At this point in time higher oil prices are an unambiguous negative for the US economy. The higher prices will drain low income consumer $, and while incomes for higher end consumers with oil related income will benefit, I don’t see them increasing spending as fast as the low end cuts back. Also, with the US importing more oil and at higher prices, incomes of foreign oil producers will benefit but, again, I don’t see them buying as many more US goods and services. And oil capex spending is asymmetrical, in that it collapsed a lot faster when prices fell then it will recover with prices rising. So I suspect that source of spending growth will be slow in coming, particularly with the very real risk of prices collapsing again should the Saudis so decide, etc. Seems it’s Trump’s nature to look for spending cuts for bragging rights, the largest of which would be bringing down the deficit and debt, which not long ago he said he’d pay off in 8 years.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

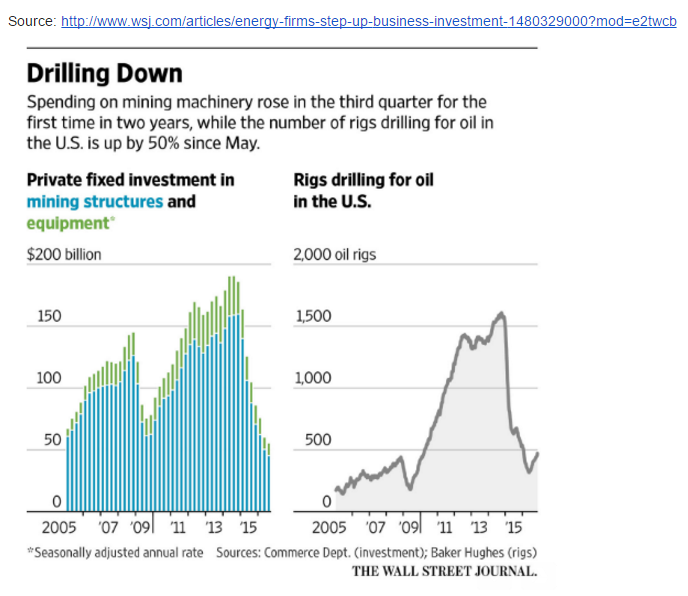

At this point in time higher oil prices are an unambiguous negative for the US economy. The higher prices will drain low income consumer $, and while incomes for higher end consumers with oil related income will benefit, I don’t see them increasing spending as fast as the low end cuts back. Also, with the US importing more oil and at higher prices, incomes of foreign oil producers will benefit but, again, I don’t see them buying as many more US goods and services.

And oil capex spending is asymmetrical, in that it collapsed a lot faster when prices fell then it will recover with prices rising. So I suspect that source of spending growth will be slow in coming, particularly with the very real risk of prices collapsing again should the Saudis so decide, etc.

Seems it’s Trump’s nature to look for spending cuts for bragging rights, the largest of which would be bringing down the deficit and debt, which not long ago he said he’d pay off in 8 years. And with the multiplier far higher on these kinds of spending cuts than any of his tax proposals, odds are the macroeconomic consequences are contractionary:

Trump takes aim at Pentagon’s ‘revolving door’ and Lockheed Martin’s $400 billion F-35 program

By Christian Davenport

Just over a year after Northrop Grumman won the multi-billion dollar contract to build a next-generation stealth bomber, the company appointed Mark Welsh, who was serving as Air Force Chief of Staff at the time of the contract award, to its board.

This isn’t about US govt. spending, but same results:

Boeing’s $16B aircraft deal with Iran Air faces challenges

Boeing has government approval to fill Iran Air’s $16 billion aircraft order, but it may still be grounded by Congress. And President-elect Trump, who has criticized the Iran nuclear accord that allowed the deal to take off, could eventually have a say …