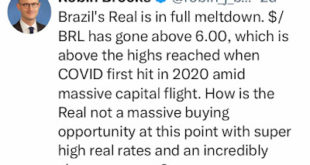

The Brazilian real depreciated last week (full meltdown might be a bit of a hyperbole), and in many quarters there has been a suggestion that it is now undervalued, and that would somehow be connected to the dangers associated with the fiscal position, and the willingness of the Lula government to push the spending cuts, and the tax changes, with cuts for those at the bottom of the income distribution and hikes at the other end (more on the fiscal story in a bit).The obvious reason for this...

Read More »Modern Money Theory (MMT) in the Tropics

Paper has been published as a PERI Working Paper.From the abstract: Functional finance is only one of the elements of Modern Money Theory (MMT). Chartal money, endogenous money and an Employer of Last Resort Program (ELR) or Job Guarantee (JG) are often the other elements. We are here interested fundamentally with the functional finance aspects which are central for any discussion of fiscal policy and have received more attention recently. We discuss both the limitations of functional...

Read More »Bill Mitchell — Prime Minister Corbyn should have no fears from global capital markets

Bill addresses many issues in this post that MMT economists don't ordinarily focus on like capital markets, capital flows, capital flight, capital controls, and exchange rate depreciation. Since most progressives don't understand the background and dynamics they generally get sucked into commonly deployed neoliberal traps. Bill shows how they don't need to.Bill Mitchell – billy blogPrime Minister Corbyn should have no fears from global capital marketsBill Mitchell | Professor in Economics...

Read More »Exchange rate depreciation and exports: the evidence

In this blog we discussed several times the reasons why exchange rate depreciation is not necessarily a panacea for current account problems (see for example here and here on Argentina depreciation before the last one with the Macri administration, here on the Europe, here in general about the idea of a Sustainable and Stable Competitive Real Exchange Rate or SSCRER, and here on the role of the exit from the Gold Standard during the Depression). Exchange rate skepticism suggested that...

Read More »Global depreciation since the collapse of oil prices

One figure is worth a thousand words (negative number imply depreciation). So, if you think China devalued a lot...Source here.

Read More »Chinese slowdown and the world economy

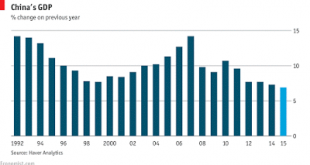

The Conference Board argues that Chinese official data should be taken with some skepticism. Nothing new there. They have adopted a new measure, which implies "Chinese economic growth at a more realistic 3.7 percent" for the recent past. In this scenario, interestingly enough, "it’s likely that the bulk of China’s slowdown has already taken place since 2011, even if unapparent in official statistics." So the picture is probably worse than the official one (as shown below, from The...

Read More » Heterodox

Heterodox