– by New Deal democrat As usual, the month starts out with important data on manufacturing and construction. The news was mixed this month and weighted more to the downside in my opinion. First, the ISM report on manufacturing declined again slightly to 48.7. This is the second month in a row that this index has been under the equipoise point of 50. More importantly, the more leading new orders subindex declined sharply to 45.4, the lowest reading since last May: The silver lining here is that manufacturing is not nearly so important to the overall economy as it was in the 50 years after World War 2, so a negative reading like this – similar to what we had in 2022-23 – does not necessarily mean recession. But it does mean that the ISM

Topics:

NewDealdemocrat considers the following as important: Hot Topics, May 2024, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

– by New Deal democrat

As usual, the month starts out with important data on manufacturing and construction. The news was mixed this month and weighted more to the downside in my opinion.

First, the ISM report on manufacturing declined again slightly to 48.7. This is the second month in a row that this index has been under the equipoise point of 50. More importantly, the more leading new orders subindex declined sharply to 45.4, the lowest reading since last May:

The silver lining here is that manufacturing is not nearly so important to the overall economy as it was in the 50 years after World War 2, so a negative reading like this – similar to what we had in 2022-23 – does not necessarily mean recession. But it does mean that the ISM services index, which will be released on Wednesday, and declined below 50 for the first-time last month, assumes extra importance. That’s because in the 20 years since the latter index has been in existence, when the weighted average of the two indexes has been below 50, that did mean recession.

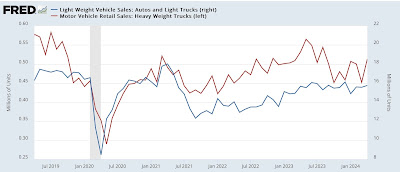

Another leading sub sector in manufacturing is heavy truck production and sales. These were for April at the end of last week. The news was good, as truck sales rebounded 13.5% in the month, and are only down -3.6% YoY:

Heavy truck sales lead light vehicle sales to the downside, but generally must be below peak by 20% to be consistent with a recession. Their three-month moving average is about 13% off peak, which still indicates weakness, but no recession signal.

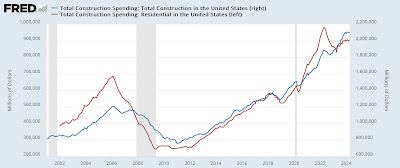

Turning to construction, total nominal spending declined -0.1% in April, but is higher 10.0% YoY. The more leading residential sector showed a 0.1% increase, and only a -0.1% YoY decline:

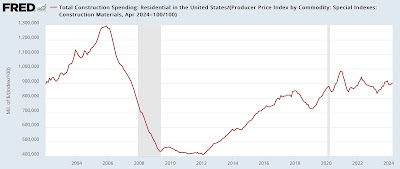

Since producer prices for construction materials declined -0.4% in April and are down -0.3% YoY, the “real” residential construction numbers are more positive:

Finally, the Inflation Reduction Act, which conferred favorable tax benefits for “restoring,” led to a sharp increase in manufacturing construction spending, which increased 0.9% for the month to another new record, up 17.3% YoY:

Again, altogether these paint a very mixed picture, but with new manufacturing orders declining significantly, and total and residential construction spending more or less flat for the past half year, I believe there is more weight to the downside.

Manufacturing treads water in April, while real construction spending turned down in March (UPDATE: and heavy truck sales weren’t so great either), Angry Bear, by New Deal democrat