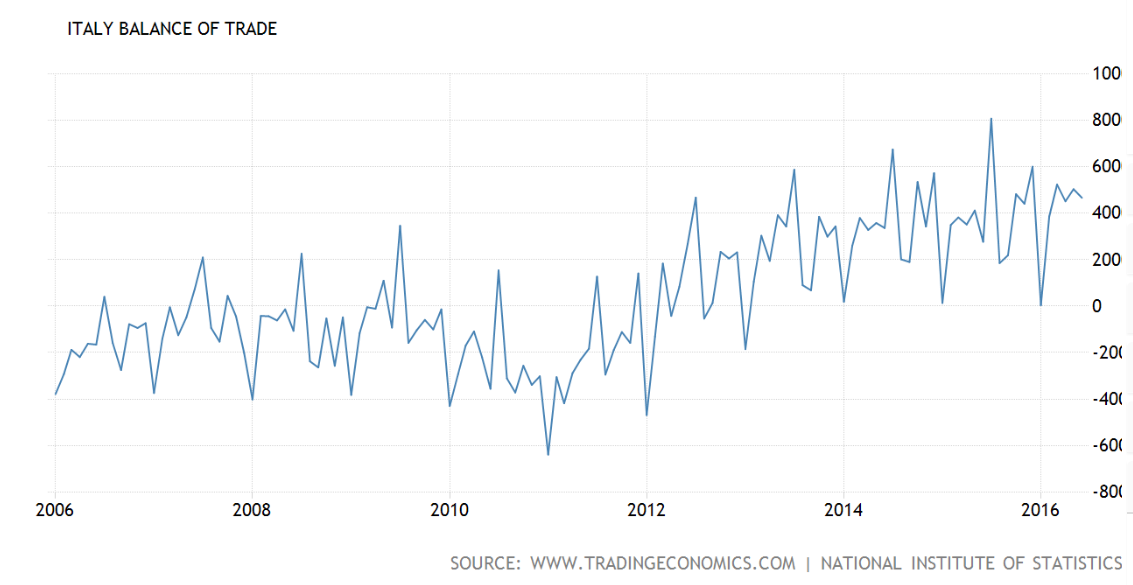

The euro area trade surplus in general seems to be continuing, even as global trade weakens. Fundamentally this removes net euro financial assets from global markets that were sold by portfolio managers. Those managers include central bankers proactively selling their euro reserves over the last two years or so to buy US dollars, which has in turn kept the euro low enough to drive the surplus:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

The euro area trade surplus in general seems to be continuing, even as global trade weakens. Fundamentally this removes net euro financial assets from global markets that were sold by portfolio managers. Those managers include central bankers proactively selling their euro reserves over the last two years or so to buy US dollars, which has in turn kept the euro low enough to drive the surplus: