2023 data begins with another lesson: the remedy for high prices is – high prices – by New Deal democrat And so, another year begins. And kicks off with a look at the leading housing sector. And furthermore, there is even some good news. Total construction spending in November rose 0.2% for the month, while the more leading residential construction spending declined -0.5%. While total construction spending is only down 0.6% from its recent high in July, residential construction spending is down -8.1% from its recent peak last May: This is in line with the steady drumbeat of negative news in the housing sector for the past year. Generally speaking, residential construction spending comports with the number of housing units under

Topics:

NewDealdemocrat considers the following as important: residential contruction, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

2023 data begins with another lesson: the remedy for high prices is – high prices

– by New Deal democrat

And so, another year begins. And kicks off with a look at the leading housing sector. And furthermore, there is even some good news.

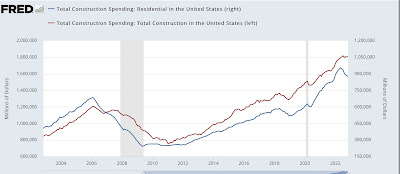

Total construction spending in November rose 0.2% for the month, while the more leading residential construction spending declined -0.5%. While total construction spending is only down 0.6% from its recent high in July, residential construction spending is down -8.1% from its recent peak last May:

This is in line with the steady drumbeat of negative news in the housing sector for the past year.

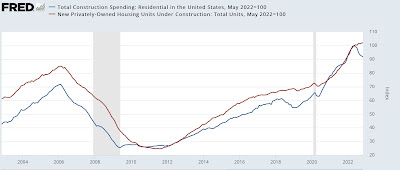

Generally speaking, residential construction spending comports with the number of housing units under construction. But in 2022, like in 2018-19, spending (blue) has declined while the number of units under construction (red) has risen slightly:

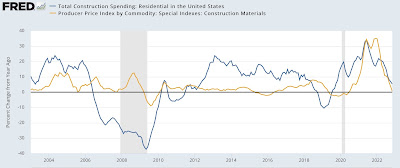

The answer probably lays in the costs of construction materials, for which there is a special inflation index, shown in gold YoY below compared with the YoY% change in residential construction spending:

The cost of materials increases and decreases with a lag once there is a boom or bust in construction. This is what happened in 2018-19, and it happened in 2022 as well. The cost of construction materials, which was up as high as 35% YoY one year ago, as of November was only up 0.6% YoY!

The remedy for high prices is – high prices. The good news is, with the complete abatement in the rise in the price of construction materials, some of the pressure is taken off of construction sales.

As I’ve already mentioned several times, while I am watching for coincident indicators like employment and consumer spending to turn down, I am already on the lookout for a positive turn in some long leading indicators. And the abatement of construction costs increases in the housing sector is one such sign.

“August existing home sales: confirmation of housing prices peaking,” Angry Bear, angry bear blog