A bit fewer than expected and prior month revised down bringing it more in line with permits: A nice uptick here, but as per the chart too soon to say the downtrend has reversed. And notice, again, how employment is faltering as has been the case in most of the surveys: Highlights Markit Economics’ U.S. samples are reporting a sharp upturn in business this month, first with Monday’s manufacturing report and now with the service flash where the headline index is up nearly 3 points to 54.8 for the strongest rate of composite growth this year. New orders are at an 11-month high as is business activity, and year-ahead expectations are at their best level since August last year. The rise in demand is being reflected in inflation readings with input costs moving up from a nearly 2-year low and with selling prices also moving higher. Not showing much life, at least yet, is employment where job creation did improve but still remains near a 3-1/2 year low. The report attributes this month’s strength to rising hopes for improvement in the domestic economy. The sharp gains for Markit’s samples are a surprise but are still only anecdotal indications. Definitive data on October will be posted next week with the month’s unit auto sales and of course the monthly employment report.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

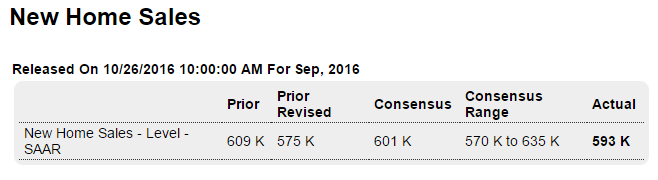

A bit fewer than expected and prior month revised down bringing it more in line with permits:

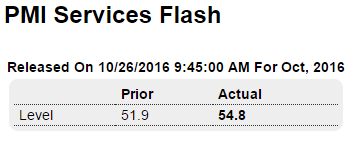

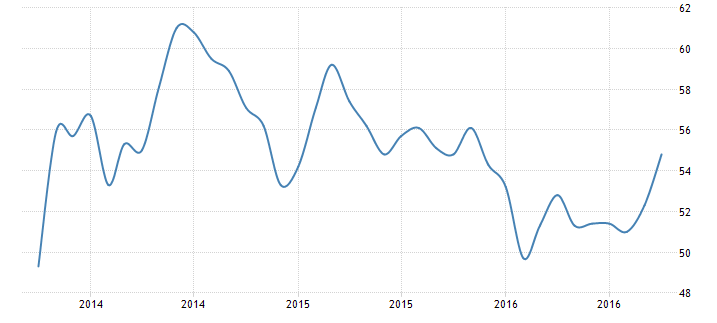

A nice uptick here, but as per the chart too soon to say the downtrend has reversed. And notice, again, how employment is faltering as has been the case in most of the surveys:

Highlights

Markit Economics’ U.S. samples are reporting a sharp upturn in business this month, first with Monday’s manufacturing report and now with the service flash where the headline index is up nearly 3 points to 54.8 for the strongest rate of composite growth this year. New orders are at an 11-month high as is business activity, and year-ahead expectations are at their best level since August last year. The rise in demand is being reflected in inflation readings with input costs moving up from a nearly 2-year low and with selling prices also moving higher. Not showing much life, at least yet, is employment where job creation did improve but still remains near a 3-1/2 year low. The report attributes this month’s strength to rising hopes for improvement in the domestic economy. The sharp gains for Markit’s samples are a surprise but are still only anecdotal indications. Definitive data on October will be posted next week with the month’s unit auto sales and of course the monthly employment report.

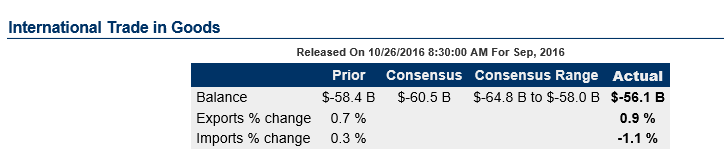

August revised higher which lowers GDP estimates, Sept higher than expected which increases estimates. I suspect Sept (like August) will be revised lower next month when October is released. And note the highlighted details that don’t bode well for domestic demand:

Highlights

In a positive for Friday’s third-quarter GDP report, the nation’s trade gap in goods narrowed sharply in September, to $56.1 billion vs a revised $59.2 billion in August. Exports in September rose a solid 0.9 percent led by the largest component, capital goods, which rose 3.8 percent in what is a positive indication for global business investment. Exports of consumer goods also rose, up 4.4 percent, with industrial supplies up 2.3 percent. Also helping the deficit is a 1.1 percent decline in imports where most components fell with the exceptions of autos, up 4.3 percent, and other goods, up 0.8 percent. In a negative indication of retail expectations for the holidays, imports of consumer goods fell 1.8 percent following a 0.6 percent decline in August. And in a negative indication for domestic business investment, imports of capital goods fell 3.6 percent. Also released this morning are advance data on September inventories in the wholesale and retail sectors, up 0.2 percent for the former and up 0.3 percent for the latter.

This will be counted as increased consumption, but will take away from other consumption:

U.S. government says benchmark 2017 Healthcare.gov premiums up 25 percent

By Caroline Humer

Oct 24 (Reuters) — The average premium for benchmark 2017 Obamacare insurance plans sold on Healthcare.gov rose 25 percent compared with 2016. The average monthly premium for the benchmark plan is rising to $302 from $242 in 2016, the Department of Health and Human Services said. The government provides income-based subsidies to about 85 percent of people enrolled, and those credits will increase with the higher premiums. It said 72 percent of consumers on HealthCare.gov will find plans with a premium of less than $75 per month.

If anything, it’s the weak euro that’s added some support to GDP, but not to consumption:

Draghi hits back at critics of QE and negative rates

By Claire Jones

Oct 25 (FT) — “We have every reason to believe that, with the impetus provided by our recent measures, monetary policy is working as expected: by boosting consumption and investment and creating jobs, which is always socially progressive,” ECB president Mario Draghi said. “I find it hard to reach the conclusion that, over a longer timeframe, the outcome of our policies has been — or will be — to redistribute wealth and income in an unfair or unequal way,” the ECB president said. “That is certainly not true across countries, and there is not much to suggest it is true within countries either.”

Germany Inc. Sits on $500 Billion in Cash Amid Weak Outlook

By Nina Adam

Oct 25 (WSJ) — Germany’s nonfinancial businesses have saved more than they have invested for the past seven years, piling up about €455 billion ($500.4 billion) in cash and deposits, German central bank data show. Of 11 companies in the DAX-30 stock index that disclosed their investment plans, five said they plan no increase in capital expenditure this year or next. Five others said they plan increases, but mostly outside Germany. Volkswagen said it was canceling or delaying all investment projects that it doesn’t consider “core.”