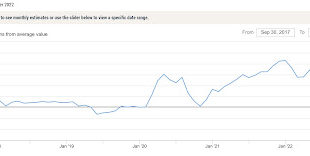

October producer prices: more evidence that supply chain pressures have eased – by New Deal democrat Let me start this discussion of October’s producer price index by pointing to the NY Fed’s “Global Supply Chain Pressure Index” for the past 5 years through October: Before Trump’s tariff’s in 2018, most often this index was slightly below zero. It zoomed higher when the pandemic, and with the exception of a few months, stayed there until...

Read More »Foreboding Economic Signs Coming from consumption and employment data

Some foreboding signs and portents from consumption and employment data – by New Deal democrat I have a special post up at Seeking Alpha, looking at some very troubling signs from several of the high frequency indicators I track weekly as to consumption and employment. Click over and read the whole article, but here is a little taste: the below is what the YoY% change in the 20-day total of payroll tax withholding has been in has been as of...

Read More »New Deal democrat’s Weekly Indicators for November 7 – 11

“Weekly Indicators for November 7 – 11″ at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. Although a few indicators are holding up, in the past month there has been almost continual deterioration in several employment and consumption metrics. These are particularly important for whether the consumer is pulling back, typically a signal that a recession is close to imminent. As usual, clicking over...

Read More »How is the working-middle class doing? Real average non-supervisory wages

Real average hourly wages and real aggregate payrolls for October – by New Deal democrat With yesterday’s report on October consumer prices, we can take up two of my favorite measures of how the working/middle class is doing – real average non-supervisory wages, and real aggregate payrolls. Real average wages for non-supervisory workers declined -0.1% for the month. They are -5% below their pandemic lockdown peak (which, recall, was...

Read More »October CPI reports total inflation increases at a 3.5% annual rate

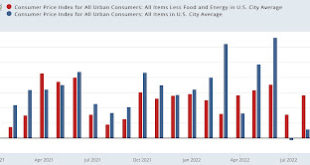

October CPI report: total inflation increasing at 3.5% annual rate, core inflation minus shelter increasing at 2.8% annual rate in the past 4 months – by New Deal democrat For a full year now I’ve been hammering the fact that the official CPI measure of housing inflation, “owners’ equivalent rent,” seriously lags actual house prices as measured by the most popular housing indexes. I said then, and I have reiterated almost every month since,...

Read More »Jobless claims: still holding steady

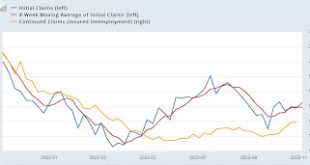

Jobless claims: still holding steady – by New Deal democrat Initial jobless claims rose slightly, by 7,000, from one week ago to 225,000. The 4 week average declined -250 to 218,750. Continuing claims also rose slightly, by 6,000, to 1,493,000: This is right in the middle of where claims have been for the last 6 months. If anything, there might be a slight rising trend in the last month. The jobs market remains very tight. Aside from...

Read More »Some Big Picture comments on the 2022 midterm elections

Some Big Picture comments on the 2022 midterm elections – by New Deal democrat No economic news today while we await tomorrow’s big inflation report (Hint: shelter inflation is going to continue to be the big driver); and I think maybe we had a little political event yesterday, so let me make a few brief comments. 1. From the beginning of this year, I told everybody who would listen that (1) the Supreme Court was really and truly going to...

Read More »New Deal democrat’s Weekly Indicators for October 31 – November 4

“Weekly Indicators for October 31 – November 4″ at Seeking Alpha. – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. Data doesn’t move relentlessly in one direction, and this week there was some improvement in some of the indicators I follow. As usual, clicking over and reading will bring you up to the virtual economic moment, and reward me a little bit for my efforts. “New Deal democrat’s Weekly Indicators for...

Read More »October jobs report: late cycle deceleration and deterioration

October jobs report: late cycle deceleration and deterioration – by New Deal democrat With the sharp increases in interest rates, and the complete stalling of real consumer spending measured YoY, since early this year I have expected employment to follow suit, decelerating over time to a stall. And the three month average in employment gains since February decelerated from over 500,000 to 372,000 through September. Because jobless claims,...

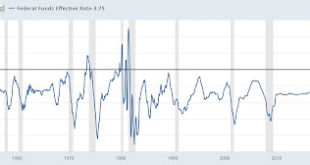

Read More »The Fed appears determined to cause a Volcker-like recession

The Fed appears determined to cause a Volcker-like recession – by New Deal democrat Yesterday the Fed raised rates another 0.75%. In the past 8 months, the Fed has raised rates a total of 3.75%. This is one of the steepest increases in interest rates ever, only exceeded by the pace of the two 1970s oil shocks (1974 and 1979) and Volcker’s inflation jihad of 1981, as shown in the below graph of the YoY% change in the Fed funds rate. Note...

Read More » Heterodox

Heterodox