RJS, MarketWatch 666 “February” Durable Goods: New Orders Down 2.2%, Shipments Flat, Inventories Up 0.4% The “Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders for February” (pdf) from the Census Bureau reported that the value of the widely watched new orders for manufactured durable goods decreased by .0 billion or 2.2 percent to 1.5 billion in February, the first decrease in five months, after January’s new orders were revised from the 7.5 billion reported last month to 7.6 billion, still a 1.6% increase from December’s new orders . . . even with February’s big decrease, however, year to date new orders are still up by 14.2% from those of 2021… The volatile monthly new orders for transportation

Topics:

Angry Bear considers the following as important: Hot Topics, MarketWatch 666, politics, RJS, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

RJS, MarketWatch 666

“February” Durable Goods: New Orders Down 2.2%, Shipments Flat, Inventories Up 0.4%

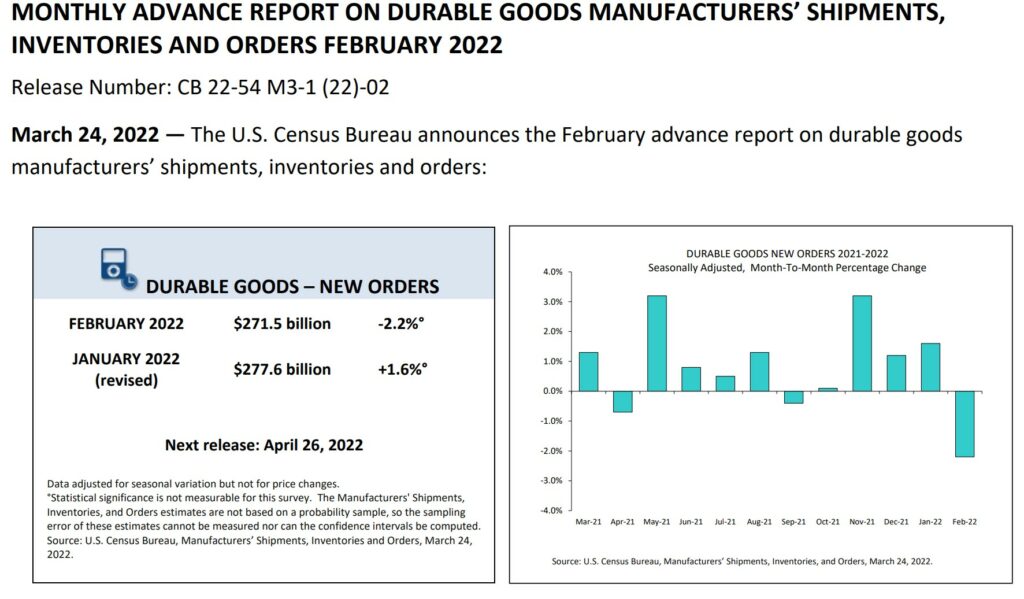

The “Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders for February” (pdf) from the Census Bureau reported that the value of the widely watched new orders for manufactured durable goods decreased by $6.0 billion or 2.2 percent to $271.5 billion in February, the first decrease in five months, after January’s new orders were revised from the $277.5 billion reported last month to $277.6 billion, still a 1.6% increase from December’s new orders . . . even with February’s big decrease, however, year to date new orders are still up by 14.2% from those of 2021…

The volatile monthly new orders for transportation equipment led February’s new orders decrease, as the value of new transportation equipment orders fell $4.9 billion or 5.6 percent to $82.6 billion, despite a 60.1% increase to $4,666 million in new orders for defense aircraft, as the value of new orders for commercial aircraft fell 30.4% to $13,481 million and the value of new orders for motor vehicles and parts fell 0.5% to $54,451 million . . . however, excluding orders for transportation equipment, other new orders still fell 0.6%, while excluding just new orders for defense equipment, new orders fell 2.7%. New orders for nondefense capital goods less aircraft, a proxy for equipment investment, were also down, falling by $252 million or 0.3% to $80,093 million…

Over the same period, the seasonally adjusted value of February’s shipments of durable goods, which will ultimately be included as inputs into various components of 1st quarter GDP after adjusting for changes in prices, fell for the first time in six months, decreasing by $0.1 billion to $270.6 billion, after the value of January’s shipments was revised from $270.4 billion to $270.7 billion, now up 1.3% from December, rather than the 1.2% increase reported a month ago . . . lower shipments of machinery led the February shipments decrease, as they decreased by $0.5 billion or 1.4 percent to $38.5 billion, but shipments of transportation equipment were also lower, decreasing by $0.4 billion or 0.6 percent to $77.7 billion, on an 0.8% decrease to $54,211 million in the value of shipments of motor vehicles and parts. However, the value of shipments of nondefense capital goods less aircraft still rose 0.5% to $79,666 million, after January’s capital goods shipments were revised up from $79,070 million to $79,292 million…

Meanwhile, the value of seasonally adjusted inventories of durable goods, also a major GDP contributor, rose by $2.0 billion or 0.4 percent to $478.5 billion, the thirteenth consecutive increase, after the value of January inventories was revised from $476.0 billion to $476.4 billion, now up 0.5% from December . . . the value of inventories of machinery rose $0.8 billion or 1.0 percent to $80.5 billion, while the value of inventories of transportation equipment was statistically unchanged, as falling inventories of defense aircraft offset rising inventories of commercial aircraft and of motor vehicles and parts..

Finally, the value of unfilled orders for manufactured durable goods, which are probably a better measure of industry conditions than the widely watched but often very volatile new orders, rose for the thirteenth consecutive month, increasing by $5.3 billion or 0.4 percent to $1,288.4 billion, following a 0.9% January increase to $1,283.1 billion, which was revised from the previously reported 0.9% increase to $1,283.2 billion . . . a $4.9 billion or 0.6 percent increase to $853.4 billion in unfilled orders for transportation equipment led the February increase, while unfilled orders excluding transportation equipment orders were up 0.1% to $435.0 billion. The unfilled order book for durable goods is now 8.6% above the level of last February, with unfilled orders for transportation equipment 6.4% above their year ago level, mostly due to a 12.4% increase in the backlog of orders for motor vehicles and parts…