Someone asked me the other day why I reject factor investing. My answer was simple. I said that factor investing is usually just a good marketing pitch to charge higher fees for something that will give you most of the correlation of a market cap weighted portfolio. For the uninitiated, factor investing is one of the hot buzz words in portfolio construction these days. Researchers found that “risk” doesn’t properly describe what drives returns over the long-term and several other factors were discovered that explain some of these outperforming anomalies. For instance, value stocks tend to outperform and momentum stocks often outperform. But this isn’t always the case. This is simply the case inside of the rather small data set that researchers have mined so far. And that brings us to a rather gigantic problem with factor investing: these factors can go through extremely long periods of underperformance. Eddy Elfenbein does the legwork over at Crossing Wall Street where he shows that value has underperformed the S&P 500 for 8 years. That’s an entire market cycle! I’m not sure there’s a single investor who would put up with that type of underperformance. And yet factor investing is more popular than ever. In fact, we keep coming up with new factors by the day. And when one fails we move on to some other fancier and more intricate sounding sales pitch.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Someone asked me the other day why I reject factor investing. My answer was simple. I said that factor investing is usually just a good marketing pitch to charge higher fees for something that will give you most of the correlation of a market cap weighted portfolio.

For the uninitiated, factor investing is one of the hot buzz words in portfolio construction these days. Researchers found that “risk” doesn’t properly describe what drives returns over the long-term and several other factors were discovered that explain some of these outperforming anomalies. For instance, value stocks tend to outperform and momentum stocks often outperform. But this isn’t always the case. This is simply the case inside of the rather small data set that researchers have mined so far. And that brings us to a rather gigantic problem with factor investing: these factors can go through extremely long periods of underperformance.

Eddy Elfenbein does the legwork over at Crossing Wall Street where he shows that value has underperformed the S&P 500 for 8 years. That’s an entire market cycle! I’m not sure there’s a single investor who would put up with that type of underperformance. And yet factor investing is more popular than ever. In fact, we keep coming up with new factors by the day. And when one fails we move on to some other fancier and more intricate sounding sales pitch.

But here’s the really big problem for me. When you buy stocks you shouldn’t look for the absolute best portfolio. There are no holy grails. You are just looking for an adequate portfolio that reflects a very broadly diversified set of equity instruments. You don’t need the best return. You want most of the return. But most factor portfolios just increase tax and fee frictions while giving you a substantial amount of the equity correlation that you’re looking for in a portfolio. But what we find with all of these factor funds is that they’re still very highly correlated with their benchmark. If you can decide when that correlation shifts a tiny bit to give you some slice of outperformance then you’re much smarter than me and everyone else in this business.

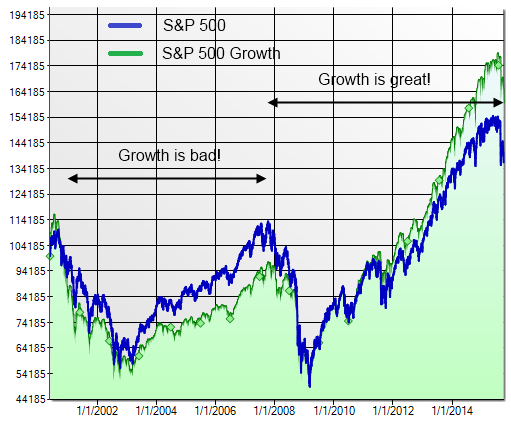

Here’s a simple example of what I mean here. If we look at growth relative to the market cap weighted portfolio we find that the two portfolios have a 96% correlation over the last 15 years:

In the early 2000’s growth looked terrible relative to market cap weighting. And then it has dramatically outperformed since the financial crisis. But over the course of the entire cycle there’s no telling where you would have gotten on and off that rollercoaster ride. All we know is that you got 96% of the equity market correlation. And if you jumped on the growth rollercoaster you paid a higher fee and you MAYBE outperformed. So, when you start looking for that holy grail in the factor pool you really start doing two things that are cardinal sins in the world of indexing:

- You’re relying on being able to time when a factor will or won’t outperform.

- You’re increasing your fees in the pursuit of beating the market.

Breaking those rules just don’t make a lot of sense to me. I prefer to keep things simple. So, maybe I am too hard on the factor investing crowd, but I just don’t see why we should pay extra for something that might give you better performance, will definitely give you most of the correlation and will definitely increase your fees.