New month’s data starts out with leading indicators in both manufacturing and construction indicating expansion – by New Deal democrat As usual, the new month’s data starts out with information on manufacturing and construction. The ISM manufacturing index has been a good leading indicator in that sector for 75 years. The difference over time, especially the last 20 years, is that manufacturing makes up a smaller share of the total US economy. With that caveat, after almost 18 months in contraction, the most leading new orders subindex in the ISM report rose from 47.0 to 52.5. Since any reading above 50 indicates expansion, this is welcome news (although I hasten to add that it is diametrically opposed to the poor regional Fed

Topics:

NewDealdemocrat considers the following as important: Hot Topics, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

New month’s data starts out with leading indicators in both manufacturing and construction indicating expansion

– by New Deal democrat

As usual, the new month’s data starts out with information on manufacturing and construction.

The ISM manufacturing index has been a good leading indicator in that sector for 75 years. The difference over time, especially the last 20 years, is that manufacturing makes up a smaller share of the total US economy.

With that caveat, after almost 18 months in contraction, the most leading new orders subindex in the ISM report rose from 47.0 to 52.5. Since any reading above 50 indicates expansion, this is welcome news (although I hasten to add that it is diametrically opposed to the poor regional Fed manufacturing readings for January). The Index as a whole rose from 47.1 to 49.1, still showing very slight contraction, but nevertheless a 1+ year high:

This is (relatively) good news for the manufacturing sector.

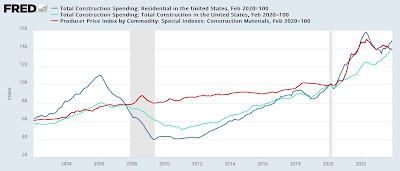

Construction spending continued its strong improvement. Total spending (light blue below) rose 0.9% in December, and the more leading residential construction sector (dark blue) increased 1.4%, both to new all-time (nominal) highs:

Since producer prices for construction materials rose 0.6% in December (red), this indicates real growth of 0.8% in residential construction spending, a strong showing.

The bottom line is that this is good news in both leading goods-producing sectors to start out the month.

Manufacturing and construction have the most positive reports all year, Angry Bear, by New Deal democrat