Good news (industrial production) and bad news (retail sales) This morning’s two reports on industrial production and retail sales for December were a case of good news and bad news. Let’s do the good news first. Industrial production, the King of Coincident Indicators, rose 1.6% in December. The manufacturing component rose by 1.0%. Needless to say, these are strong positive numbers. As a result, overall production is only -3.3% below its February level, while manufacturing is only down -2.4% since February: Manufacturing has consistently been one of the biggest bright spots in the economy ever since April. Now on to the bad news. Nominal retail sales declined -1.0% in December. Excluding the food services sector which has been

Topics:

NewDealdemocrat considers the following as important: US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Good news (industrial production) and bad news (retail sales)

This morning’s two reports on industrial production and retail sales for December were a case of good news and bad news.

Let’s do the good news first. Industrial production, the King of Coincident Indicators, rose 1.6% in December. The manufacturing component rose by 1.0%. Needless to say, these are strong positive numbers. As a result, overall production is only -3.3% below its February level, while manufacturing is only down -2.4% since February:

Manufacturing has consistently been one of the biggest bright spots in the economy ever since April.

Now on to the bad news.

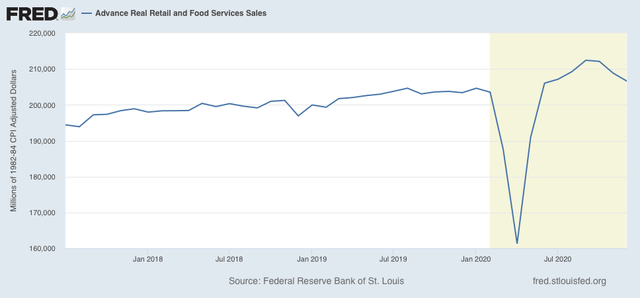

Nominal retail sales declined -1.0% in December. Excluding the food services sector which has been especially hard hit by the pandemic and lockdowns, sales were nevertheless down -0.3%. Total sales are down -2.7% since September; excluding food sales they are still down -1.5%:

In real terms, retail sales declined -1.0%, and are down -2.7% since September:

The silver lining is that this type of decline doesn’t necessarily mean a steep decline back into recession lows. Similar declines happened several times during the last expansion. And they are still up 1.5% since February.

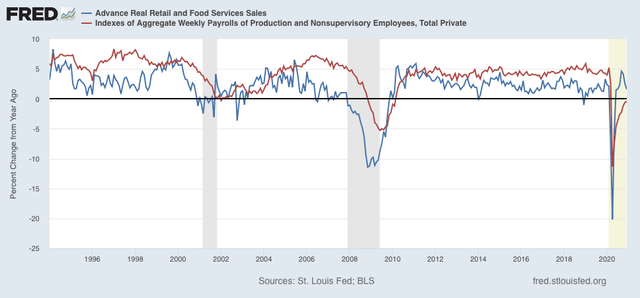

As I have pointed out many times, consumption leads to employment. It’s even a better match for aggregate hours worked in the economy, as shown in the long term graph below:

Last month I wrote that “I continue to expect employment to continue to rise – with a lag, and quite possibly a pause during this winter as the pandemic continues to rage – to match the level of sales.” Well, we certainly got the “pause” in December’s employment report, and if we get more initial jobless claims reports like yesterday’s, a further downturn. But I still expect employment to rise to meet sales once the winter surge in cases and shutdowns of outdoor activities including dining both abate.