Summary:

Permits and starts have fallen off but are still above pre-Covid levels. This particular sector is presumed to be the target of Fed rate hikes. I suspect it is a temporary setback with buyers taking a wait and see attitude, as employment continues to grow: The post-Covid bounce continues with no sign of recession. US energy costs are relatively low which is helping drive the export component: Peter Coy’s NYT article today was about my assertion that rate hikes are adding to inflation, which was confirmed by his quote from Prof. Michael Woodford, who is considered the #1 mainstream monetary economist and the Fed’s ‘go to’ economist:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

Permits and starts have fallen off but are still above pre-Covid levels. This particular sector is presumed to be the target of Fed rate hikes. I suspect it is a temporary setback with buyers taking a wait and see attitude, as employment continues to grow: The post-Covid bounce continues with no sign of recession. US energy costs are relatively low which is helping drive the export component: Peter Coy’s NYT article today was about my assertion that rate hikes are adding to inflation, which was confirmed by his quote from Prof. Michael Woodford, who is considered the #1 mainstream monetary economist and the Fed’s ‘go to’ economist:

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

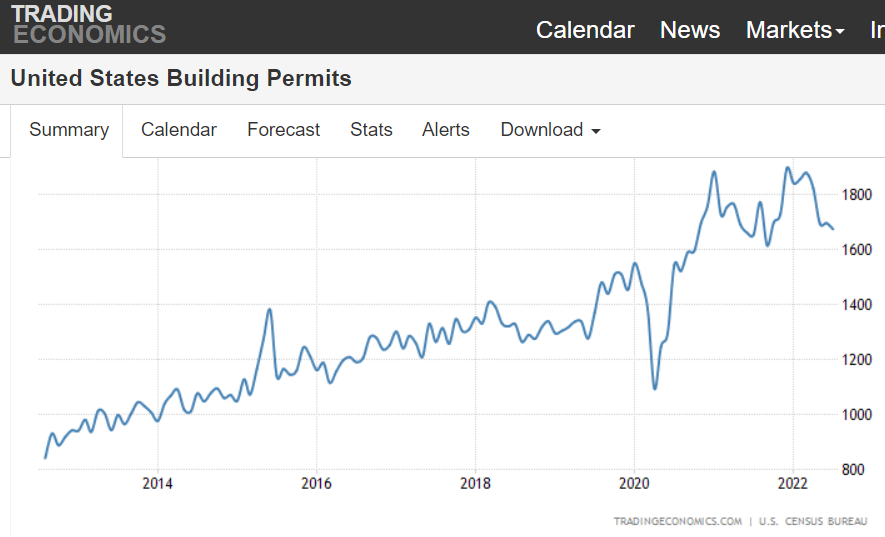

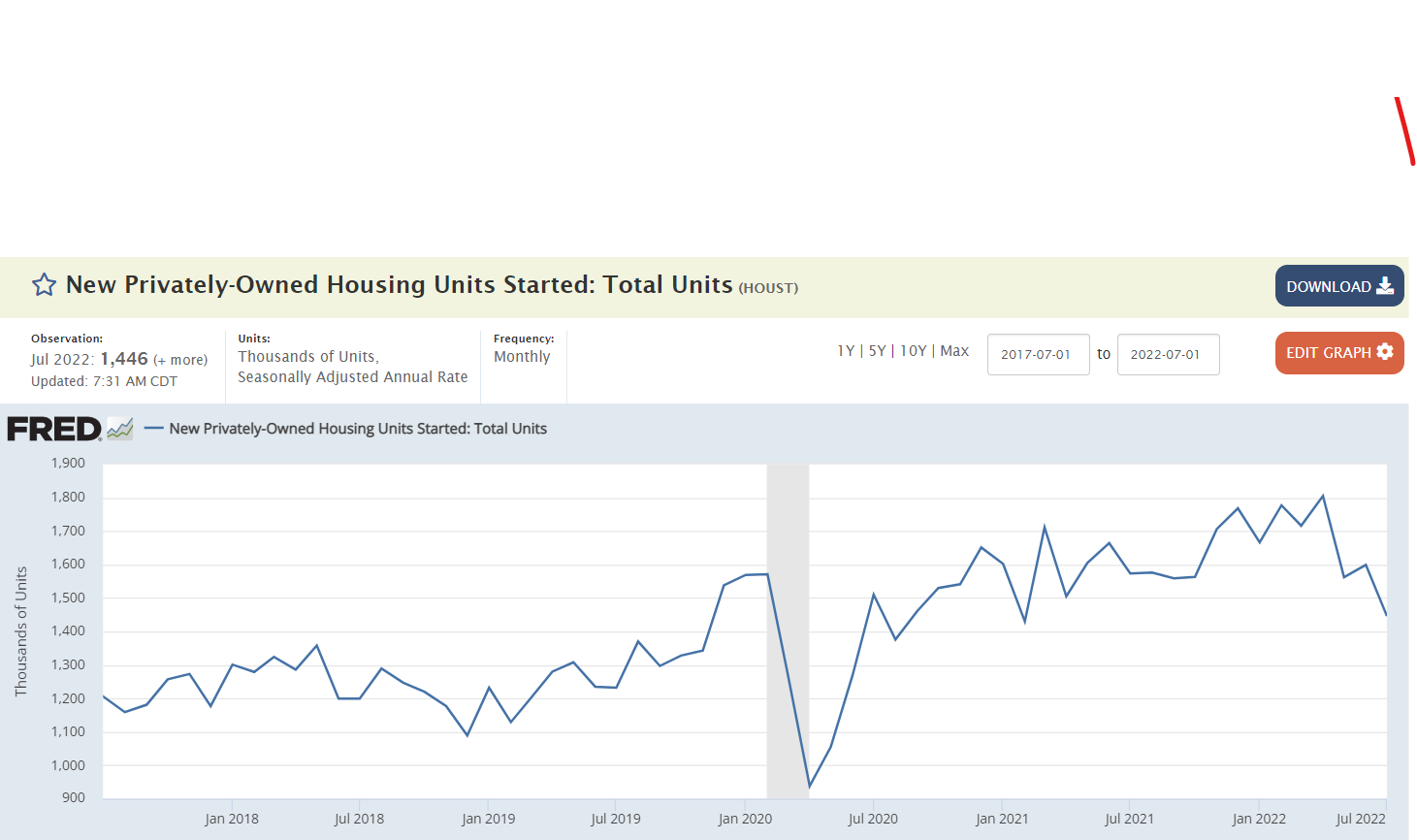

Permits and starts have fallen off but are still above pre-Covid levels. This particular sector is presumed to be the target of Fed rate hikes. I suspect it is a temporary setback with buyers taking a wait and see attitude, as employment continues to grow:

The post-Covid bounce continues with no sign of recession.

US energy costs are relatively low which is helping drive the export component:

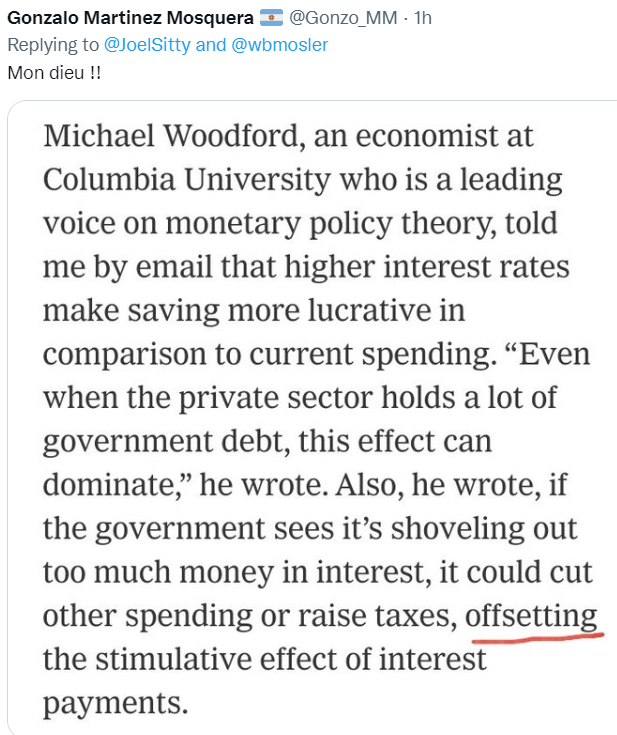

Peter Coy’s NYT article today was about my assertion that rate hikes are adding to inflation, which was confirmed by his quote from Prof. Michael Woodford, who is considered the #1 mainstream monetary economist and the Fed’s ‘go to’ economist: