– by New Deal democrat Initial jobless claims rose 3,000 last week to 219,000. More importantly, the 4 week moving average rose another 2,500 to 222,500, the highest level in 9 months. With the usual one week lag, continuing claims rose 4,000 to 1.791 million: On the one hand, it does appear that claims have been in a small uptrend for the last four weeks. But on the other hand, recall that there was a similar increase last May into summer, so there could be some unresolved post-pandemic seasonality in play. As usual, though, the YoY% changes are more important for forecasting purposes. Here, initial claims were down -5.2%, and the four week average down -2.0%. Continuing claims remained higher by 3.6%, but aside from two weeks in April,

Topics:

NewDealdemocrat considers the following as important: Hot Topics, May 2024, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

– by New Deal democrat

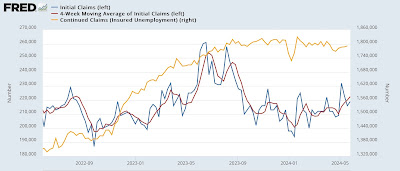

Initial jobless claims rose 3,000 last week to 219,000. More importantly, the 4 week moving average rose another 2,500 to 222,500, the highest level in 9 months. With the usual one week lag, continuing claims rose 4,000 to 1.791 million:

On the one hand, it does appear that claims have been in a small uptrend for the last four weeks. But on the other hand, recall that there was a similar increase last May into summer, so there could be some unresolved post-pandemic seasonality in play.

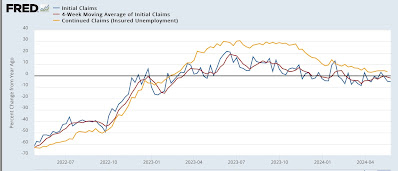

As usual, though, the YoY% changes are more important for forecasting purposes. Here, initial claims were down -5.2%, and the four week average down -2.0%. Continuing claims remained higher by 3.6%, but aside from two weeks in April, this is the best YoY comparison in 15 months:

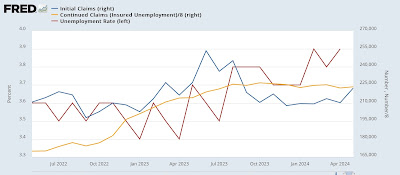

This does not suggest any significant weakening of the jobs market. It also does not suggest any upward pressure on the unemployment rate for May, which will be reported next week:

Since the unemployment rate lags initial claims by several months, they are supplying downward pressure on unemployment. Meanwhile continuing claims having been in a flat to slightly declining trend for over half a year, suggests no further upward pressure and some slight downward pressure on unemployment as well. As a result, next week I anticipate we will see an unemployment rate of between 3.7%-3.9%.

The Bonddad Blog

The snooze-a-than in jobless claims continues; what I am looking for in tomorrow’s jobs report, Angry Bear by New Deal democrat