The state of freight – by New Deal democrat There’s no significant economic news today. Yesterday we did get durable goods orders, which are an official leading indicator. I don’t pay too much attention to them, because they are so volatile. Thus yesterday’s big -6.1% decline (blue in the graph below) is more likely than not just noise, particularly because “core” capital goods orders (red) increased 0.1%, and have been generally tending sideways. Another segment which is also an official leading indicator, consumer durable goods orders (gold), have been trending higher for the past six months: Another important – and less noisy – way to look at the manufacturing and consumption aspects of the economy is to compare transportation with

Topics:

NewDealdemocrat considers the following as important: Freight, Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

The state of freight

– by New Deal democrat

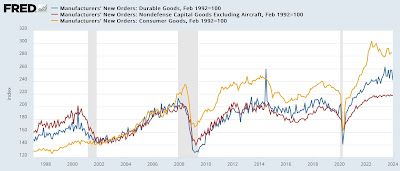

There’s no significant economic news today. Yesterday we did get durable goods orders, which are an official leading indicator. I don’t pay too much attention to them, because they are so volatile. Thus yesterday’s big -6.1% decline (blue in the graph below) is more likely than not just noise, particularly because “core” capital goods orders (red) increased 0.1%, and have been generally tending sideways. Another segment which is also an official leading indicator, consumer durable goods orders (gold), have been trending higher for the past six months:

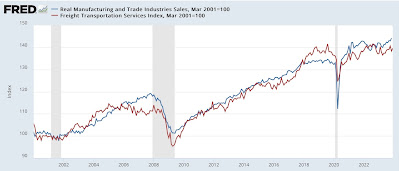

Another important – and less noisy – way to look at the manufacturing and consumption aspects of the economy is to compare transportation with real sales. Note that comparing *production,* which seems logical, won’t work because so many products are imported and so are not caught in domestic production data. But they are caught in sales. The theory goes back to Charles Dow (he of the Dow Jones averages) who pointed out that every product that is produced, must be shipped to market before it is sold. Thus if there is a disconnect between production and transportation, something is amiss, and probably not to the upside.

To cut to the chase, here’s the comparison of real total sales and transportation going back to the start of the Millennium (which is when the freight index data starts):

You can see that they closely track one another, with a few exceptions that have gotten resolved within 12-24 months. Notably, before the 2001 and 2008 recessions, freight turned down significantly first.

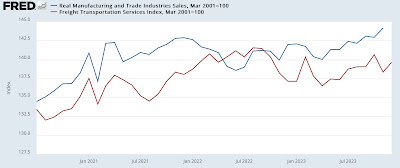

Here is the close-up on the last several years:

We had a significant downturn in transportation early last year, but the trend has appeared to reverse higher in the past six months.

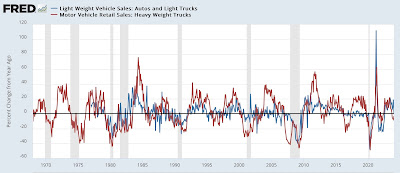

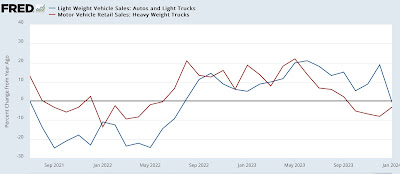

Another aspect of transportation, which has a solid historical leading quality is sales of heavy weight trucks. Here’s what they look like YoY (red) compared with passenger vehicles and light weight trucks (blue):

Not every downturn presages a recession, but every recession has been preceded by a downturn. And heavy weight truck sales always turn down before light vehicle sales.

Here’s the close-up of that for the past several years:

We have had a relatively minor downturn YoY during the autumn, but as of December that *may* have been resolving. We’ll find out in the next week when the January data is released.

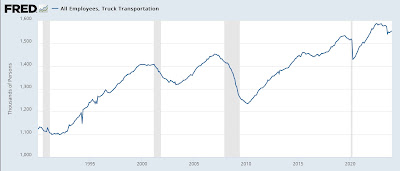

Finally, trucks need to be driven (duh!). So employment in the trucking industry has also been a leading indicator. There, the news is definitely not good:

The big downturn in summer 2023 was the bankruptcy and closure of a major trucking company, with the resulting unemployment of its former employees. Some of that has been recovered since, but not that much, suggesting that the bankruptcy was signal, not noise.

As indicated above, motor vehicle sales will be updated within the next week. Trucking employment will be a week from Friday as part of the February employment report.

Both production and transportation are down from 2022 peaks; why wasn’t that enough to cause a recession? Angry Bear, by New Deal democrat