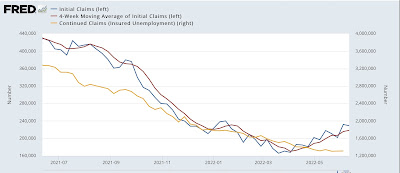

The increasing trend in new jobless claims continues Initial jobless claims declined -3,000 to 229,000 last week, vs. the 50+ year low of 166,000 set in March. The 4 week average also rose 2,750 to 218,500, compared with the all-time low of 170,500 ten weeks ago. Continuing claims rose 3,000 to 1,312,000, or 6,000 above their 50 year low of 2 weeks ago: It’s now clear that initial claims have been in an uptrend over the past 2.5 months. If this continues until the end of this month, they will no longer qualify as a “positive” in my array of short leading indicators, although they have not risen to levels that would change their rating to a negative. This is yet more slight weakening in the economic indicators, and yet more reason for concern

Topics:

NewDealdemocrat considers the following as important: jobless claims, NDd, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

The increasing trend in new jobless claims continues

Initial jobless claims declined -3,000 to 229,000 last week, vs. the 50+ year low of 166,000 set in March. The 4 week average also rose 2,750 to 218,500, compared with the all-time low of 170,500 ten weeks ago. Continuing claims rose 3,000 to 1,312,000, or 6,000 above their 50 year low of 2 weeks ago:

It’s now clear that initial claims have been in an uptrend over the past 2.5 months. If this continues until the end of this month, they will no longer qualify as a “positive” in my array of short leading indicators, although they have not risen to levels that would change their rating to a negative.

This is yet more slight weakening in the economic indicators, and yet more reason for concern about a recession as we get to 2023.