This is how they would start a downward price spiral if that’s what they wanted: Saudi Aramco Cuts Crude to Asia, U.S. Amid Weak Demand By Anthony Dipaola Oct 4 (Bloomberg) —Saudi Arabia cut pricing for November oil sales to Asia and the U.S. as the world’s largest crude exporter seeks to keep its barrels competitive with rival suppliers amid sluggish demand. Saudi Arabian Oil Co. reduced its official selling price for Medium grade crude to Asia next month to a discount of .20 a barrel below the regional benchmark, compared with a .30 discount for October sales, the company said in an e-mailed statement. The discount for the Medium grade to Asia, the main market for Saudi crude, widened by the most since the state-owned company made a a barrel cut in February 2012, according to data compiled by Bloomberg. Doesn’t look so good (Imports aren’t part of GDP): Here’s the foreign car sales: Even total sales don’t look all that stellar. The growth rate has to match the prior year growth rate to make the same contribution to GDP: The rest of the bank lending charts haven’t updated yet. Will post when I get the updates. The post Saudi Price Cut, Domestic Car Sales, Commercial Paper appeared first on The Center of the Universe.

Topics:

WARREN MOSLER considers the following as important: Credit, GDP, Oil

This could be interesting, too:

Angry Bear writes GDP Grows 2.3 Percent

NewDealdemocrat writes Real GDP for Q3 nicely positive, but long leading components mediocre to negative for the second quarter in a row

Mike Norman writes Atlanta Fed reduces Q2 GDP forecast once again, as I said they would

Frances Coppola writes Why the Tories’ “put people to work” growth strategy has failed

This is how they would start a downward price spiral if that’s what they wanted:

Saudi Aramco Cuts Crude to Asia, U.S. Amid Weak Demand

By Anthony Dipaola

Oct 4 (Bloomberg) —Saudi Arabia cut pricing for November oil sales to Asia and the U.S. as the world’s largest crude exporter seeks to keep its barrels competitive with rival suppliers amid sluggish demand.

Saudi Arabian Oil Co. reduced its official selling price for Medium grade crude to Asia next month to a discount of $3.20 a barrel below the regional benchmark, compared with a $1.30 discount for October sales, the company said in an e-mailed statement. The discount for the Medium grade to Asia, the main market for Saudi crude, widened by the most since the state-owned company made a $2 a barrel cut in February 2012, according to data compiled by Bloomberg.

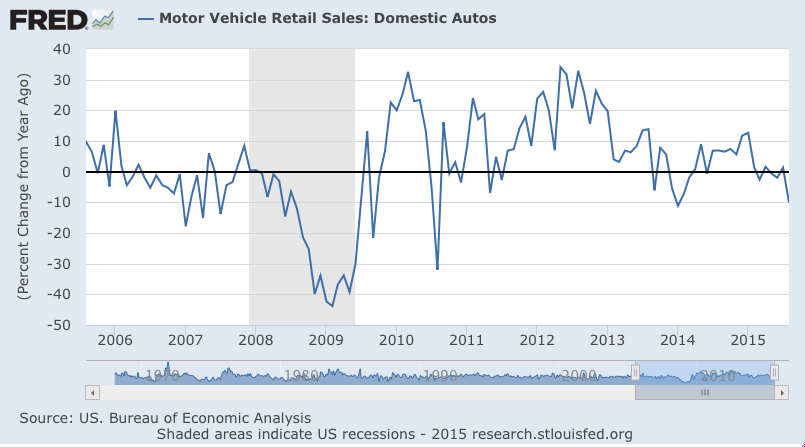

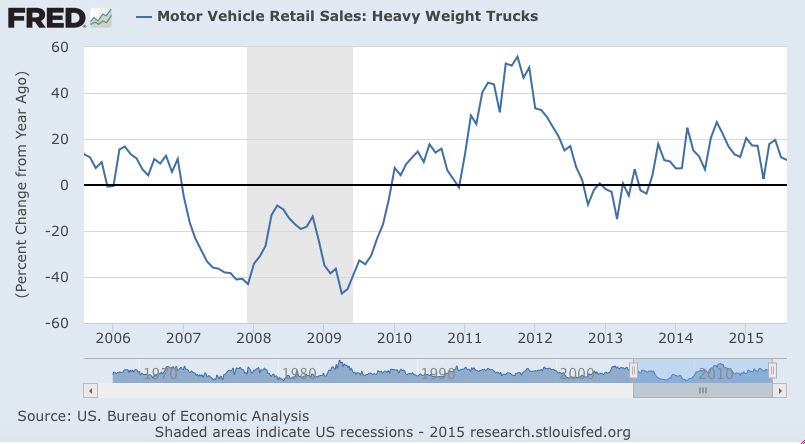

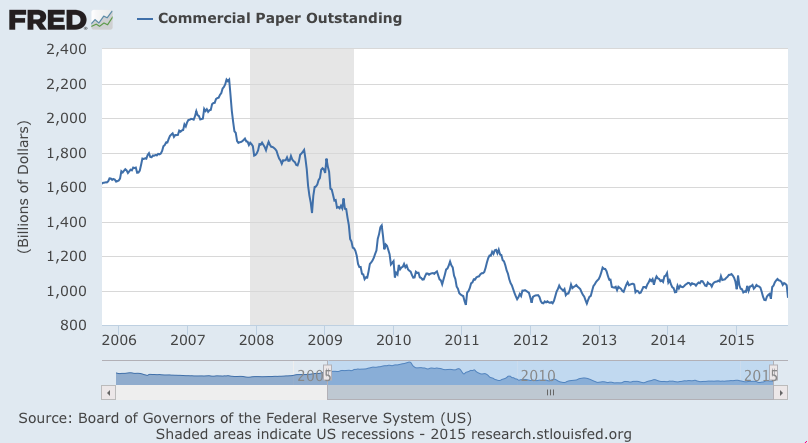

Doesn’t look so good (Imports aren’t part of GDP):

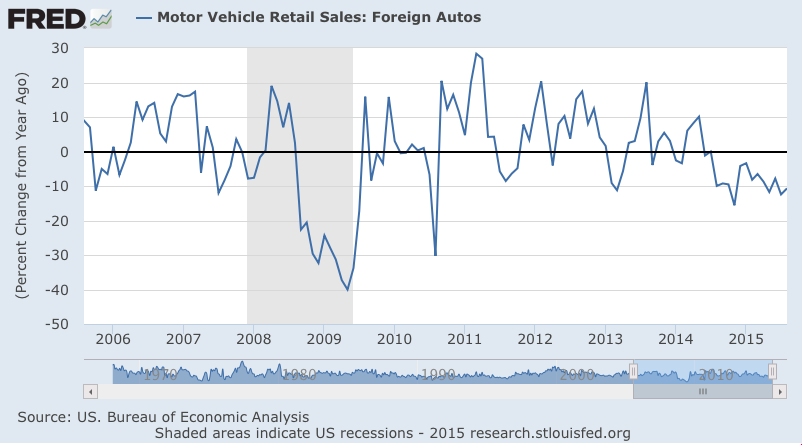

Here’s the foreign car sales:

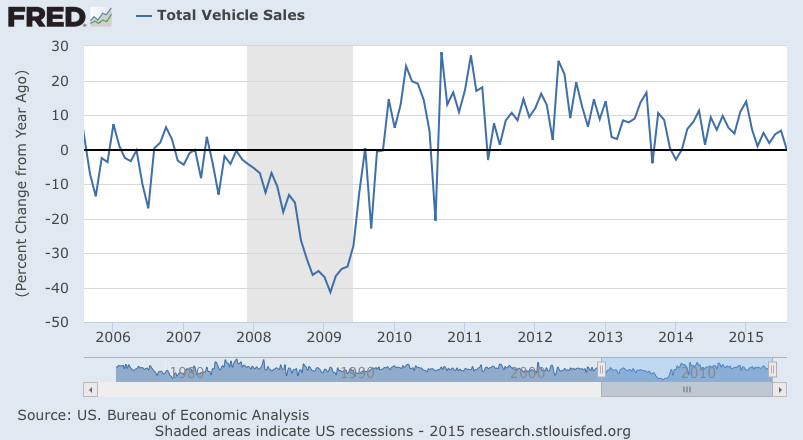

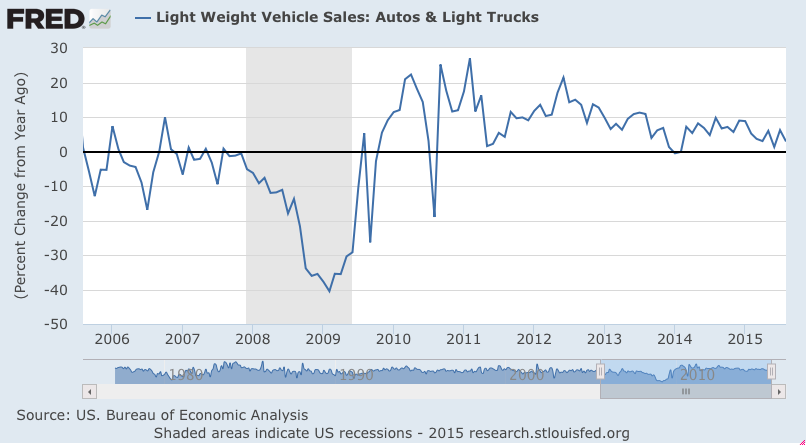

Even total sales don’t look all that stellar.

The growth rate has to match the prior year growth rate to make the same contribution to GDP:

The rest of the bank lending charts haven’t updated yet. Will post when I get the updates.

The post Saudi Price Cut, Domestic Car Sales, Commercial Paper appeared first on The Center of the Universe.