February jobs report: the decelerating trend resumes – by New Deal democrat As I’ve written several times this week, my focus on this report was on whether manufacturing and residential construction jobs turned negative or not, whether temporary jobs continued on their downward trajectory, and whether the deceleration apparent in job growth would reappear after the blockbuster January report. Deceleration absolutely reasserted itself: and manufacturing jobs appear to have rolled over, while construction and temporary jobs held up: Although here too the decelerating trend is apparent. Here’s my in depth synopsis. HEADLINES: 311,000 jobs added. Private sector jobs increased 265,000. Government jobs increased by 46,000. The

Topics:

NewDealdemocrat considers the following as important: February jobs report, Healthcare, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

February jobs report: the decelerating trend resumes

– by New Deal democrat

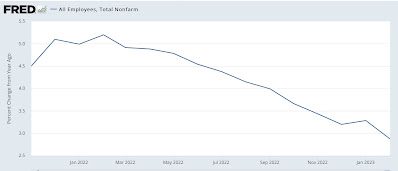

As I’ve written several times this week, my focus on this report was on whether manufacturing and residential construction jobs turned negative or not, whether temporary jobs continued on their downward trajectory, and whether the deceleration apparent in job growth would reappear after the blockbuster January report.

Deceleration absolutely reasserted itself:

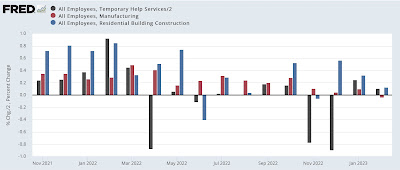

and manufacturing jobs appear to have rolled over, while construction and temporary jobs held up:

Although here too the decelerating trend is apparent.

Here’s my in depth synopsis.

HEADLINES:

- 311,000 jobs added. Private sector jobs increased 265,000. Government jobs increased by 46,000. The three month moving average of growth declined slightly to 351,000, still 67,000 higher than the average in December.

- The alternate, and more volatile measure in the household report rose by 177,000 jobs. The above household number factors into the unemployment and underemployment rates below.

- U3 unemployment rate increased +0.2% to 3.6%.

- U6 underemployment rate also rose 0.2% to 6.8%.

- December was revised downward by -21,000, and January was also revised downward by -13,000, for a net decrease of -34,000 jobs compared with previous reports.

Leading employment indicators of a slowdown or recession

These are leading sectors for the economy overall, and will help us gauge whether the strong rebound from the pandemic will continue. These were mixed, although as indicated above even the positive indicators still weakened:

- the average manufacturing workweek, one of the 10 components of the Index of Leading Indicators, declined -0.2 hours to 40.7, down -0.9 hours from February peak last year of 41.6 hours.

- Manufacturing jobs declined by -4,000.

- Construction jobs increased 24,000.

- Residential construction jobs, which are even more leading, increased by only 1,200.

- Temporary jobs, which had been declining late last year, rose for the second month in a row, by 6,800.

- the number of people unemployed for 5 weeks or less rose 343,000 to 2,289,000.

Wages of non-managerial workers

- Average Hourly Earnings for Production and Nonsupervisory Personnel increased $.013, or +0.5%, to $28.42, a YoY gain of 5.3%, an increase from its previous deceleration to 5.1% in January.

Aggregate hours and wages:

- the index of aggregate hours worked for non-managerial workers declined -0.4%.

- the index of aggregate payrolls for non-managerial workers was unchanged, and resumed its deceleration to 7.4% YoY, the lowest since early 2021, although still more than 1% higher YoY than inflation as of the last reading.

Other significant data:

- Leisure and hospitality jobs, which were the most hard-hit during the pandemic, rose 105,000, and have improved to -2.4% below their pre-pandemic peak.

- Within the leisure and hospitality sector, food and drink establishments added 69,900 jobs, and are now only -0.9% below their pre-pandemic peak.

- Professional and business employment rose 45,000. This series has also been decelerating consistently, and is now up 2.7% YoY, the lowest increase since mid-2021.

- The Labor Force Participation Rate increased 0.1% to 62.5%, vs. 63.4% in February 2020.

- The number of job holders who were part time for economic reasons rose 17,000.

- Those not in the labor force at all, but who want a job now, declined -211,000 to 5.103 million, compared with 4.996 million in February 2020.

SUMMARY

In absolute terms, this report was yet another solid positive report in terms of job growth. In relative terms, however, the deceleration which was apparent for most of last year resumed.

Positive signs included growth in temporary and construction jobs, the nearly total recovery in food and drinking places jobs, resumed stronger wage growth, an increase in labor force participation, and a decline in those who aren’t in the labor force but want a job now.

Negatives included a resumption in the decline of the manufacturing work week, a decline in manufacturing jobs (plus downward revisions for the prior two months), increases ini both the un- and under-employment rates as well as short term unemployment, and an outright decline in the number of hours worked.

Deceleration was apparent in residential construction jobs, professional and business jobs, and aggregate non-supervisory payrolls.

In sum, we have further deceleration but no indication of any imminent downturn in the number of actual jobs available in the economy.

The “gold standard” of jobs data shows a strong rebound in Q3 2022, Angry Bear, New Deal democrat