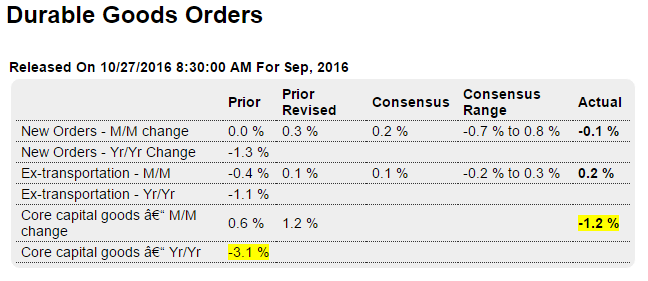

This should have been doing better by now, indicating that, in general, unspent income is still not being sufficiently offset by deficit spending, public or private: Highlights Flat is the takeaway from the September durable goods report where orders slipped 0.1 percent, a lower-than-expected result offset however by an upward revision to August which now stands at plus 0.3 percent. A 45 percent monthly downswing for defense aircraft is a special factor in the September data, offsetting a 13 percent rise in civilian aircraft and, for the transportation reading, a solid 1.2 percent gain in vehicle orders. Excluding transportation, orders inched 0.2 percent higher for a third straight gain. Capital goods data are mixed. The good news is a 0.3 percent rise in core shipments (nondefense ex-aircraft) and an upward revision to August which is now unchanged. These results should give a boost to the business investment component of tomorrow’s third-quarter GDP report. But the bad news is the indication on future core shipments as orders fell a very steep 1.2 percent though an upward revision to August, now at plus 1.2 percent, is a partial offset. A concern in the report is continuing contraction in unfilled orders, down 0.4 percent for a 4th straight decline. Factories have been drawing down unfilled orders to keep shipments going which rose 0.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

This should have been doing better by now, indicating that, in general, unspent income is still not being sufficiently offset by deficit spending, public or private:

Highlights

Flat is the takeaway from the September durable goods report where orders slipped 0.1 percent, a lower-than-expected result offset however by an upward revision to August which now stands at plus 0.3 percent. A 45 percent monthly downswing for defense aircraft is a special factor in the September data, offsetting a 13 percent rise in civilian aircraft and, for the transportation reading, a solid 1.2 percent gain in vehicle orders. Excluding transportation, orders inched 0.2 percent higher for a third straight gain.

Capital goods data are mixed. The good news is a 0.3 percent rise in core shipments (nondefense ex-aircraft) and an upward revision to August which is now unchanged. These results should give a boost to the business investment component of tomorrow’s third-quarter GDP report. But the bad news is the indication on future core shipments as orders fell a very steep 1.2 percent though an upward revision to August, now at plus 1.2 percent, is a partial offset.

A concern in the report is continuing contraction in unfilled orders, down 0.4 percent for a 4th straight decline. Factories have been drawing down unfilled orders to keep shipments going which rose 0.8 percent in the month which, however, follows two months of unchanged readings. Inventories rose 0.1 percent in the month, well under the rise in shipments to pull down the inventory-to-shipments ratio to 1.64 from two months at 1.65.

September’s data point to more of the same for the factory sector, a flat path reflecting weakness in global demand and specific weakness in business investment.

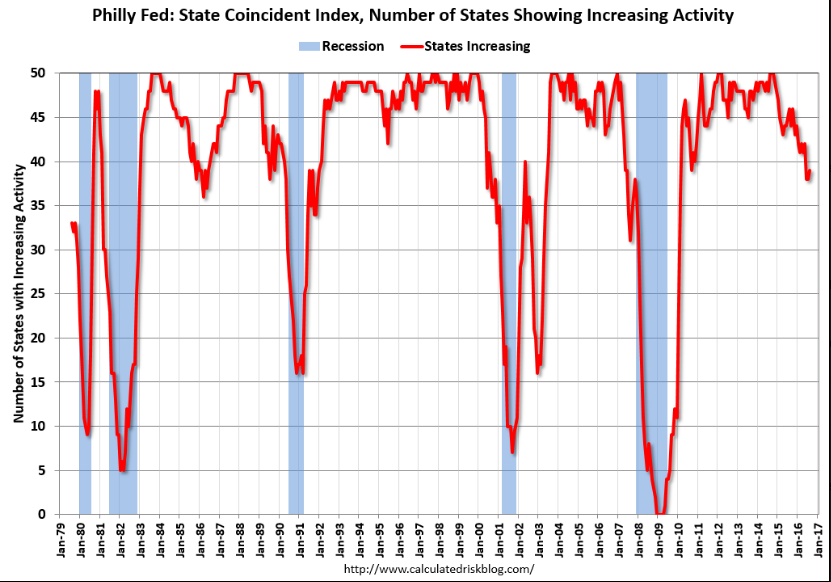

Past the point of no return? Indicates the recession started a while ago?

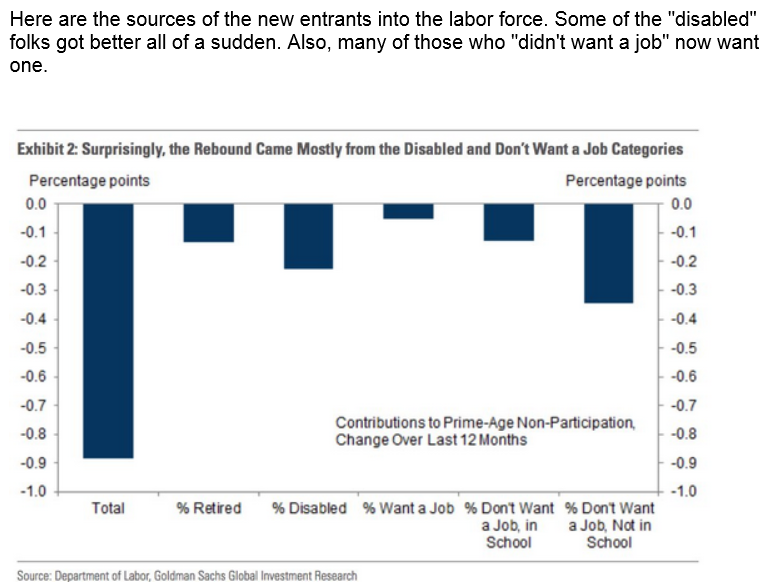

As suspected, there has been a lot more ‘slack’ in the ‘labor market’ than the mainstream has asserted: