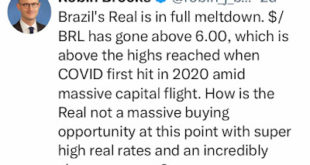

The Brazilian real depreciated last week (full meltdown might be a bit of a hyperbole), and in many quarters there has been a suggestion that it is now undervalued, and that would somehow be connected to the dangers associated with the fiscal position, and the willingness of the Lula government to push the spending cuts, and the tax changes, with cuts for those at the bottom of the income distribution and hikes at the other end (more on the fiscal story in a bit).The obvious reason for this...

Read More »Open Thread January 4 2024 overly “restrictive” monetary policy

Dollar eases as Fed minutes offer few clues on rate cuts timeline, MSN, Markets Today Tags: monetary policy

Read More »Monetary Policy Debates in the Age of Deglobalisation: the Turkish Experiment – III

A slightly edited version of this article first appeared in the Economic and Political Weekly on 22 July 2023. Summary: This article is the third and last in a series of articles on monetary policy debates in the age in which deglobalisation became a buzzword. Here, we continue our discussion of the ongoing Turkish monetary policy experiment by focusing on macroprudential measures, capital controls and central bank independence, as promised in the first article, as an example of these...

Read More »Monetary Policy Debates in the Age of Deglobalisation: the Turkish Experiment – III

A slightly edited version of this article first appeared in the Economic and Political Weekly on 22 July 2023.Summary: This article is the third and last in a series of articles on monetary policy debates in the age in which deglobalisation became a buzzword. Here, we continue our discussion of the ongoing Turkish monetary policy experiment by focusing on macroprudential measures, capital controls and central bank independence, as promised in the first article, as an example of these...

Read More »Monetary Policy Debates in the Age of Deglobalisation: the Turkish Experiment – III

A slightly edited version of this article first appeared in the Economic and Political Weekly on 22 July 2023.Summary: This article is the third and last in a series of articles on monetary policy debates in the age in which deglobalisation became a buzzword. Here, we continue our discussion of the ongoing Turkish monetary policy experiment by focusing on macroprudential measures, capital controls and central bank independence, as promised in the first article, as an example of these...

Read More »Settling the public sector pay disputes now – modest cost, big benefits

Another week goes by. Hundreds of thousands of workers, mainly public sector, on strike last week, and again this week. Pay deals way below inflation. Zero movement from government. Continuing disruption and decay. Why can’t a settlement be reached?Just before Christmas, Prime Minister Sunak told us“I want to make sure that we reduce inflation and part of that is being responsible in setting public sector pay..”On 1st February, Mr Sunak’s Official Spokesman said“We want to have further...

Read More »Settling the public sector pay disputes now – modest cost, big benefits

Another week goes by. Hundreds of thousands of workers, mainly public sector, on strike last week, and again this week. Pay deals way below inflation. Zero movement from government. Continuing disruption and decay. Why can’t a settlement be reached?Just before Christmas, Prime Minister Sunak told us“I want to make sure that we reduce inflation and part of that is being responsible in setting public sector pay..”On 1st February, Mr Sunak’s Official Spokesman said“We want to have further...

Read More »Settling the public sector pay disputes now – modest cost, big benefits

Another week goes by. Hundreds of thousands of workers, mainly public sector, on strike last week, and again this week. Pay deals way below inflation. Zero movement from government. Continuing disruption and decay. Why can’t a settlement be reached? Just before Christmas, Prime Minister Sunak told us “I want to make sure that we reduce inflation and part of that is being responsible in setting public sector pay..” On 1st February, Mr Sunak’s Official Spokesman said “We want to have...

Read More »Snake oil sellers in the stablecoin world

It's been evident for some years now that those selling risky crypto products to risk-averse investors like to have federal branding on their snake oil. Tether claimed to have 100% actual dollar backing for its stablecoin. Various exchanges and platforms claimed that customer deposits were FDIC insured. The New York Attorney General showed that Tether didn't have 100% dollar backing or anything like it. And now the FDIC has sent cease & desist orders to FTX, Voyager and several other...

Read More »Waiting for Deglobalisation – I

Ahmet Öncü & T.Sabri ÖncüThis article first appeared in the Economic & Political Weekly on 12 November 2022.Monetary Policy Debates in the Age of DeglobalisationThis article is the first in a series of two articles on monetary policy debates in the age in which deglobalisation is a buzzword. The ongoing monetary policy debates of the age will be discussed by focusing on macroprudential measures, capital controls and central bank independence in Part II.IntroductionIn a recent article,...

Read More » Heterodox

Heterodox