If long-term interest rate r is less than the trend growth rate of GDP g Yesterday (technically very early today) I promised a post on why long-term Treasury interest rates are very important. In particular it is very important if the long-term interest rate r is less than the trend growth rate of GDP g. If rg is a condition for optimality. This has a fancy name — the transversality condition. It also is true for an obvious reason. If all can afford to consume more now without consuming less later, they can benefit by doing so. Therefore, the current consumption/saving plan is not efficient. To get from the whole economy owned by a mythical representative consumer to the government add the assumption that tax revenues are a constant fraction of

Topics:

Robert Waldmann considers the following as important: Featured Stories, r- g, US/Global Economics

This could be interesting, too:

Ken Melvin writes A Developed Taste

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

if long-term interest rate r is less than the trend growth rate of GDP g

Yesterday (technically very early today) I promised a post on why long-term Treasury interest rates are very important. In particular it is very important if the long-term interest rate r is less than the trend growth rate of GDP g. If r<g then the public sector intertemporal budget constraint is not binding. This means that public policy is not even Pareto efficient. In particular it means that increased budget deficits are good policy (unless they are increased by depraved policy like pointless aggressive war or something). I will try to explain all this in the rest of the post.

Olivier Blanchard discussed this in his now a very long 5 years old presidential address to the American Economic Association. The five years are very important exactly because interest rates have increased a lot as noted in yesterday’s post. Even in 2019, Blanchard at least warned that the arguments only work if interest rates are low and remain low. I want to consider if they still are valid.

First the arguments. First thing is that it doesn’t matter whether one looks at nominal interest rates and nominal GDP growth or real interest rates and real GDP growth. Nominal interest – nominal GDP growth equals (nominal interest rates – inflation) – (nominal GDP growth – inflation). Second the argument is based on the simpler present value formula. The present value of all future GDP is calculated discounting each future period’s GDP. If GDP growth is consistently higher than the interest rate, then each term in the sum is greater than the preceding term so the series sums to infinity. This means that the present value of future income is infinite and one can afford an increase in current spending. That’s it. Very simple. Maybe absurdly and implausibly simple.

In very simple models in which it is assumed that all families are identical and have identical wealth and income. r>g is a condition for optimality. This has a fancy name — the transversality condition. It also is true for an obvious reason. If all can afford to consume more now without consuming less later, they can benefit by doing so. Therefore, the current consumption/saving plan is not efficient.

To get from the whole economy owned by a mythical representative consumer to the government add the assumption that tax revenues are a constant fraction of GDP. The present value of tax revenues are a positive constant which is less than one times infinity = infinity. The government can spend more now without ever spending less and without raising taxes now or in the fuure.

Another way of putting this is that the public debt can be rolled over forever always using new borrowing to pay bondholders. The debt then grows at rate r + the primary deficit/debt. The primary deficit is spending except for interest on the debt minus revenues. If the debt is increased this year by increased spending or reduced taxes, the increase in the debt at time t grows at rate r. If r is always less than g then the ratio of the increased debt to GDP always shrinks until it is negligible. It never creates a huge problem.

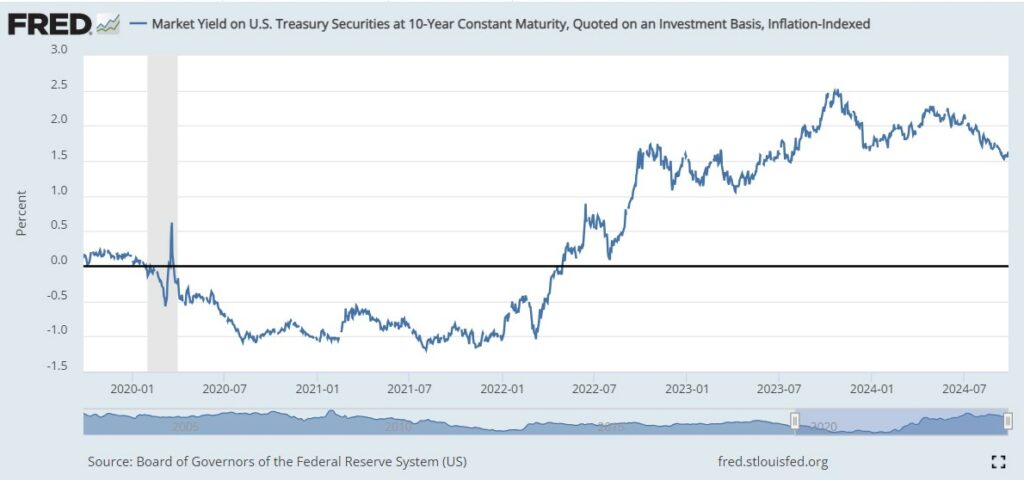

OK so let’s look at the long term real interest rate again.

Back in 2019 it was about zero. The trend growth of GDP is definitely positive. The data suggested that if real interest rates and real GDP growth rates stayed about the same, then the intertemporal public sector budget constraint was not binding. During the period of extremely low interest rates (most of which does not appear on the graph – sorry) there were periods of intense focus on the national debt and assertions that it was the nation’s biggest problem and that something had to be done about budget deficits. This was very odd given the intertemporal budgetary arithmetic.

The 10 year real interest rate shot up when the FED started to fight inflation. This still seems very odd to me. It got as high as 2.5%. Estimates (guesses) of the long-term trend growth rate of real GDP range from 2 to 3. Currently the 10-year real interest rate is 1.5%. This is much higher than -1% but still lower than the lower end of the range of forecasts (guesses) of g.

My way of describing this is that the Treasury would make a profit on the sale of 10 year TIPS except for those sold during a brief period in late 2003.

There are a couple of things which stengthen the case for higher deficits. First the return on short term treasuries is lower than the return on long term treasuries. The Treasury does not have to sell long term treasuries. Selling only short term might be risky, but the Treasury has huge risk bearing capacity and lasts forever. Second the average real return on TIPs is greater than the average real return on ordinary nominal Treasuries. It is easier to see what is happening in the graph of real returns on TIPs, but selling only TIPs would be a mistake which would reduce debt sustainability. The graph in the figure is chosen to make it harder to argue that higher national debt is no problem.

The argument had no traction back in 2019 when the data were much more favorable. I am sure it will have no traction now.

Finally, even if the argument is convincing, current fiscal policy is unsustainable. The current primary deficit is large. The national debt is growing at a rate faster than r. The US has a choice between higher taxes, spending cuts, or default just as deficit hawks claim. If anything, the fact that the reduction in deficits required to get the nominal debt to grow at a rate lower than the trend growth rate of nominal GDP makes the case for, say, higher taxes on high incomes, stronger. A sustainable fiscal policy is not so very far away that it would be political suicide to aim for it.