July real retail sales show more stagnation, but slightly positive YoY Consumption leads employment. Increasing demand for goods and services leads employers to hire more people to fulfill that demand. That, in a nutshell, is the biggest reason why real retail sales is one of my favorite economic indicators. In July, nominal retail sales increased by less than 0.1%, rounding to 0. Consumer prices declined by less than -0.1%, also rounding to 0. But the combination was just enough to push real retail sales to round to +0.1%: Still, real retail sales remain -1.1% below their April peak: Interestingly, while as noted above nominal total retail sales were unchanged, retail sales excluding motor vehicles increased 0.4%, and retail sales

Topics:

NewDealdemocrat considers the following as important: Retail sales, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

July real retail sales show more stagnation, but slightly positive YoY

Consumption leads employment. Increasing demand for goods and services leads employers to hire more people to fulfill that demand. That, in a nutshell, is the biggest reason why real retail sales is one of my favorite economic indicators.

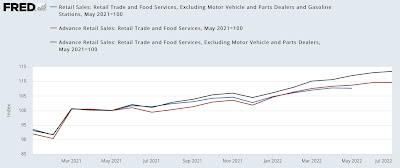

In July, nominal retail sales increased by less than 0.1%, rounding to 0. Consumer prices declined by less than -0.1%, also rounding to 0. But the combination was just enough to push real retail sales to round to +0.1%:

Still, real retail sales remain -1.1% below their April peak:

Interestingly, while as noted above nominal total retail sales were unchanged, retail sales excluding motor vehicles increased 0.4%, and retail sales excluding both vehicles and gas increased 0.7%. Since March 2021, total nominal retail sales are up 9.6%, and ex-vehicles and gas up 9.4%, but excluding vehicles only up 13.4%:

[Note: retail ex gas and vehicles has not updated yet on FRED, so June and July of that series are not shown]

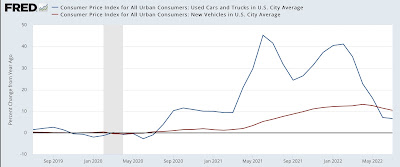

This indicates that consumers are avoiding the purchase of motor vehicles, given their big price increases as shown in this graph which I ran when CPI was updated earlier:

And it further suggests that a big reason for the dampened consumer spending this year is the big increase in car and SUV prices. In other words, the chip shortage is a Big Economic Deal.

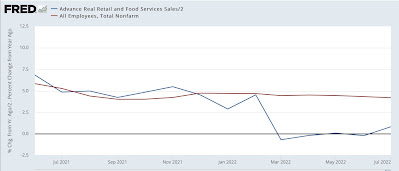

That being said, YoY real retail sales, which were negative for the past several months, are now up 1.7%:

This is a good sign, since negative YoY real retail sales typically have been a recession marker, but positive YoY real retail sales have historically only happened either in expansions or late in recessions (i.e., a short leading indicator of an incipient recovery). In other words, yet another sign that the US economy is not currently in a recession.

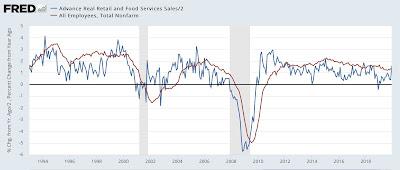

Finally, as noted above, real retail sales is a good short leading indicator for employment. Here’s the long term view from 1993-2019:

And here is the last year:

Even with the blowout July employment gains, on a YoY basis job growth has continued to decelerate, and I expect it to decelerate further, perhaps sharply.