Here are some things I Think I am thinking about: 1. The fact that markets are hard to “beat” does not make them smart. I noticed this comment on a recent Scott Sumner post claiming that markets must be smart because they make it difficult to become wealthy. He says: Markets are just amazingly wise. But that shouldn’t be surprising, because they must be smarter than us in order to make it tough to get rich. I see this a lot in academic circles. People often say the Efficient Market Hypothesis is valuable because it shows us how difficult it is to “beat the market”. But this isn’t really true at all. The market is difficult to beat because the arithmetic of the market works against us. That is, after taxes and fees the aggregate return of the financial markets is the equivalent of playing a professional sport where you are docked 30% of your final score every game. In the game of financial markets we end up giving away 30% or more of our total return to Uncle Sam and other players in the game. That will make even the best players in the world look very bad relative to a benchmark that doesn’t get docked 30%.¹ The fact that a market is hard to beat could actually mean that market is very stupid. That is, a market could make colossally erroneous decisions on a regular basis which would make it very difficult for someone to predict where that market is headed.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Here are some things I Think I am thinking about:

1. The fact that markets are hard to “beat” does not make them smart. I noticed this comment on a recent Scott Sumner post claiming that markets must be smart because they make it difficult to become wealthy. He says:

Markets are just amazingly wise. But that shouldn’t be surprising, because they must be smarter than us in order to make it tough to get rich.

I see this a lot in academic circles. People often say the Efficient Market Hypothesis is valuable because it shows us how difficult it is to “beat the market”. But this isn’t really true at all. The market is difficult to beat because the arithmetic of the market works against us. That is, after taxes and fees the aggregate return of the financial markets is the equivalent of playing a professional sport where you are docked 30% of your final score every game. In the game of financial markets we end up giving away 30% or more of our total return to Uncle Sam and other players in the game. That will make even the best players in the world look very bad relative to a benchmark that doesn’t get docked 30%.¹

The fact that a market is hard to beat could actually mean that market is very stupid. That is, a market could make colossally erroneous decisions on a regular basis which would make it very difficult for someone to predict where that market is headed. And while I would argue that markets are usually pretty smart I think it’s also safe to say that markets also make big time mistakes because they are comprised of behaviorally biased and mentally deficient participants. So we have to be careful about this degree of market worship. Free markets are great, but they are not infallible.

2. Tim Duy is super sharp on Fed policy. If you read just one person on Fed policy it should probably be Tim Duy. In a Bloomberg piece yesterday Tim discusses the many reasons why they are likely to sit tight at the meeting on Thursday and avoid raising rates. He says:

Bottom Line: The Federal Reserve is looking for a time with minimal downside risks to raise interest rates. The wavering global economy is likely creating enough downside risk to defer that first hike to a later meeting. But the Fed still wants to begin normalizing policy, and it will signal that it remains committed to a rate hike this year. Regardless of the global situation and the inflation picture, I suspect it will feel increasingly compelled to do just that as the unemployment rate drifts below 5 percent.

Nailed it. Absolutely nailed it.

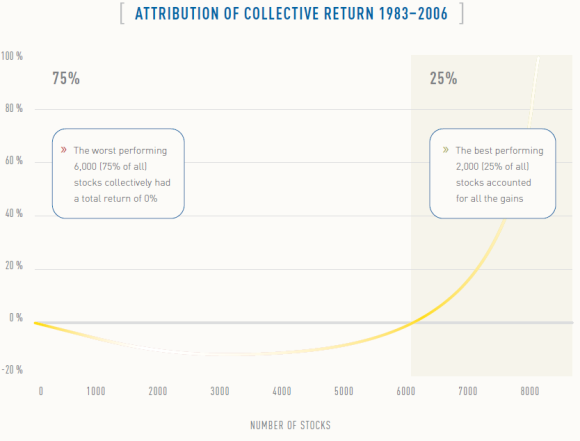

3. Stock picking is hard. Really, really hard. As an advocate of low fee countercyclical indexing I am obviously not a big fan of stock picking for most savers. And here’s a good visualization as to why that is. This piece of research from Longboard Asset Management shows just how difficult it is to pick stocks over long periods of time. What they show is that the vast majority of the gains in the market are made up by a very small number of stocks.

Basically, in order to generate a positive return you had a 1 in 4 chance of doing so. Those are pretty crappy odds. It’s no wonder that 80% of closet index funds can’t outperform their benchmarks.

¹ – Think of it this way. If you average 10% per year you are likely paying 2-3% in taxes and fees every year relative to a pre-fee benchmark. That’s like being the ’95 Chicago Bulls, averaging 100 points per game and having the NBA reduce your score by 30 points and then declaring that your team is bad. Of course, benchmarks don’t pay taxes and fees so they’re very difficult to outperform for this reason.