Still looks to me like this is perhaps the most misunderstood statistic, as analysts believe it is signaling strength in the labor markets. Instead I’m suggesting claims are extraordinarily low because the unemployment benefits have become much harder to get: Even with a much higher population and labor force, and with a higher unemployment rate,new claims are at 40 year lows: Not at all good: HighlightsOnce again the Philly Fed’s headline tells an entirely different story than the details. At plus 2.0, the headline may be a bit flat but that’s far better than orders or employment which are in deep contraction. New orders fell back into negative ground, to minus 7.2 from July’s plus 11.8 for the very weakest reading of the year. Backlog orders fell to minus 15.0 from plus 1.9 which is also the weakest reading of the year. At a numbing minus 20.0, employment is down for an 8th month in a row for the weakest showing of the cycle, since July 2009. Inventories are in sharp contraction, the workweek is in sharp contraction, and delivery times are speeding up which is a sign of weakness. The one sign of strength (other than the headline) is shipments, at plus 8.4 in a gain that won’t likely be repeated anytime soon given the weakness in orders. The headline for this report is not a composite but maybe it should be. If it were, it would be deeply negative.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

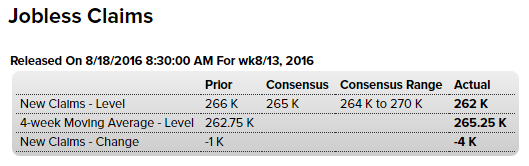

Still looks to me like this is perhaps the most misunderstood statistic, as analysts believe it is signaling strength in the labor markets. Instead I’m suggesting claims are extraordinarily low because the unemployment benefits have become much harder to get:

Even with a much higher population and labor force, and with a higher unemployment rate,

new claims are at 40 year lows:

Not at all good:

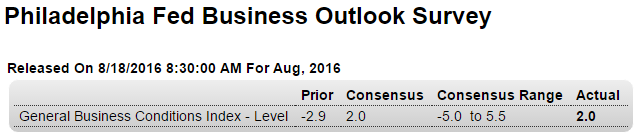

Highlights

Once again the Philly Fed’s headline tells an entirely different story than the details. At plus 2.0, the headline may be a bit flat but that’s far better than orders or employment which are in deep contraction.New orders fell back into negative ground, to minus 7.2 from July’s plus 11.8 for the very weakest reading of the year. Backlog orders fell to minus 15.0 from plus 1.9 which is also the weakest reading of the year. At a numbing minus 20.0, employment is down for an 8th month in a row for the weakest showing of the cycle, since July 2009. Inventories are in sharp contraction, the workweek is in sharp contraction, and delivery times are speeding up which is a sign of weakness. The one sign of strength (other than the headline) is shipments, at plus 8.4 in a gain that won’t likely be repeated anytime soon given the weakness in orders.

The headline for this report is not a composite but maybe it should be. If it were, it would be deeply negative.

Exports and imports both dropped substantially, indicating global trade continues to decline:

Japan Balance of Trade

Japan recorded a 513.5 JPY billion surplus in July of 2016, compared to a 261.39 JPY billion deficit a year earlier and beating market consensus of a 283.7 JPY billion surplus, as exports fell less than imports.Year-on-year, sales dropped by 14.0 percent to 5,728.41 JPY billion in July, following a 7.4 percent fall in June and in line with estimates.

Imports decreased by 24.7 percent to 5,214.90 JPY billion, compared to a 18.8 percent decrease in a month earlier while markets expected a 20.6 percent drop.

In June 2016, the country posted a 692.83 JPY billion trade surplus.