– by New Deal democrat The Bonddad Blog [Note: I’ll put up a post discussing Q1 GDP later today.] Initial and continuing claims continued their snooze-fest this week. Initial claims declined -5,000 to 207,000, continuing their nearly 3 month long range of between 200-220,000 per week. The four week average declined 1,250 to 213,250. This average has remained in the 200-225,000 range for over half a year! Finally, with the typical one week delay, continuing claims declined -15,000 to 1.781 million: As per usual, for forecasting purposes the YoY range is more important. Here, initial claims were down -1.0%, the four week average down -1.8%, and continuing claims higher by 3.4%, still the lowest comparison for continuing claims since

Topics:

NewDealdemocrat considers the following as important: Hot Topics, Jobless Claims 2024, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

– by New Deal democrat

The Bonddad Blog

[Note: I’ll put up a post discussing Q1 GDP later today.]

Initial and continuing claims continued their snooze-fest this week.

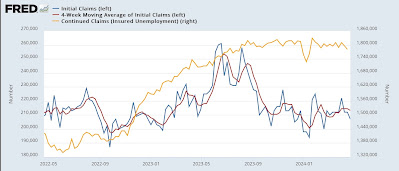

Initial claims declined -5,000 to 207,000, continuing their nearly 3 month long range of between 200-220,000 per week. The four week average declined 1,250 to 213,250. This average has remained in the 200-225,000 range for over half a year! Finally, with the typical one week delay, continuing claims declined -15,000 to 1.781 million:

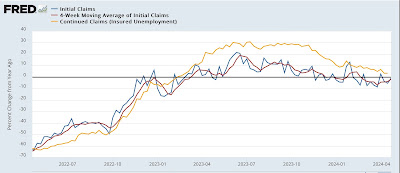

As per usual, for forecasting purposes the YoY range is more important. Here, initial claims were down -1.0%, the four week average down -1.8%, and continuing claims higher by 3.4%, still the lowest comparison for continuing claims since February 2023:

Needless to say, this is potent evidence that we can expect the economy to continue to expand in the next few months.

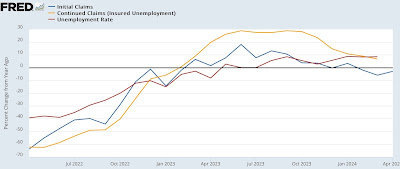

As you also might expect, with initial claims lower YoY for the month of April so far by -2.9%, this also suggests that the unemployment rate will trend lower YoY over the coming months, towards 3.7% or even 3.6%:

Since initial claims (and to a lesser extent continuing claims) lead the unemployment rate, the Sahm rule for recessions is not going to be triggered.

The positive streak of news from initial and continuing jobless claims continues – Angry Bear by New Deal democrat.