– by New Deal democrat Tomorrow and Thursday a plethora of data will be released, on consumer inflation and spending, production, housing, and jobless claims. In the meantime today we got a chance to look at upstream pressures on inflation. And those upstream pressures do seem to be building slightly, reflecting a strong economy with full employment. Commodity prices increased 0.9%. These are very volatile, so this was not particularly out of the ordinary, as shown in the below graph of monthly changes for the past 10 years: YoY commodity prices are just 0.1% above unchanged (red, left scale in the graph below). They are very well behaved compared with just after the pandemic (blue, right scale): By the time we get to finished

Topics:

NewDealdemocrat considers the following as important: Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

– by New Deal democrat

Tomorrow and Thursday a plethora of data will be released, on consumer inflation and spending, production, housing, and jobless claims. In the meantime today we got a chance to look at upstream pressures on inflation.

And those upstream pressures do seem to be building slightly, reflecting a strong economy with full employment.

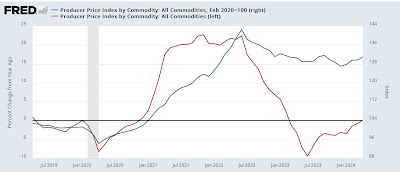

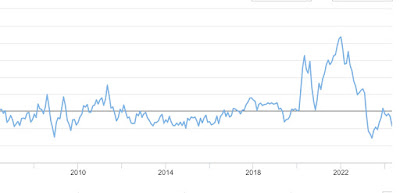

Commodity prices increased 0.9%. These are very volatile, so this was not particularly out of the ordinary, as shown in the below graph of monthly changes for the past 10 years:

YoY commodity prices are just 0.1% above unchanged (red, left scale in the graph below). They are very well behaved compared with just after the pandemic (blue, right scale):

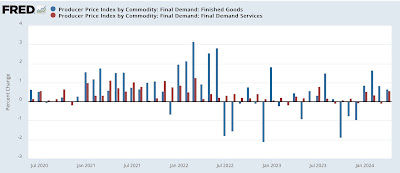

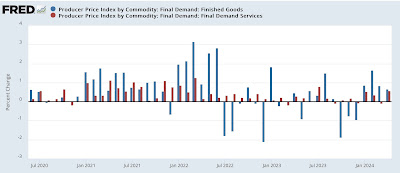

By the time we get to finished products, we can see some pressures building up particularly as to goods (blue), which increased 0.7% in April and so far this year are up 4.1%. Service inflation (red) for producers rose 0.6%, the second highest monthly increase in two years:

By contrast, as shown in the below graph, in the six years before the pandemic, final demand goods and services typically rose on the order of 0.2% or 0.3% monthly:

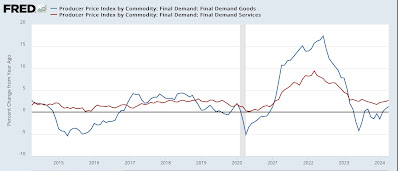

Nevertheless, on a YoY basis both producer goods and services inflation is well within its normal range prior to the pandemic:

There is reason to believe, at least when it comes to goods, that the recent bigger monthly increases may not last. Below is the most recent update of the FRBNY’s Global Supply Chain Pressure Index:

Each horizontal line represents one standard deviation from the long term average (including the pandemic). Since late last year there had been some tightness compared with the pre-pandemic average, but in April this entirely dissipated.

So to reiterate, it looks likely that there is a little producer pressure due to a strong economy and full employment, but nothing out of the range of normal on any significant time frame at this point.

Tomorrow we will see how this plays out with consumer prices. Because gas prices increased 5.4% in April, I am expecting the headline number to come in a little hot as well. Meanwhile I expect shelter inflation to continue to abate but more slowly than in the past 12 months. We’ll see.

Producer prices flat, commodities decline, shelter is sole inflationary pressure, Angry Bear, by New Deal democrat