Summary:

How weird has 2015 been so far? This weird – every major asset class is negative on a one year basis (via Capital Spectator): I don’t have the exact data, but I would venture to guess that this just about never happens. Heck, even a long-term bond is barely positive on a 1 year basis. If you had told me that China might be falling apart in 2015, emerging markets were falling 25%+ and we’d have a flash crash I’d have guessed that long-term bonds were up 10%+ in that period. But no, even bonds have been suppressed. There has been almost nowhere to hid this year. Except for cash of course. And I am old enough to remember a few months ago when certain Robo Advisor proponents were arguing that cash should never be held in a brokerage account. Aside from being a fallacy of composition that position looks pretty silly right now. But as they say, this too shall pass…. Got a comment or question about this post? Feel free to use the Ask Me Anything section or connect with me on Twitter or email.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

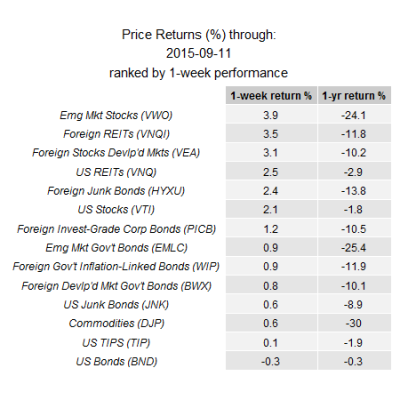

How weird has 2015 been so far? This weird – every major asset class is negative on a one year basis (via Capital Spectator):

How weird has 2015 been so far? This weird – every major asset class is negative on a one year basis (via Capital Spectator): I don’t have the exact data, but I would venture to guess that this just about never happens. Heck, even a long-term bond is barely positive on a 1 year basis. If you had told me that China might be falling apart in 2015, emerging markets were falling 25%+ and we’d have a flash crash I’d have guessed that long-term bonds were up 10%+ in that period. But no, even bonds have been suppressed. There has been almost nowhere to hid this year. Except for cash of course. And I am old enough to remember a few months ago when certain Robo Advisor proponents were arguing that cash should never be held in a brokerage account. Aside from being a fallacy of composition that position looks pretty silly right now. But as they say, this too shall pass…. Got a comment or question about this post? Feel free to use the Ask Me Anything section or connect with me on Twitter or email.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

I don’t have the exact data, but I would venture to guess that this just about never happens. Heck, even a long-term bond is barely positive on a 1 year basis. If you had told me that China might be falling apart in 2015, emerging markets were falling 25%+ and we’d have a flash crash I’d have guessed that long-term bonds were up 10%+ in that period. But no, even bonds have been suppressed.

There has been almost nowhere to hid this year. Except for cash of course. And I am old enough to remember a few months ago when certain Robo Advisor proponents were arguing that cash should never be held in a brokerage account. Aside from being a fallacy of composition that position looks pretty silly right now. But as they say, this too shall pass….

I don’t have the exact data, but I would venture to guess that this just about never happens. Heck, even a long-term bond is barely positive on a 1 year basis. If you had told me that China might be falling apart in 2015, emerging markets were falling 25%+ and we’d have a flash crash I’d have guessed that long-term bonds were up 10%+ in that period. But no, even bonds have been suppressed.

There has been almost nowhere to hid this year. Except for cash of course. And I am old enough to remember a few months ago when certain Robo Advisor proponents were arguing that cash should never be held in a brokerage account. Aside from being a fallacy of composition that position looks pretty silly right now. But as they say, this too shall pass….