Contrary to the tenets of orthodox economists, contemporary research suggests that, rather than seeking always to maximise our personal gain, humans still remain reasonably altruistic and selfless. Nor is it clear that the endless accumulation of wealth always makes us happier. And when we do make decisions, especially those to do with matters of principle, we seem not to engage in the sort of rational “utility-maximizing” calculus that orthodox economic models take as a given. The truth is, in much of our daily life we don’t fit the model all that well. For decades, neoliberal evangelists replied to such objections by saying it was incumbent on us all to adapt to the model, which was held to be immutable – one recalls Bill Clinton’s depiction of neoliberal globalisation,

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

Contrary to the tenets of orthodox economists, contemporary research suggests that, rather than seeking always to maximise our personal gain, humans still remain reasonably altruistic and selfless. Nor is it clear that the endless accumulation of wealth always makes us happier. And when we do make decisions, especially those to do with matters of principle, we seem not to engage in the sort of rational “utility-maximizing” calculus that orthodox economic models take as a given. The truth is, in much of our daily life we don’t fit the model all that well.

For decades, neoliberal evangelists replied to such objections by saying it was incumbent on us all to adapt to the model, which was held to be immutable – one recalls Bill Clinton’s depiction of neoliberal globalisation, for instance, as a “force of nature”. And yet, in the wake of the 2008 financial crisis and the consequent recession, there has been a turn against globalisation across much of the west …

It would be tempting for anyone who belongs to the “expert” class, and to the priesthood of economics, to dismiss such behaviour as a clash between faith and facts, in which the facts are bound to win in the end. In truth, the clash was between two rival faiths – in effect, two distinct moral tales. So enamoured had the so-called experts become with their scientific authority that they blinded themselves to the fact that their own narrative of scientific progress was embedded in a moral tale. It happened to be a narrative that had a happy ending for those who told it, for it perpetuated the story of their own relatively comfortable position as the reward of life in a meritocratic society that blessed people for their skills and flexibility. That narrative made no room for the losers of this order, whose resentments were derided as being a reflection of their boorish and retrograde character – which is to say, their fundamental vice. The best this moral tale could offer everyone else was incremental adaptation to an order whose caste system had become calcified. For an audience yearning for a happy ending, this was bound to be a tale of woe.

The failure of this grand narrative is not, however, a reason for students of economics to dispense with narratives altogether. Narratives will remain an inescapable part of the human sciences for the simple reason that they are inescapable for humans. It’s funny that so few economists get this, because businesses do.

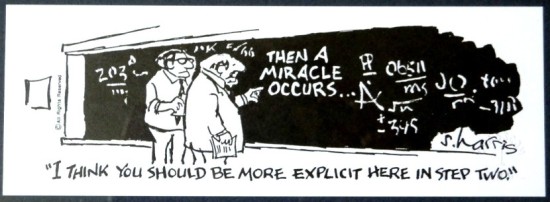

Yes indeed, one would think it self-evident that “the facts are bound to win in the end.” But still, mainstream economists seem to be impressed by the ‘rigor’ they bring to macroeconomics with their totally unreal New-Classical-New-Keynesian DSGE models and their rational expectations and microfoundations!

It is difficult to see why.

Take the rational expectations assumption. Rational expectations in the mainstream economists’ world imply that relevant distributions have to be time-independent. This amounts to assuming that an economy is like a closed system with known stochastic probability distributions for all different events. In reality, it is straining one’s beliefs to try to represent economies as outcomes of stochastic processes. An existing economy is a single realization tout court, and hardly conceivable as one realization out of an ensemble of economy-worlds since an economy can hardly be conceived as being completely replicated over time. It is — to say the least — very difficult to see any similarity between these modeling assumptions and the expectations of real persons. In the world of the rational expectations hypothesis, we are never disappointed in any other way than when we lose at the roulette wheels. But real life is not an urn or a roulette wheel. And that’s also the reason why allowing for cases where agents make ‘predictable errors’ in DSGE models doesn’t take us any closer to a relevant and realist depiction of actual economic decisions and behaviors. If we really want to have anything of interest to say on real economies, financial crises, and the decisions and choices real people make we have to replace the rational expectations hypothesis with more relevant and realistic assumptions concerning economic agents and their expectations than childish roulette and urn analogies.

‘Rigorous’ and ‘precise’ DSGE models cannot be considered anything else than unsubstantiated conjectures as long as they aren’t supported by evidence from outside the theory or model. To my knowledge no in any way decisive empirical evidence has been presented.

No matter how precise and rigorous the analysis, and no matter how hard one tries to cast the argument in modern mathematical form, they do not push economic science forward one single millimeter if they do not stand the acid test of relevance to the target. No matter how clear, precise, rigorous, or certain the inferences delivered inside these models are, they do not say anything about real-world economies.

Proving things ‘rigorously’ in DSGE models is at most a starting point for doing an interesting and relevant economic analysis. Forgetting to supply export warrants to the real world makes the analysis an empty exercise in formalism without real scientific value.

Mainstream economists think there is a gain from the DSGE style of modeling in its capacity to offer some kind of structure around which to organize discussions. To me, that sounds more like religious theoretical-methodological dogma, where one paradigm rules in divine hegemony. That’s not progress. That’s the death of economics as a science.