Here are some things I think I am thinking about: 1) Trumponomics – a bi-partisan dream come true? Donald Trump has only just started to offer details on his economic plan and I have to admit that I am intrigued. He’s essentially calling for across the board income tax cuts, closing the carried interest loophole, taxing importers and boosting spending on infrastructure and the military. There haven’t been a lot of details here, but so far it sounds like the spending cuts would be wildly unrealistic while spending plans on infrastructure and the military would almost certainly expand discretionary spending by a YUUUUGE amount. Combine that with the tax cuts and you probably get a large increase in the budget deficit. That’s right, you’ve made everyone happy at once. Republicans get their tax cut, Democrats get their infrastructure spending and they get a larger budget deficit. But there’s another interesting aspect here. Trump wants to tax importers and incenvitize domestic production. This is something I essentially agree with, but Trump’s implementation is botched in my view. He should be implementing a version of Warren Buffett’s Import Certificates. This plan would work in a very simple market based manner. The government issues Import Certifices equal to the value of exports.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Here are some things I think I am thinking about:

1) Trumponomics – a bi-partisan dream come true? Donald Trump has only just started to offer details on his economic plan and I have to admit that I am intrigued. He’s essentially calling for across the board income tax cuts, closing the carried interest loophole, taxing importers and boosting spending on infrastructure and the military. There haven’t been a lot of details here, but so far it sounds like the spending cuts would be wildly unrealistic while spending plans on infrastructure and the military would almost certainly expand discretionary spending by a YUUUUGE amount. Combine that with the tax cuts and you probably get a large increase in the budget deficit. That’s right, you’ve made everyone happy at once. Republicans get their tax cut, Democrats get their infrastructure spending and they get a larger budget deficit.

But there’s another interesting aspect here. Trump wants to tax importers and incenvitize domestic production. This is something I essentially agree with, but Trump’s implementation is botched in my view. He should be implementing a version of Warren Buffett’s Import Certificates. This plan would work in a very simple market based manner. The government issues Import Certifices equal to the value of exports. Exporters would be issued the certificates and they could then sell them in a market exchange to any company that wants to import goods and services. The importers would be required to own import certificates equal to the amount they import. If the USA was running a current account deficit this would result in expensive certificates which should have a natural rebalancing effect over time. This would be a market based version of a tax on imports. The Levy Center has an even better version of the Buffett plan here which could be combined with a payroll tax cut. This would likely boost domestic employment even though it would also boost domestic prices. But it’s a net benefit for the USA in the global view. Is it protectionist? Yes, but in a world where many of the dominant players don’t play by the free trade rules, you’re a fool if you play by the rules and still think you’re winning.

As crazy as Trump sounds sometimes his economic plan might be a lot more attractive than he’s getting credit for.

2) Derpistan – you can check out any time, but you can never leave. Paul Krugman reprimands the inflationistas for the millionth time on his blog. The berating of the inflationstas strikes me as a little unfair. Okay, yes, the people who predicted hyperinflation have been totally discredited. We know their views and understanding of banking were wrong. But many of these people also thought that low rates and QE would lead to financial instability (as Cliff Asness did). And that seems to be something that is starting to play out in various markets. For instance, the quantity of dollar denominated loans in emerging markets has become a huge problem. And there are even signs that corporate America has financed lots of foolish activities in the last 7 years thanks in part to the Fed explicitly trying to get the private sector to lever back up. And I won’t even mention the fact that Krugman’s IS-LM model relies on a fixed money supply and theoretical natural rate of interest. The first idea has been soundly rejected by the Fed, Bank of England and others while the second idea is theoretical to the point of being useless.

Anyhow, I don’t really like this idea that there is one economic ideology out there that has all the right answers. No one’s economic model is perfect. We all make mistakes given that the monetary system is such an incredibly dynamic and complex system so I don’t think it’s ever quite as black and white as some people make it out to be. This world could use a lot more humility and open-mindedness and not this partisanship that dominates views.

3) Is the US economy strong or weak? Does it Matter? There has been so much conflicting data in recent weeks. Housing data has been strong, jobless claims are near lows, ADP employment was strong, manufacturing is weak, auto sales were through the roof, the Challenger Job Cuts report showed labor deterioration, etc. But this has been the story of the last 7 years. It has been an uneven muddle through. This economy remains very weak despite what some of the headline figures say. And that’s one reason why I am so skeptical of a recession right now. It’s hard to die when you’re jumping out of the ground floor window.

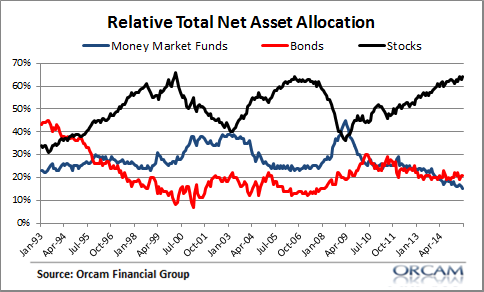

Of course, regarding the financial markets, the business cycle isn’t the market cycle. And by my measures we do look like we’re in the latter stages of the market cycle according to my relative net asset calculations. That doesn’t mean it’s time to take it all off the table and jump in a bunker, but there’s a sound argument to be made right now that US stocks are in a much riskier phase of the market cycle than they have been at any point in the last 7 years.