Post election euphoria? In any case, as per the chart, historically it doesn’t tend to stay this high for long: Highlights Post-election confidence continues to build, lifting consumer sentiment by more than 4 points to a 98.0 level that hits the very outside of the Econoday range and is 1 tenth away from the index’s recovery peak hit last year. Consumers specifically cite expectations of new economic policies as the biggest positive. A rise in the current conditions component, up 4.5 percent from November to 112.1, offers an early indication of strength for December’s holiday spending while a gain for expectations, up 4.3 percent to 88.9, points to confidence in the jobs outlook. But the rise in spirits isn’t translating to any improvement for inflation with both the 1-year and 5-year outlooks down 1 tenth, to 2.3 percent and 2.5 percent respectively. Inflation aside, this report is another signal that the economy may be closing out the fourth-quarter with strong momentum. Inventories resume their decline which means less new output and lower GDP, as too high inventory to sales ratios do their thing: Highlights Inventories were looking heavy going into the fourth quarter but, given strength in demand, are turning out to be perhaps too lean. Inventories at the wholesale level fell 0.4 percent in October, drawn down by a 1.4 percent surge in wholesale sales.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

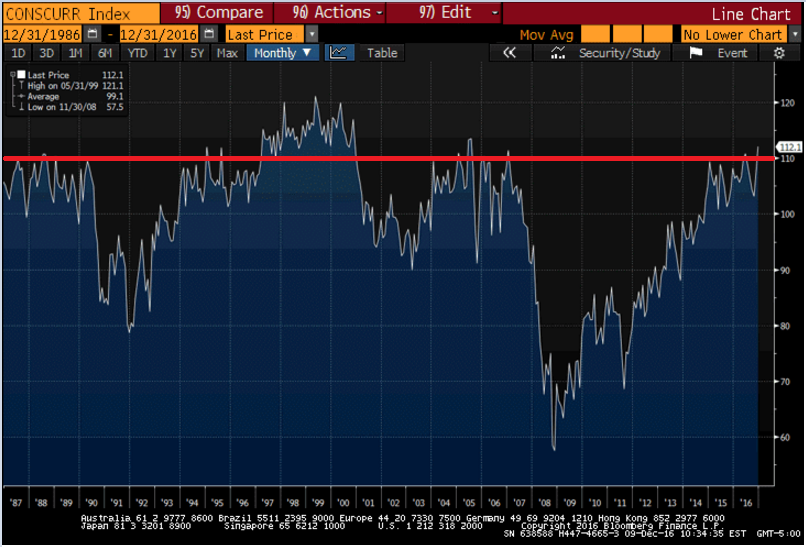

Post election euphoria? In any case, as per the chart, historically it doesn’t tend to stay this high for long:

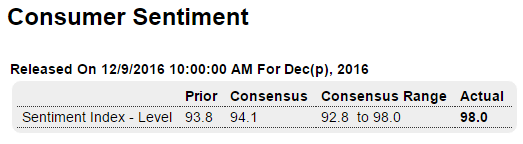

Highlights

Post-election confidence continues to build, lifting consumer sentiment by more than 4 points to a 98.0 level that hits the very outside of the Econoday range and is 1 tenth away from the index’s recovery peak hit last year. Consumers specifically cite expectations of new economic policies as the biggest positive. A rise in the current conditions component, up 4.5 percent from November to 112.1, offers an early indication of strength for December’s holiday spending while a gain for expectations, up 4.3 percent to 88.9, points to confidence in the jobs outlook. But the rise in spirits isn’t translating to any improvement for inflation with both the 1-year and 5-year outlooks down 1 tenth, to 2.3 percent and 2.5 percent respectively. Inflation aside, this report is another signal that the economy may be closing out the fourth-quarter with strong momentum.

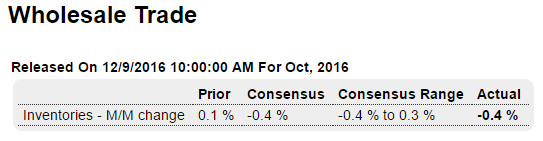

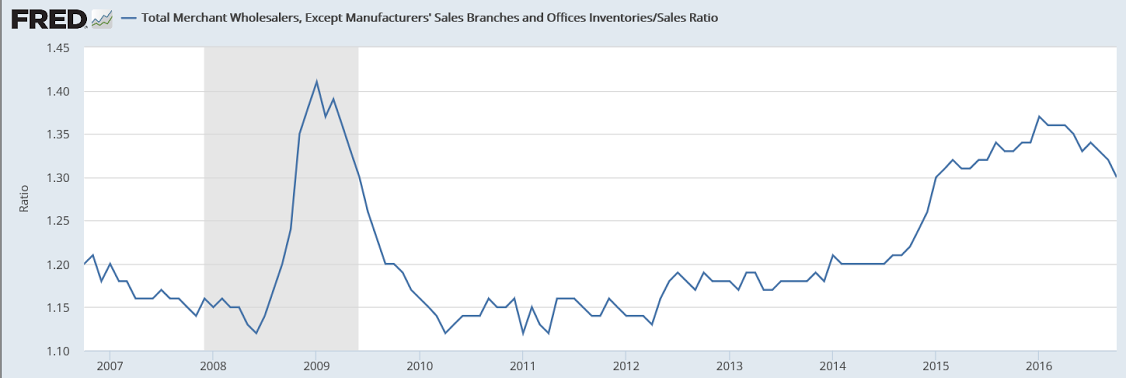

Inventories resume their decline which means less new output and lower GDP, as too high inventory to sales ratios do their thing:

Highlights

Inventories were looking heavy going into the fourth quarter but, given strength in demand, are turning out to be perhaps too lean. Inventories at the wholesale level fell 0.4 percent in October, drawn down by a 1.4 percent surge in wholesale sales. The mismatch drops the stock-to-sales ratio from 1.32 to 1.30 for the lowest reading in nearly two years. Advance data for retail point to a similar decline for retail inventories to be posted next week while factory inventories, posted earlier in the week with the factory orders report, were unchanged.

Looks to me like maybe 1.2 would be normal indicating there’s a long way to go:

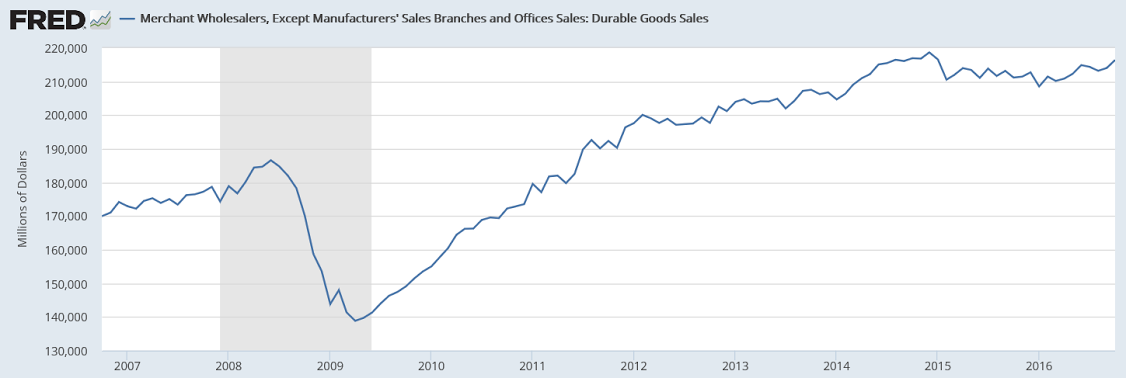

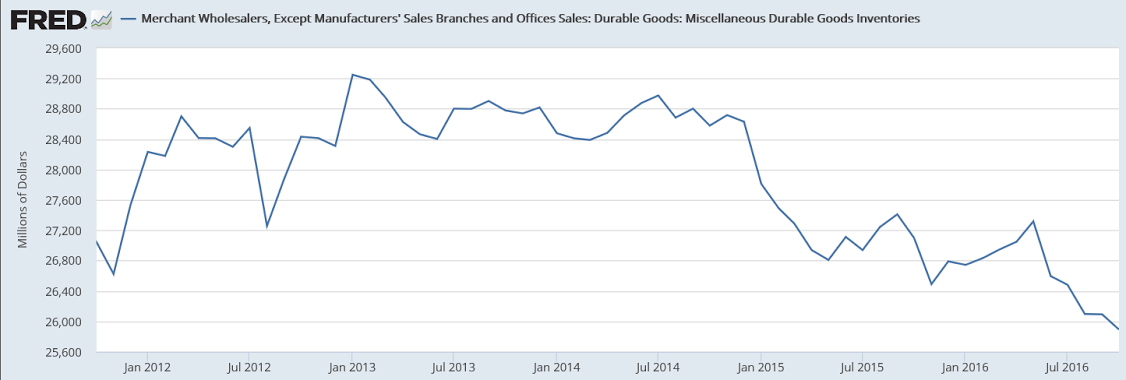

Sales have recovered but remain well below ‘normal’:

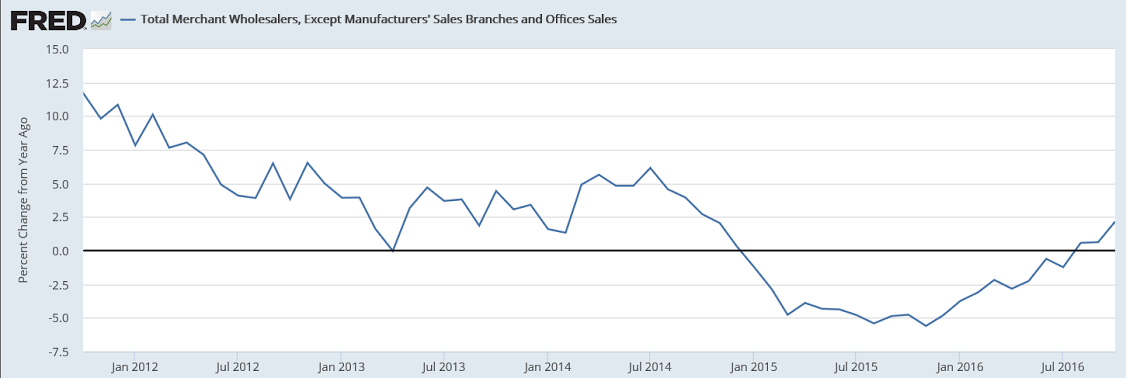

For all practical purposes, these sales have gone flat: