– by New Deal democrat The Bonddad Blog New Deal democrat has been on top of the discussions of shelter and/or gasoline prices in February and also in January. He has been on top of these discussions which appear to be making the news moreso in April than earlier in the year. I have linked to the February commentary and there you can find an earlier commentary link. Enjoy the detail of NDd’s. ~~~~~~~~ The one advantage of not reporting on the March CPI results for two days is I’ve had the opportunity to look at more data in depth and mull things over. And I’ve decided that there really wasn’t much change from the pattern we’ve seen for about the past 9 months. Basically, the month-to-month variation in inflation is a function of the

Topics:

NewDealdemocrat considers the following as important: Hot Topics, politics, shelter and gas prices, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

– by New Deal democrat

New Deal democrat has been on top of the discussions of shelter and/or gasoline prices in February and also in January. He has been on top of these discussions which appear to be making the news moreso in April than earlier in the year. I have linked to the February commentary and there you can find an earlier commentary link. Enjoy the detail of NDd’s.

~~~~~~~~

The one advantage of not reporting on the March CPI results for two days is I’ve had the opportunity to look at more data in depth and mull things over.

And I’ve decided that there really wasn’t much change from the pattern we’ve seen for about the past 9 months. Basically, the month-to-month variation in inflation is a function of the interplay between shelter and gas prices. During late 2022 and early 2023, the latter were still accelerating or steady at a high rate of inflation, while the latter were falling. Beginning in late 2023, the dynamic reversed, as shelter inflation was slowly decelerating, while gas prices had bottomed.

The big takeaway for the last several months has been a renewed increase in gas prices, while the deceleration in shelter inflation has slowed. There have been a couple of other players in the process that I’ll also discuss below.

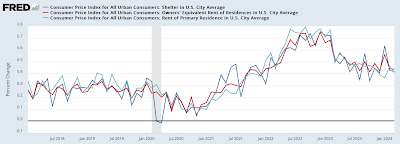

First, let’s look at the month over month change in inflation for shelter as a whole (dark blue) vs. rent of primary residence (light blue) and owners’ equivalent rent (red) for the past 6 years:

In the years prior to the pandemic, the three averaged +0.3% growth +/-0.1% each month. After the pandemic, they peaked at roughly .75%, and in the past 12 months have slowly declined from an average of +0.5% per month to +0.4% per month.

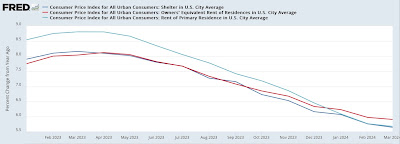

On a YoY basis, the various measures of shelter have decelerated from roughly +8% to just over 5.5%:

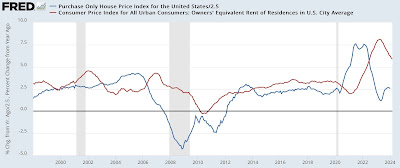

Because house prices lead shelter inflation with a 12-18 month lag, here’s the update of that metric:

Since house prices are presently increasing at 2.5% YoY, about average for the pre-pandemic period, I expect OER and the other measures of shelter inflation to continue to decelerate YoY, but probably at a slow pace compared with their initial rapid decline, because they will be compared with +0.5% monthly increases 12 months before vs. 0.7% at their peak.

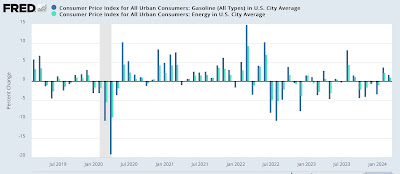

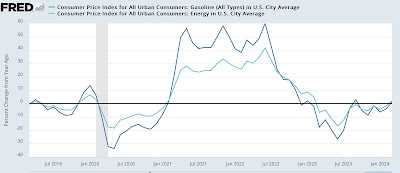

Now let’s take a look at monthly gas prices (dark blue in the graph below) vs. energy prices generally (light blue). On a monthly basis, these had mainly declined beginning in mid-2022, but in the last two months have increased at more than their pre-pandemic average:

On a YoY basis, both are now higher, by 1.3% and 2.1% respectively:

This contrasts with their negative YoY readings for almost the entirety of the previous 16 months.

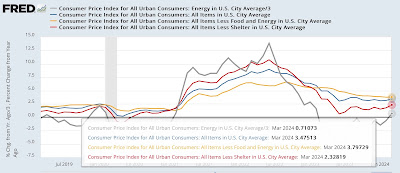

So, to summarize: the deceleration in shelter inflation has slowed, while gas prices have reversed higher. This explains most of the increase in monthly inflation in the past several months, as is shown in the graph below comparing energy inflation (grey), headline (blue), core (gold), and inflation ex-shelter (red) YoY:

The reversal in gas prices has caused a similar, albeit smaller, reversal higher in both headline inflation and inflation ex-shelter. But it is noteworthy that, simply by excluding shelter, inflation is still only higher by 2.3%.

In other words, it remains the case that, except for shelter, US consumer inflation is well-behaved.

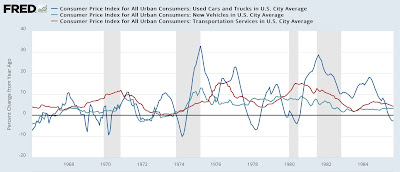

As noted above, let me also take a look at several other sectors of note. Although I won’t bother with a graph, the former problem children of new and used vehicle prices have reached a new equilibrium. New car prices have actually *declined* -0.1% YoY, while used vehicles are down -2.2% YoY.

The remaining problem areas of inflation are:

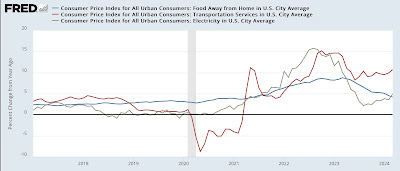

(1) food away from home, which peaked at 8.8% YoY one year ago, and is now down to 4.2%, close to its pre-pandemic average of 2.5%-3.0%;

(2) electricity, which has followed gas prices higher, rising from 2.2% YoY last August to 5.0% in March; and

(3) transportation services – mainly car repairs and insurance – which has rocketed from its pre-pandemic range of 2.5%-5.0% to as high as 15.2% in October 2022, and is now still up 10.7%.

I’m not sure if there is more to the electricity story than the price of gas-powered turbines. But car repairs are up 8.2% YoY, and motor vehicle insurance is up a whopping 22.2%! Based on the past inflationary period of 1966-82, it is clear that transportation services lags increases in vehicle prices by 1-2 years and even more, sometimes increasing right through recessions:

So, while I expect food away from home to continue to revert to its prior average, and perhaps electricity as well, price increases in transportation services may remain a problem for quite some time.

February consumer inflation: the tug of war between gasoline and shelter continues, Angry Bear by New Deal democrat.