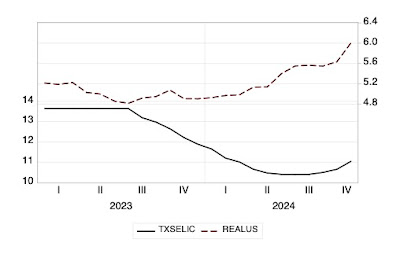

The Brazilian real depreciated last week (full meltdown might be a bit of a hyperbole), and in many quarters there has been a suggestion that it is now undervalued, and that would somehow be connected to the dangers associated with the fiscal position, and the willingness of the Lula government to push the spending cuts, and the tax changes, with cuts for those at the bottom of the income distribution and hikes at the other end (more on the fiscal story in a bit).The obvious reason for this is that the Brazilian basic interest rate was coming down from its post-pandemic high, and probably, and in spite of all the pressure from progressives and heterodox economists, it was a bit too low. As it can be seen, as the SELIC rate came down, the exchange rate started, eventually, to depreciate.

Topics:

Matias Vernengo considers the following as important: Brazil, exchange rate depreciation, Monetary Policy, Robin Brooks

This could be interesting, too:

Matias Vernengo writes The behavior of the nominal exchange rate between the Brazilian Real and the dollar in 2024

Matias Vernengo writes Serrano, Summa and Marins on Inflation, and Monetary Policy

Matias Vernengo writes 30 years of the Real Plan: Unoriginal Lessons from Latin American Stabilizations

Matias Vernengo writes Brief note on public debt and interest rates in Brazil

The Brazilian real depreciated last week (full meltdown might be a bit of a hyperbole), and in many quarters there has been a suggestion that it is now undervalued, and that would somehow be connected to the dangers associated with the fiscal position, and the willingness of the Lula government to push the spending cuts, and the tax changes, with cuts for those at the bottom of the income distribution and hikes at the other end (more on the fiscal story in a bit).

The obvious reason for this is that the Brazilian basic interest rate was coming down from its post-pandemic high, and probably, and in spite of all the pressure from progressives and heterodox economists, it was a bit too low. As it can be seen, as the SELIC rate came down, the exchange rate started, eventually, to depreciate. This will have some impact on inflation, but it is nothing that should be of any significant concern. A higher SELIC, and a few interventions by the Brazilian Central Bank (BCB) should be more than enough to stabilize the exchange rate.

The fiscal situation does not require any adjustment, and certainly not one for next year, and not at the expense of reducing government outlays on education and health. Brazil managed to grow more than predicted by markets since Lula's election, because the fiscal rules were taken with pragmatism and the adjustment has been delayed. If the government goes through with the spending cuts, expect growth to decelerate, and the fiscal accounts to worsen.

This is exactly what Dilma tried in her first government, then backtracked, and then adopted in the aftermath of her victory in 2015, leading to the worsening of the fiscal results, and the impeachment (not that this is on the table; but the political future certainly is if Lula cannot deliver growth and better income distribution). Btw, the changes in the taxes are a good thing.