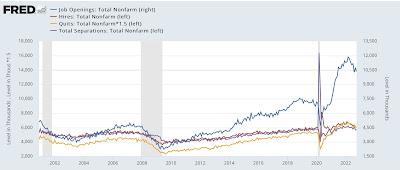

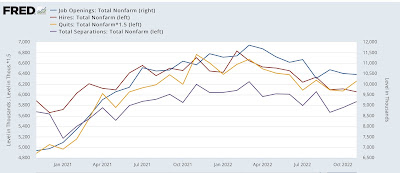

November JOLTS report consistent with a continued “hot” labor market – by New Deal democrat The JOLTS report for November showed both continuing decelerating trends in some series, but overall a picture of a labor market that continued “hot.” Here’s the graph I ran one month ago of job openings, hires, quits, and total separations: Now here is an update for the past 2 years of all four series: Three of the four series – openings, hires, and total separations – show a pattern of continued deceleration since the beginning of this past spring, although only hires made a new 12+ month low is this report. Only quits appear consistent with a stabilizing market – although they too could be read as decelerating. At the same time, both

Topics:

NewDealdemocrat considers the following as important: December 2022, hot Labor Market, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

November JOLTS report consistent with a continued “hot” labor market

– by New Deal democrat

The JOLTS report for November showed both continuing decelerating trends in some series, but overall a picture of a labor market that continued “hot.”

Here’s the graph I ran one month ago of job openings, hires, quits, and total separations:

Now here is an update for the past 2 years of all four series:

Three of the four series – openings, hires, and total separations – show a pattern of continued deceleration since the beginning of this past spring, although only hires made a new 12+ month low is this report. Only quits appear consistent with a stabilizing market – although they too could be read as decelerating.

At the same time, both openings and hires continue at levels above any month that predated the pandemic.

In the eight years before the pandemic, layoffs and discharges averaged 1800 +/-100 monthly, with a low of 1500. Since the end of the pandemic lockdowns, they have averaged 1400 +/-100. At 1350 in November, they continue right in that range:

Taken as a whole, the JOLTS data for November implies a hot labor market; just not as hot as before.

“Oct JOLTS report: Job Market deceleration and Job Opening Gap,” Angry Bear, angry bear blog