Nothing here to get the Fed concerned about inflation: Not good, less then expected and excluding autos, a ‘core reading’ even worse. Seems to me that perhaps the higher gas prices that caused the increases over the last couple of month’s have taken their toll on other spending. And at the macro level, without an increase in either private or public deficit spending top line growth won’t be there: HighlightsConsumers spent their money on vehicles in July but not on much else as retail sales came in unchanged. When excluding autos, retail sales slipped 0.3 percent for the first decline in this reading since March. When excluding both autos and gasoline, the latter falling on lower prices, retail sales improve slightly but are still down 0.1 percent for the first decline since January. This core reading is telling and will likely define total consumer spending (which includes services) for the month of July. The big plus that saves the report is the 1.1 percent monthly surge in motor vehicle sales, one that follows a 0.5 percent gain in June. Spending elsewhere may be weak, but spending on vehicles is a signal of consumer confidence and strength. Elsewhere, positives are hard to find. Supermarket sales fell in the month as did building materials.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

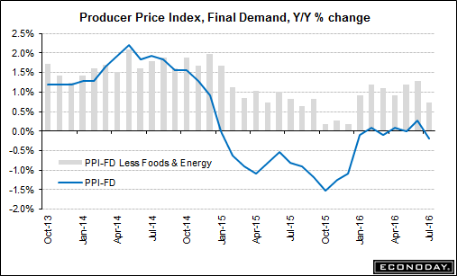

Nothing here to get the Fed concerned about inflation:

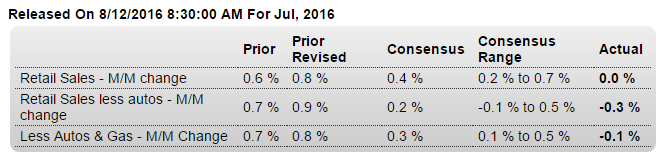

Not good, less then expected and excluding autos, a ‘core reading’ even worse. Seems to me that perhaps the higher gas prices that caused the increases over the last couple of month’s have taken their toll on other spending. And at the macro level, without an increase in either private or public deficit spending top line growth won’t be there:

Highlights

Consumers spent their money on vehicles in July but not on much else as retail sales came in unchanged. When excluding autos, retail sales slipped 0.3 percent for the first decline in this reading since March. When excluding both autos and gasoline, the latter falling on lower prices, retail sales improve slightly but are still down 0.1 percent for the first decline since January. This core reading is telling and will likely define total consumer spending (which includes services) for the month of July.The big plus that saves the report is the 1.1 percent monthly surge in motor vehicle sales, one that follows a 0.5 percent gain in June. Spending elsewhere may be weak, but spending on vehicles is a signal of consumer confidence and strength. Elsewhere, positives are hard to find.

Supermarket sales fell in the month as did building materials. Sporting goods were especially weak as were restaurant sales, the latter a discretionary category that speaks to the month’s lack of non-vehicle punch. On the plus side once again are sales at nonstore retailers which, driven by ecommerce, jumped a sizable 1.3 percent for a second straight month and follows even larger gains in prior months. Sales at gasoline stations, reflecting lower prices, swung 2.7 percent lower following a 2.2 percent gain in the prior month.

The consumer is the driver of the economy and July’s weakness for retail sales makes for a slow start to the third quarter and will ease talk for now of a September FOMC rate hike. Upward revisions are footnotes in the report with June now at plus 0.8 percent, up 2 tenths from the initial reading which will pull GDP revision estimates for the second quarter higher.

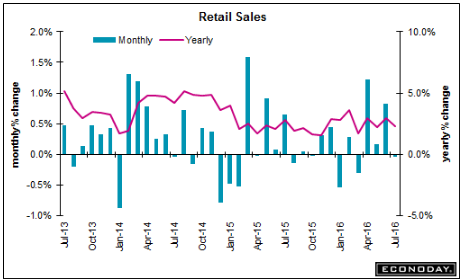

You can see how retail sales growth peaked when oil capex collapsed at the end of 2014,

and that spending has yet to be ‘replaced’:

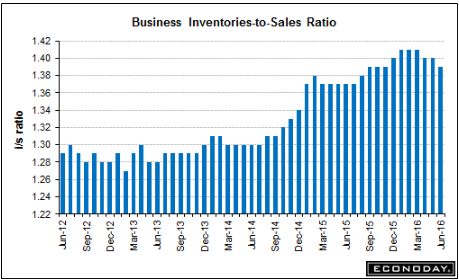

Business inventories corrected some due to what I think was a one time jump in auto sales (which remain down year over year). However inventories still look way too high to me and so the liquidation is likely to continue into q3. And note that the inventory growth began when oil capex collapsed:

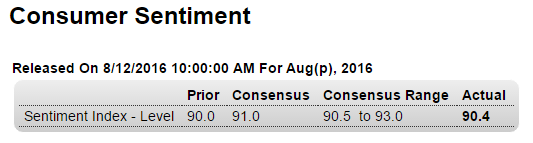

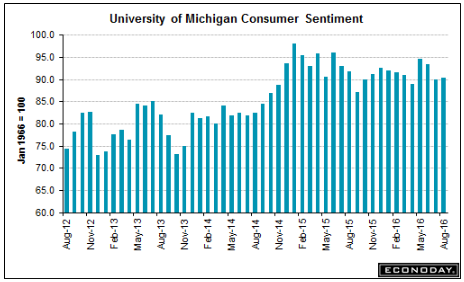

This was also below expectations and doesn’t look to be recovering to prior levels:

Highlights

Consumer sentiment is flat, at 90.4 for the August flash for only a 4 tenths gain. Components are mixed with expectations higher, at 80.3 for a 3.5 point gain, but current conditions lower, down 2.9 points to 106.1. The gain in expectations points to rising confidence in the jobs outlook but the decline in current conditions hints at a second month of slowing for consumer spending.

This too peaked when oil capex collapsed:

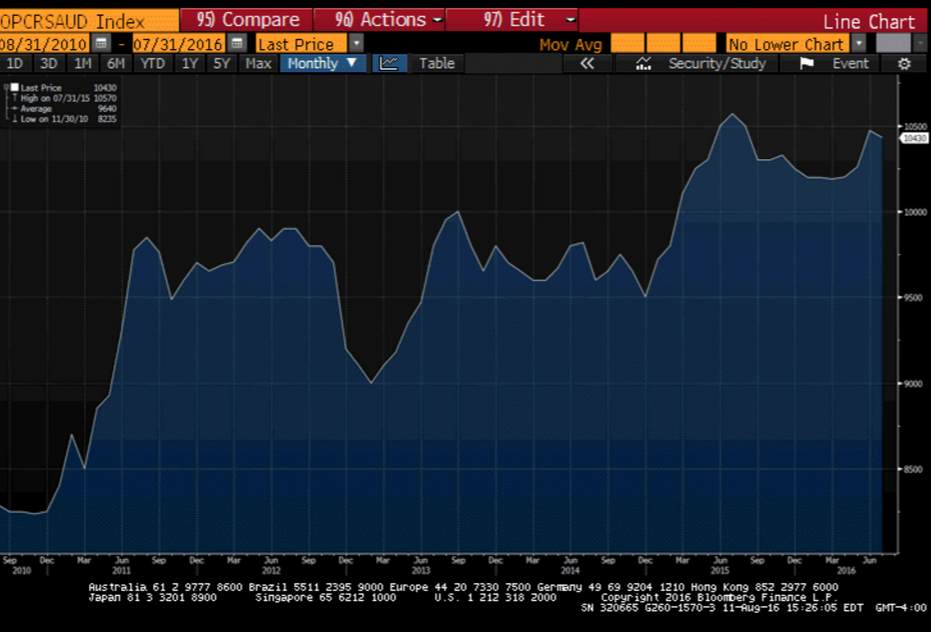

Saudi oil sales have moved up a bit but are still far below their presumed output availability of 12 million bpd. So it’s still a matter of setting price, in this case via their posted discounts to benchmarks:

German GDP grows much faster than expected

By Todd Buell

Aug 12 (MarketWatch) — Germany’s economy grew at a much faster pace than expected in the second quarter. In quarterly adjusted terms, Europe’s largest economy and economic powerhouse grew by 0.4%. The statistics office said that growth came primarily from foreign trade. Quarterly growth in the first quarter was 0.7%.

Euro Area GDP Growth Rate

The Eurozone’s economy expanded 0.3 percent on quarter in the three months to June 2016 slowing from a 0.6 percent growth in the previous period and matching preliminary reading, second estimate showed. Among the largest economies of the Euro Area, GDP growth slowed in Germany and Spain; while growth in France and Italy was flat.