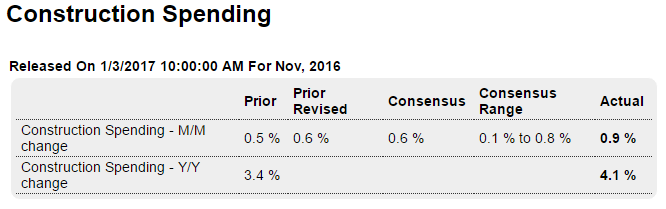

A bit of a bump up going into year end. Could be about expiring tax breaks as has happened in prior years: Highlights Construction had been lagging through most of 2016 but, like the factory sector, appears to have picked up steam going into year-end. Spending rose 0.9 percent in November which just tops Econoday’s high estimate and is the best reading since June. Residential spending rose 1.0 percent in the month on top of October’s 1.6 percent gain. The gain here is concentrated in single-family homes which offset a monthly dip for multi-family units which otherwise have been leading the residential sector. Home improvements added to the spending in November. Non-residential spending was also strong, up 0.9 percent which most categories showing gains led by office construction and transportation construction. Public spending was also solid including a 3.1 percent monthly jump in Federal spending. The breadth of gains is most impressive in this report, one that will give a lift to fourth-quarter GDP estimates. These numbers aren’t inflation adjusted, so in real terms spending is still far below what it was.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

A bit of a bump up going into year end. Could be about expiring tax breaks as has happened in prior years:

Highlights

Construction had been lagging through most of 2016 but, like the factory sector, appears to have picked up steam going into year-end. Spending rose 0.9 percent in November which just tops Econoday’s high estimate and is the best reading since June.

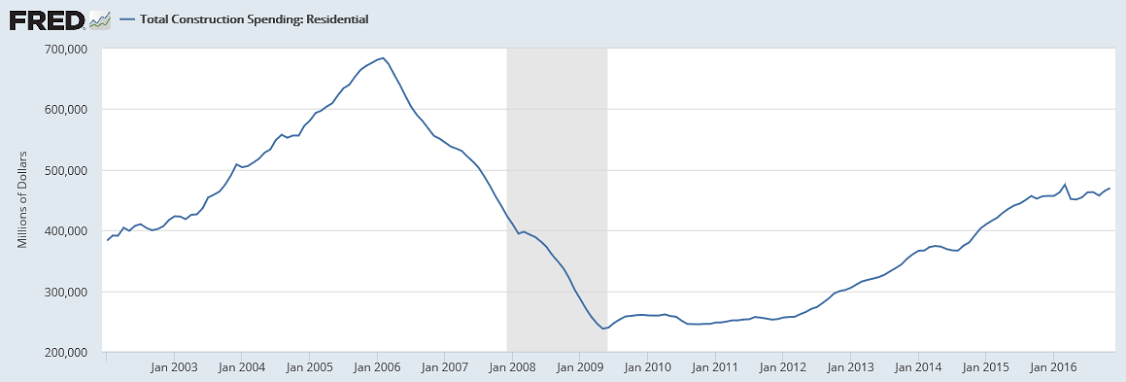

Residential spending rose 1.0 percent in the month on top of October’s 1.6 percent gain. The gain here is concentrated in single-family homes which offset a monthly dip for multi-family units which otherwise have been leading the residential sector. Home improvements added to the spending in November.

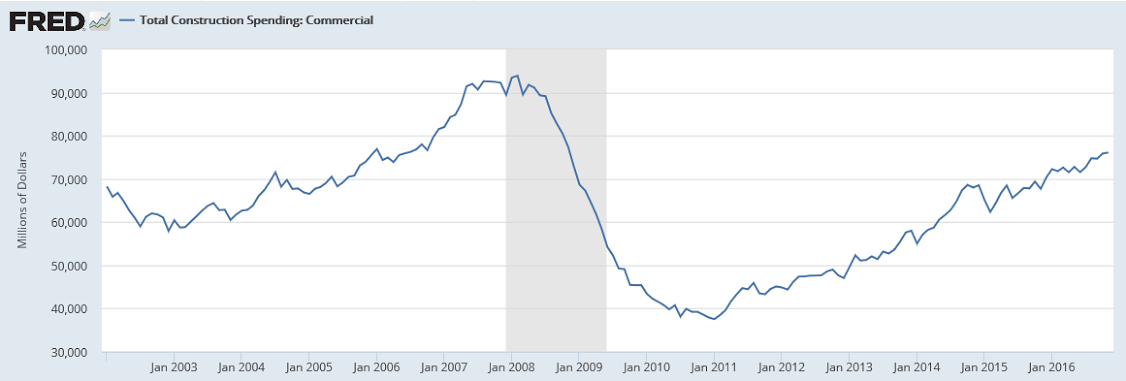

Non-residential spending was also strong, up 0.9 percent which most categories showing gains led by office construction and transportation construction. Public spending was also solid including a 3.1 percent monthly jump in Federal spending.

The breadth of gains is most impressive in this report, one that will give a lift to fourth-quarter GDP estimates.

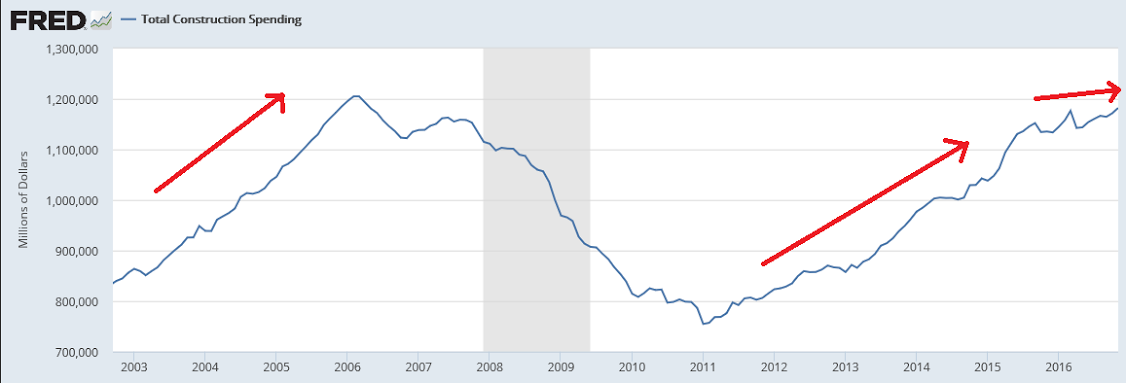

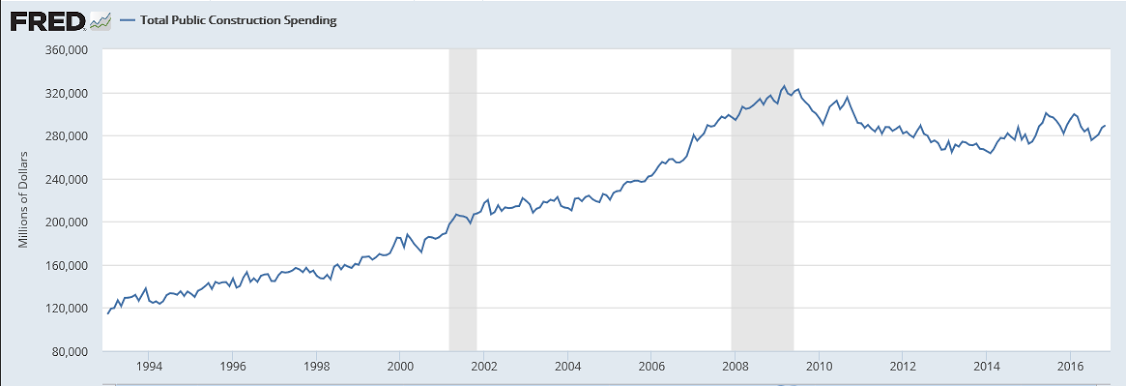

These numbers aren’t inflation adjusted, so in real terms spending is still far below what it was. And during this cycle construction spending grew at a slow pace than prior cycles and seems to have flattened out:

Public construction spending for all practical purposes has been flat nominally, and down when adjusted for inflation:

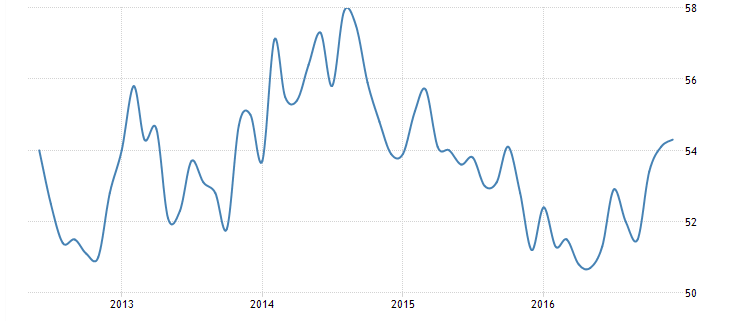

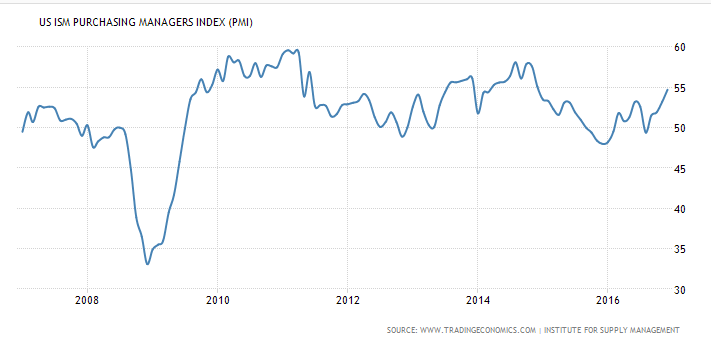

Manufacturing surveys have stabilized at modest levels of growth as previously discussed, and possibly reflecting some post election euphoria:

Market PMI:

ISM manufacturing

Growth in China’s factories, services slows in December: official PMI

Dec 31 (Reuters) — The official PMI stood at 51.4 in December compared with 51.7 in November. Factory output slowed in December, with the sub-index hitting 53.3 compared with 53.9 the previous month. Total new orders were flat at 53.2, logging the same as in November, while new export orders fell to 50.1 from 50.3. Jobs were again lost, with the employment sub-index sitting at 48.9, compared to 49.2 in November. A sub-index for smaller firms fell, and performance for larger companies also worsened. The official non-manufacturing Purchasing Managers’ Index (PMI) stood at 54.5 in December, down from 54.7 in November.

China Caixin manufacturing PMI climbs to 51.9 in December, fastest improvement since January 2013

Jan 2 (CNBC) — In December, the Caixin PMI reading came in at 51.9, up from November’s 50.9. “A further rise in production at Chinese manufacturers supported the higher PMI reading in December. Notably, the rate of output growth accelerated to a 71-month high, with a number of panelists commenting on stronger underlying demand and new client wins,” the Caixin data statement said. “Data indicated that improved domestic demand was the key driver of new business growth, however, as new export sales were unchanged in December.”