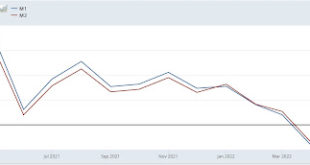

Two long leading indicators – real money supply and credit conditions – worsen – by New Deal democrat ~~~~~~~ M1 and M2 money supply for May was reported yesterday by the Fed. The former was unchanged for the month, and the latter was up a tiny 0.1%: That is significant. Why? Because real money supply is a long leading indicator. Real M2 fell out of favor after failing to actually decline YoY prior to the 2001 and 2008 recessions, but a...

Read More »Comment on Miguel Ramirez’s paper, ‘Credit, Indebtedness and Speculation in Marx’s Political Economy’ – ECONOMIC THOUGHT

The new issue of the journal ECONOMIC THOUGHT (Vol 8, No 2, 2019) has just been published. In this issue I have contributed a comment on Miguel Ramirez’s paper, ‘Credit, Indebtedness and Speculation in Marx’s Political Economy’. The issue contains of course the paper by M.Ramirez as well as his reply to my comments. The whole table of contents of the issue is the following: Vol 8, No 2, 2019 Table of contents Hierarchical Inconsistencies: A Critical Assessment of Justification Juozas...

Read More »Vladimir Asriyan, Luc Laeven, Alberto Martin — Credit booms and information depletion

Credit booms are perceived to fuel resource allocation and often end in crises that are followed by protracted periods of low growth. This column investigates the macroeconomic effects of credit booms using a new theory of information production. The theory predicts that when the economy enters a collateral boom, the price of collateral rises and lenders rely more on collateralisation and less on information-producing screening of entrepreneurs. Empirical evidence based on US data confirms...

Read More »Brad DeLong — This is, I think, both right and wrong. China has an… interesting property-rights system—your property is secure not …

Beginning to figure out how China works and why Western expectations have been consistently wrong about China' stability and resilience. The post addresses much more than property rights.More evidence that the Chinese leadership groks the basics of MMT?Grasping RealityThis is, I think, both right and wrong. China has an... interesting property-rights system—your property is secure not ...Brad DeLong | Professor of Economics, UCAL Berkeley

Read More »Brian Romanchuk — Housing Bubbles And Their Financing

Housing finance is interesting, and offers an interesting take on some theoretical issues. Although the theoretical issues sound abstract, they are critical issues in economies facing a housing bubble. This article looks at one aspect of housing finance: the limit to financing is credit risk, not funding. Monetary flows in a credit-based economy are circular. Bond Economics Housing Bubbles And Their Financing Brian Romanchuk

Read More »Jeff Desjardins — A Timeline of Every Major Disruption in Payments

Infographic and short summary of the history of money and credit.Visual CapitalistA Timeline of Every Major Disruption in PaymentsJeff Desjardins

Read More »The Arthurian on a no-credit-growth system

Read these two posts together. Art brings up an interesting issue. Why can capitalism not survive in a no-growth world? Because that's how we set it up. If we set it up differently, it would work differently. If we designed economic policy for a no-growth world, we could live in a no-growth world. You see it in economic models all the time. We're almost there now, actually. We live in an almost-no-growth world, right? And yes, things are not very good. And even I have been calling for (or...

Read More »David Harvey — The value of money [excerpt]

Value is a social relation. As such, it is ‘immaterial but objective.’ The ‘phantom-like objectivity’ of value arises because ‘not an atom of matter enters into the objectivity of commodities as values’. Their status as values contrasts with ‘the coarsely sensuous objectivity of commodities as physical objects. We may twist and turn a single commodity as we wish; it remains impossible to grasp it as a thing possessing value.’ The value of commodities is, like many other features of social...

Read More »Joseph Salerno — A Program to Stabilize the Economy—in Four Words

Paul Cantor, Clifton Waller Barrett Professor of English at the University of Virginia and Associated Scholar of the Mises Institute, attended Ludwig von Mises’s seminar at NYU as a young man. He recently surprised and delighted a few of us by revealing that the line that he remembers Mises speaking most frequently in the seminar was “No farzer credit expansion!” As a native German speaker with an accent and less than complete familiarity with English usage, what Mises meant to say, of...

Read More »Kevin Erdmann — Leverage is not a sign of risk seeking, a continuing series

A contrarian view. Idiosyncratic WhiskLeverage is not a sign of risk seeking, a continuing seriesKevin Erdmann

Read More » Heterodox

Heterodox