Trumped up expectations cooling a bit?PMI Manufacturing Index Flash Services: Initial earnings estimates have tended to fall: This is extraordinary, as their liabilities are most likely predominately euro denominated, which is what I’d call a ‘fundamental short’ position. That is, this has been part of the ‘portfolio shifting’ that has been keeping the euro down: Source: http://uk.reuters.com/article/uk-ecb-eurozone-investment-idUKKBN15Z1GE Reserves capable of being profitable way down with lower prices: Energy Companies Face Crude Reality: Better to Leave It in the Ground By Sarah Kent, Bradley Olsen and Georgi Kantchev Feb 17 (WSJ) — U.S. regulations require companies to take oil reserves off their books if they aren’t profitable at existing prices or can no longer be included as part of five-year development plans. Canada was once thought to hold the world’s third-largest trove of crude. Today, only about 20% of those reserves, or about 36.5 billion barrels, are capable of being profitable, according to energy consultancy Wood Mackenzie. In the decade leading up to the 2014 price collapse, companies spent as much as 0 billion building megaprojects to extract heavy oil in Alberta’s boreal forest.

Topics:

WARREN MOSLER considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

Trumped up expectations cooling a bit?

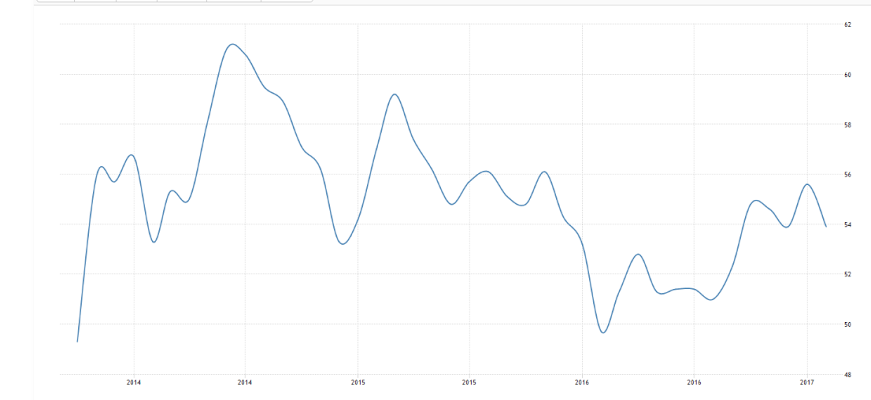

PMI Manufacturing Index Flash

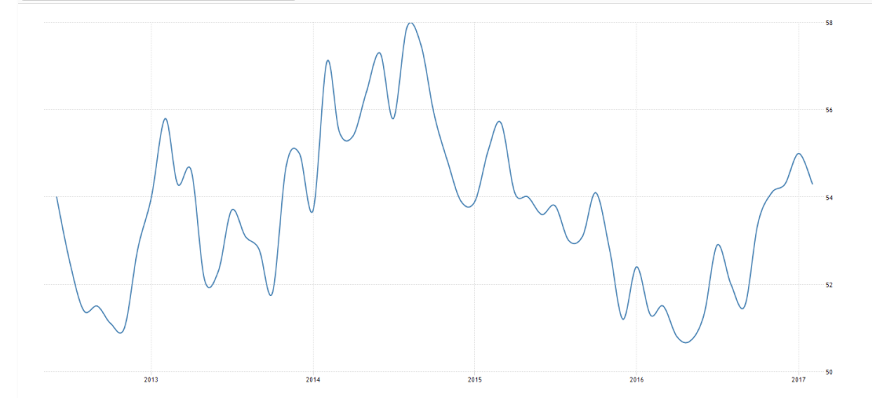

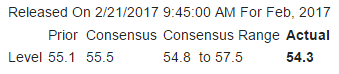

Services:

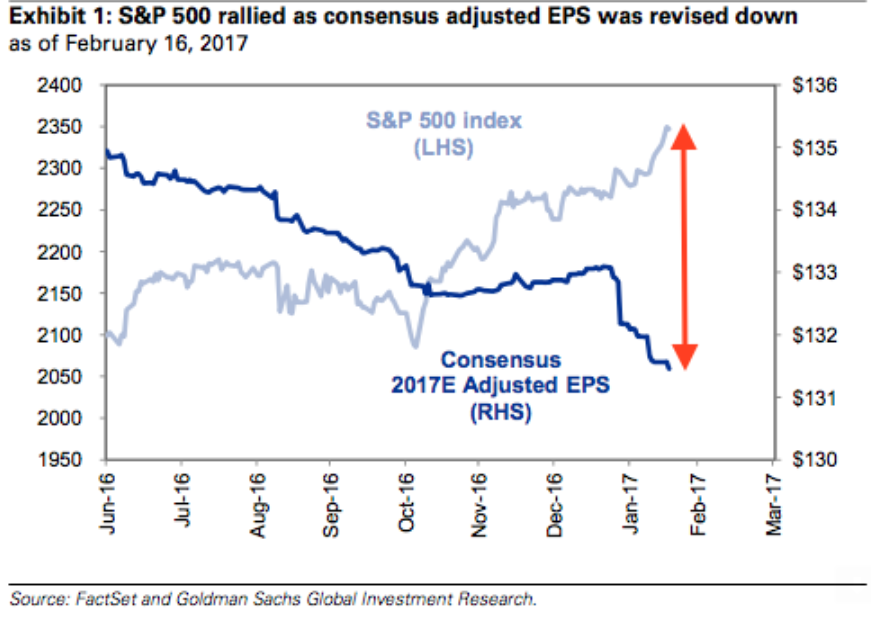

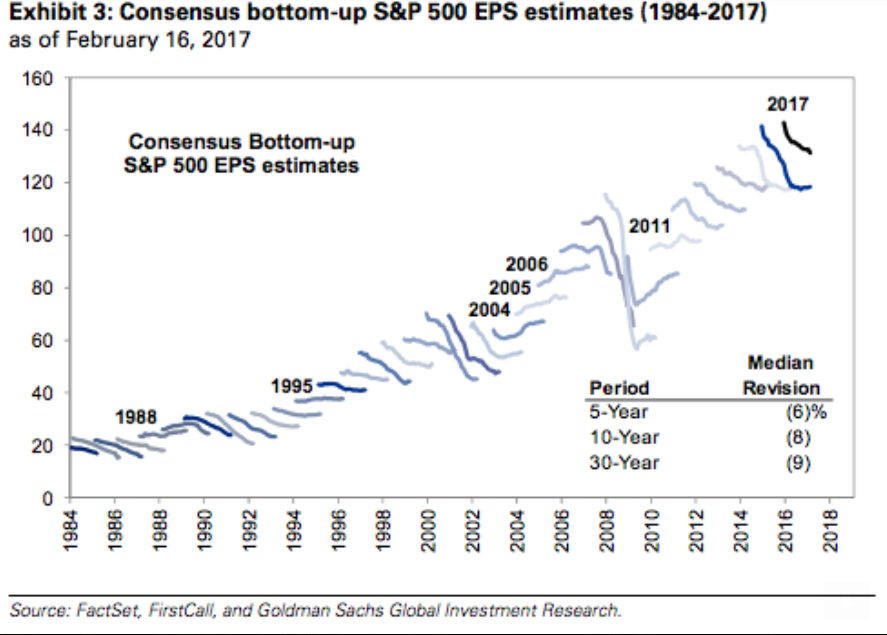

Initial earnings estimates have tended to fall:

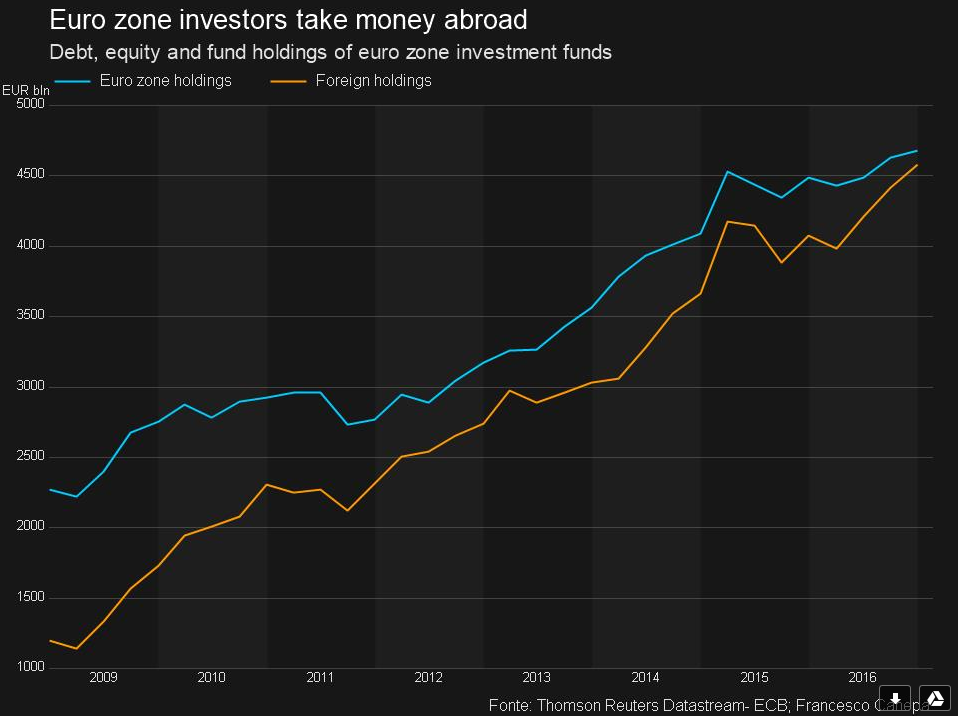

This is extraordinary, as their liabilities are most likely predominately euro denominated, which is what I’d call a ‘fundamental short’ position. That is, this has been part of the ‘portfolio shifting’ that has been keeping the euro down:

Source: http://uk.reuters.com/article/uk-ecb-eurozone-investment-idUKKBN15Z1GE

Reserves capable of being profitable way down with lower prices:

Energy Companies Face Crude Reality: Better to Leave It in the Ground

By Sarah Kent, Bradley Olsen and Georgi Kantchev

Feb 17 (WSJ) — U.S. regulations require companies to take oil reserves off their books if they aren’t profitable at existing prices or can no longer be included as part of five-year development plans. Canada was once thought to hold the world’s third-largest trove of crude. Today, only about 20% of those reserves, or about 36.5 billion barrels, are capable of being profitable, according to energy consultancy Wood Mackenzie. In the decade leading up to the 2014 price collapse, companies spent as much as $200 billion building megaprojects to extract heavy oil in Alberta’s boreal forest.

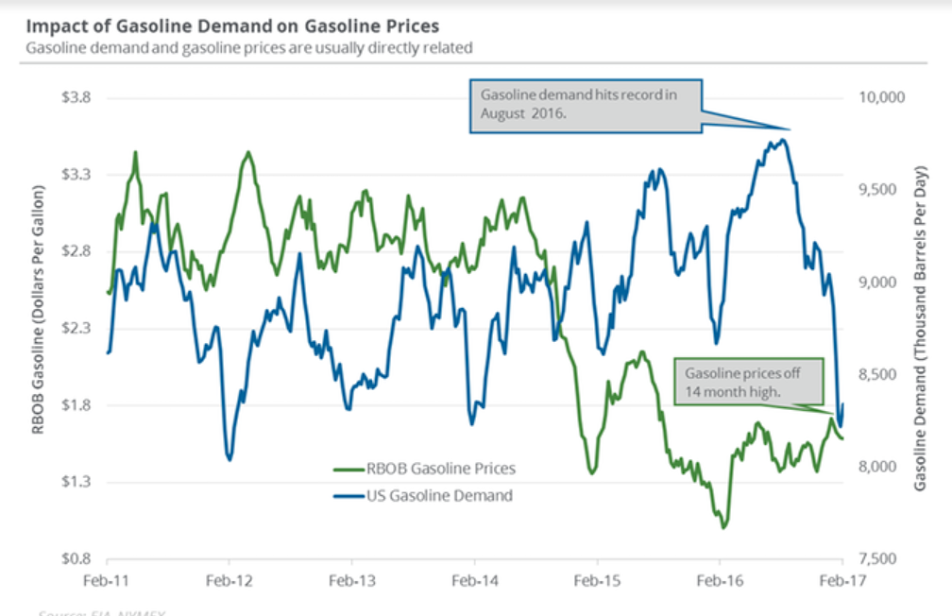

Gasoline demand always falls this time of year but more than expected this year, raising questions of whether demand is fundamentally down even with lower prices, etc: