Summary:

Personal income and spending both surprisingly continued to increase in September, plus a note on GDP Yesterday the first estimate of Q3 GDP was reported. Since this report includes 2 long leading indicators, it gives us insight into what the economy might be like in the 2nd half of next year. I have a post on that up at Seeking Alpha. As usual, clicking over and reading should be informative for you, and it rewards me a little bit for my efforts. This morning personal income and spending for September was reported. Both real income and spending increased, which is positive – and surprising. On the spending side, below I show real personal spending (blue) in comparison with real retail sales (red), both scaled to 100 as of January of this year:

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Personal income and spending both surprisingly continued to increase in September, plus a note on GDP Yesterday the first estimate of Q3 GDP was reported. Since this report includes 2 long leading indicators, it gives us insight into what the economy might be like in the 2nd half of next year. I have a post on that up at Seeking Alpha. As usual, clicking over and reading should be informative for you, and it rewards me a little bit for my efforts. This morning personal income and spending for September was reported. Both real income and spending increased, which is positive – and surprising. On the spending side, below I show real personal spending (blue) in comparison with real retail sales (red), both scaled to 100 as of January of this year:

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Personal income and spending both surprisingly continued to increase in September, plus a note on GDP

Yesterday the first estimate of Q3 GDP was reported. Since this report includes 2 long leading indicators, it gives us insight into what the economy might be like in the 2nd half of next year.

I have a post on that up at Seeking Alpha. As usual, clicking over and reading should be informative for you, and it rewards me a little bit for my efforts.

This morning personal income and spending for September was reported. Both real income and spending increased, which is positive – and surprising.

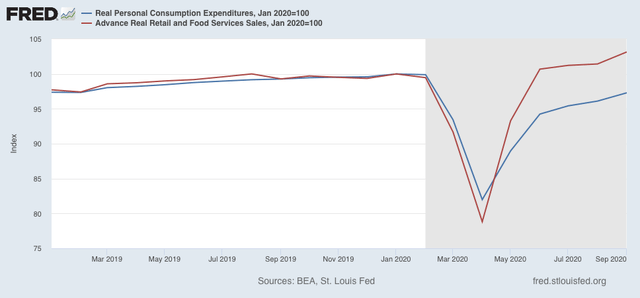

On the spending side, below I show real personal spending (blue) in comparison with real retail sales (red), both scaled to 100 as of January of this year:

Both show similar trajectories, collapsing in April and rebounding since, including a further monthly increase from August to September. While real retail sales have exceeded their precession peak, the broader measure of real personal spending has still only recovered about 85% of its decline.

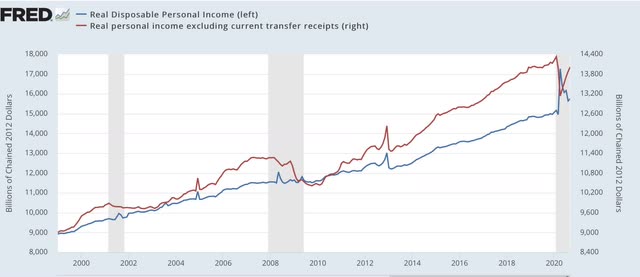

On the income side, here is a long term view of real personal income minus transfer payments (like unemployment insurance)(red, right scale) vs. real disposable personal income (blue, left scale):

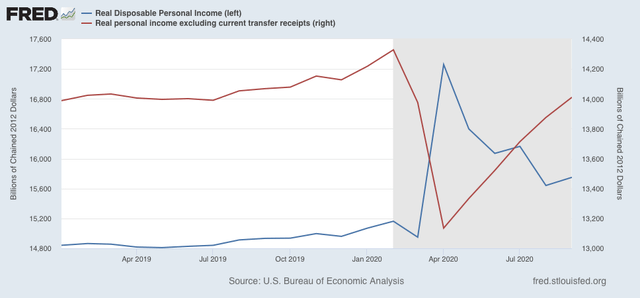

The former is one of the coincident economic series focused on by the NBER in declaring the beginning and end dates for recessions. Similarly to real personal income less transfer payments discussed above, it has rebounded by about 70% from its April bottom. Disposable income, however, increased sharply with the emergency Congressional stimulus, and remains elevated several percent above where it was just before the pandemic hit, as shown better in the close-up of the last two years shown below:

The continuing improvement in spending, and the fact that income remains elevated, despite the failure of Congress (due almost 100% to the Senate) to extend any further stimulus, is the biggest surprise in the economic data over the past several months.