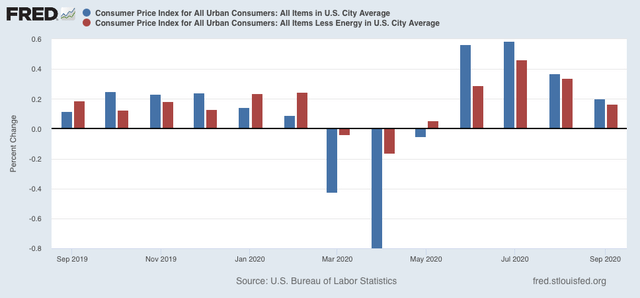

In September Consumer prices rose a “normal” 0.2%, the first such typical increase since the pandemic began (blue in the graph below):

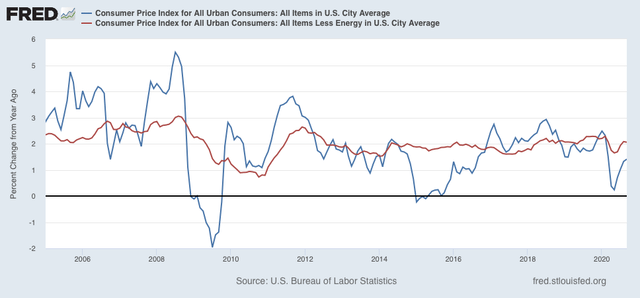

For the past 40 years, recessions had typically happened when CPI less energy costs (red) had risen to close to or over 3%/year. We are nowhere near that now (last 15 years shown in graph):

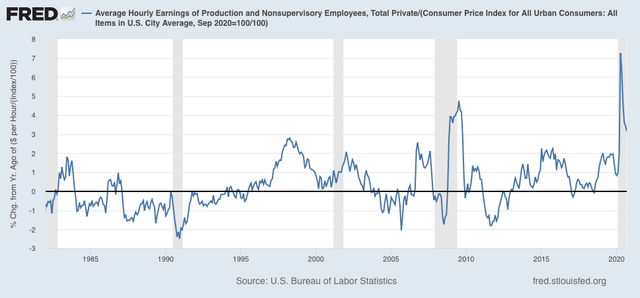

Because wages are “stickier” than prices, typically as recessions beat down prices (or at least price increases), in real terms wages rise. That has been the case for the coronavirus recession as well:

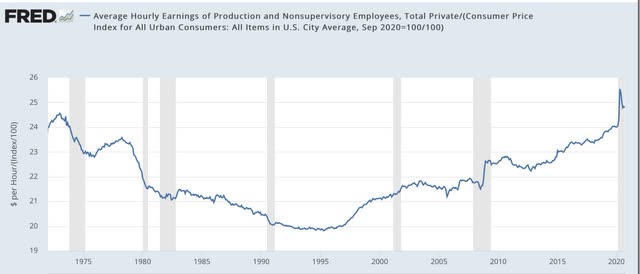

As a result, as I’ve noted for the past several months, real hourly wages for non-supervisory workers have finally exceeded their previous 1973 peak:

Of course, this is also because lower-wage workers disproportionately lost their jobs during the pandemic. Until several months ago, they were buoyed by emergency Congressional assistance. One of the big mysteries in the past few months is why the expiration of those benefits has not caused a steep drop in consumer spending. Retail sales will be reported on Friday, and that is when we will know the answer for September.