I’m excited to share a new research paper with you all. It’s the first one I’ve published in 6 years and it’s one of the few things I’ve written that I believe deserves the formalities of a paper. It’s called “All Duration Investing” and what I’ve done in this paper is quantified the actual “durations” of all asset classes. What’s nice about this approach is that you can now structure different asset classes in specific time horizons using a financial planning foundation. This allows us to use an asset-liability matching framework and help investors understand how specific assets fit into a specific financial plan. Everyone has short, medium and long-term liabilities. The problem with investing is that these time horizons involve uncertainty because we do not know the time

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

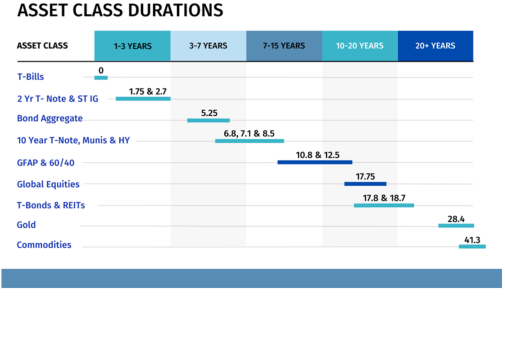

I’m excited to share a new research paper with you all. It’s the first one I’ve published in 6 years and it’s one of the few things I’ve written that I believe deserves the formalities of a paper. It’s called “All Duration Investing” and what I’ve done in this paper is quantified the actual “durations” of all asset classes. What’s nice about this approach is that you can now structure different asset classes in specific time horizons using a financial planning foundation. This allows us to use an asset-liability matching framework and help investors understand how specific assets fit into a specific financial plan.

Everyone has short, medium and long-term liabilities. The problem with investing is that these time horizons involve uncertainty because we do not know the time horizons over which certain instruments exist and protect us. For instance, cash is a perfect short-term nominal instrument, but creates uncertainty across the long-term as an inflation hedge. Stocks, on the other hand, are good inflation hedges in the long-run, but can create a lot of nominal uncertainty in the short-term.

By quantifying a “duration” for all of these instruments we create a framework which allows us to implement an asset allocation that is similar to bond laddering where we’re applying specific assets to specific time horizons. This gives the investor greater certainty about their financial plan and their asset allocation because they can now segment specific assets into specific behavioral allocations.

The paper’s only 10 pages and I think I’ve jammed a lot of useful info into a relatively short space. I hope you find it helpful!

See here for more information on the All Duration white paper and strategy.