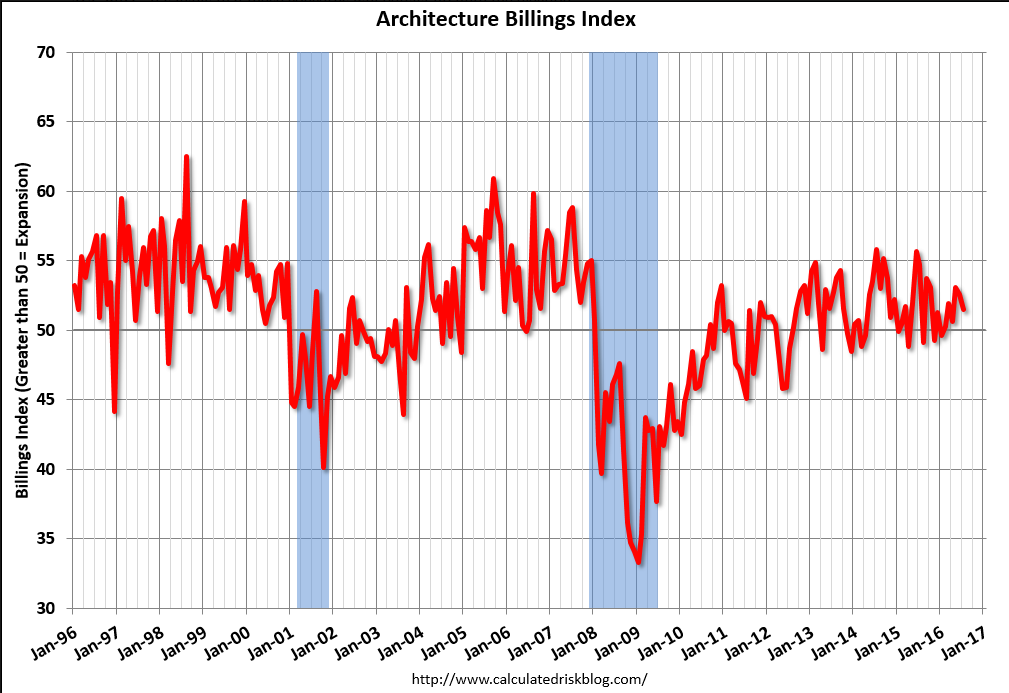

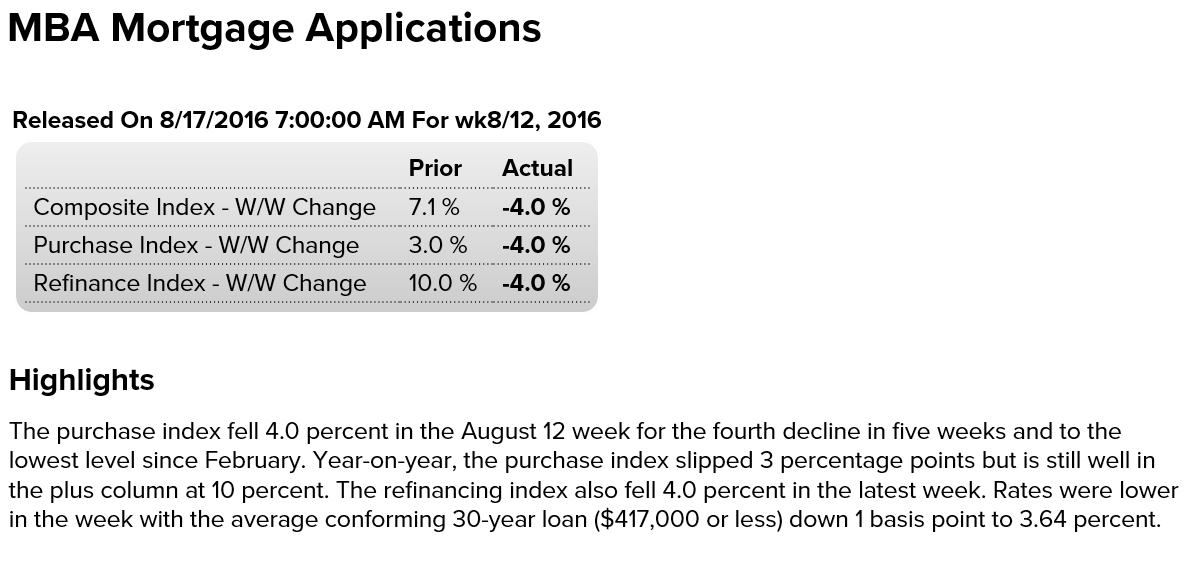

The chart shows both how depressed the mortgage market is historically as well as how it’s been deteriorating over the last several months: And lots of headlines like this popping up: Wednesday, August 17, 2016Sacramento Housing in July: Sales down 7%, Active Inventory down 10% YoYLas Vegas Real Estate in July: Sales down 10% YoY, Inventory down 1% Read more at http://www.calculatedriskblog.com U.S. companies’ stock buyback plans hit four-year low: TrimTabs Aug 16 (Reuters) — At .8 billion a day, the amount of buyback announcements from U.S. companies during the nearly completed second-quarter earnings season is tracking to the lowest since the same period of 2012, according to TrimTabs, which compared six-week periods during which companies report quarterly results. The number of companies announcing buybacks has also fallen, averaging 3.3 a day so far, well below the 6.1 per day during earnings season a year ago. According to TrimTabs, the total amount of announced buybacks through July is down 21 percent from the same period a year ago.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

The chart shows both how depressed the mortgage market is historically as well as how it’s been deteriorating over the last several months:

And lots of headlines like this popping up:

Wednesday, August 17, 2016

Sacramento Housing in July: Sales down 7%, Active Inventory down 10% YoY

Las Vegas Real Estate in July: Sales down 10% YoY, Inventory down 1%Read more at http://www.calculatedriskblog.com

U.S. companies’ stock buyback plans hit four-year low: TrimTabs

Aug 16 (Reuters) — At $1.8 billion a day, the amount of buyback announcements from U.S. companies during the nearly completed second-quarter earnings season is tracking to the lowest since the same period of 2012, according to TrimTabs, which compared six-week periods during which companies report quarterly results. The number of companies announcing buybacks has also fallen, averaging 3.3 a day so far, well below the 6.1 per day during earnings season a year ago. According to TrimTabs, the total amount of announced buybacks through July is down 21 percent from the same period a year ago.*

It dropped a bit so don’t expect to read about it anywhere else…

;)