October personal income declines, but still well above pre-pandemic peak; increased likelihood of negative pandemic reversal in jobless claims Before I turn to this week’s report on jobless claims, a brief word first about October’s personal income and spending. Although personal income declined in October compared with September, more importantly depending on how you measure it, real personal income is still 2.6% to 3.4% *higher* than it was at its peak in February just before the onset of the pandemic: Much of that is the emergency pandemic aid passed by Congress. When you take out such “government transfer receipts,” personal income actually continued to improve in October, but is still -0.8% below its February peak. This demonstrates the

Topics:

NewDealdemocrat considers the following as important: US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

October personal income declines, but still well above pre-pandemic peak; increased likelihood of negative pandemic reversal in jobless claims

Before I turn to this week’s report on jobless claims, a brief word first about October’s personal income and spending.

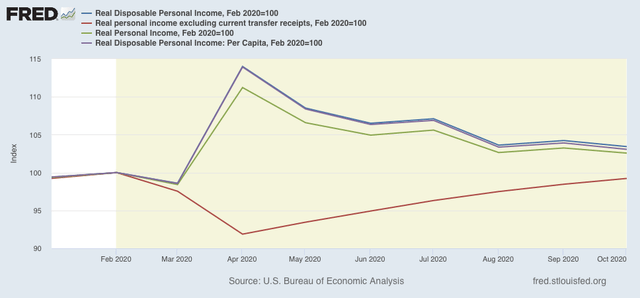

Although personal income declined in October compared with September, more importantly depending on how you measure it, real personal income is still 2.6% to 3.4% *higher* than it was at its peak in February just before the onset of the pandemic:

Much of that is the emergency pandemic aid passed by Congress. When you take out such “government transfer receipts,” personal income actually continued to improve in October, but is still -0.8% below its February peak.

This demonstrates the efficacy of the emergency aid, the urgency of continuing it after the end of the year as the pandemic continues to rage, and also is a likely explanation for why Trump did considerably better, even though he lost, than other economic fundamentals forecast.

Bottom line: we need renewed Congressional aid until the promising vaccines are widely available.

Turning now to this week’s new jobless claims, they increased further from the pandemic lows of two weeks ago, while continued jobless claims, which lag slightly, again declined to new pandemic lows.

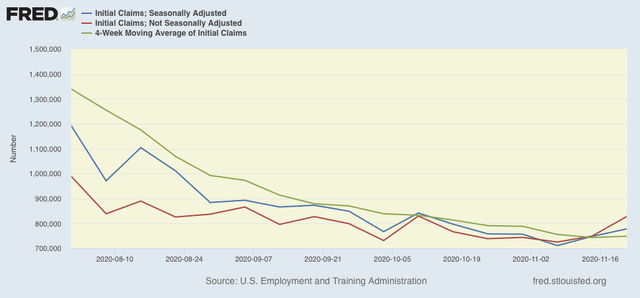

On an unadjusted basis, new jobless claims rose by 48,360 to 827,710. Seasonally adjusted claims rose by 30,000 to 778,000, which is also 67,000 higher than their pandemic lows two weeks ago. The 4 week moving average also rose from last week’s pandemic low by 5,000 to 748,500. Here is the close up since the end of July (for comparison, remember that these numbers were in the range of 5 to 7 million at their worst in early April):

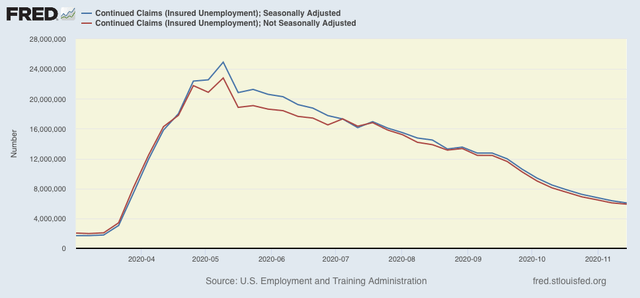

Unadjusted continuing claims, which -importantly – lag initial claims typically by a few weeks to several months, continued to decline by 167,617 to 5,911,965. With seasonal adjustment they declined by 299,000 to 6,071,000, both new pandemic lows:

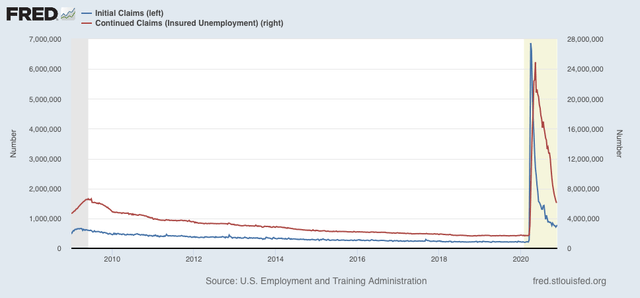

Seasonally adjusted new jobless claims have declined about 88% from their March and April pandemic high, and continuing claims have declined about 75% from the April high:

Both of these are slightly higher than their worst levels of the Great Recession.

It appears increasingly likely that two weeks ago will mark an interim low, due to the pandemic spiraling out of control again in most of the country. How much worse the jobless situation gets will depend on how much worse the pandemic continues to get. In particular, even without lockdowns increasingly cautious or frightened people are going to engage in less economic activity that involves in-person social interactions.